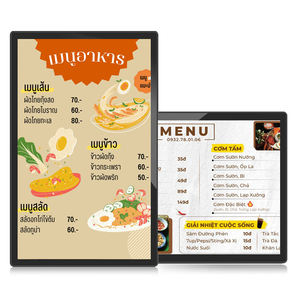

Digital Retail Examples

About digital retail examples

Where to Find Digital Retail Solutions Suppliers?

China remains a central hub for digital retail hardware manufacturing, with key production clusters in Guangdong and Jiangsu provinces driving innovation and cost efficiency. Guangzhou-based suppliers dominate the digital signage segment, leveraging proximity to component manufacturers for LCD/LED displays, touch sensors, and media players. This regional integration reduces material procurement lead times by 20–30% compared to offshore alternatives. Suzhou and surrounding areas in Jiangsu specialize in commercial refrigeration units with embedded digital interfaces, combining cooling systems with display technology for smart retail applications.

These industrial ecosystems support vertically integrated operations—from PCB assembly and metal fabrication to software integration—enabling rapid prototyping and scalable production. Buyers benefit from concentrated technical expertise and logistics networks that facilitate delivery within 15–30 days for standard orders. Average production costs are 25–40% lower than equivalent Western-manufactured units, particularly for interactive kiosks, menu boards, and window displays. The region’s focus on export-oriented electronics ensures compatibility with global power standards and communication protocols.

How to Choose Digital Retail Hardware Suppliers?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Technical & Functional Compliance

Verify product specifications align with deployment environment requirements. Outdoor or high-brightness installations demand luminance ratings exceeding 2,000 nits and IP65-rated enclosures. For interactive systems, confirm touchscreen responsiveness (capacitive vs. infrared) and compatibility with content management platforms. Where applicable, ensure compliance with CE, FCC, or RoHS directives for electromagnetic compatibility and hazardous substance restrictions.

Production and Customization Capacity

Assess supplier capabilities through measurable indicators:

- Minimum factory area of 3,000m² to support batch production

- In-house R&D teams capable of firmware customization and UI adaptation

- Customization options including size, mounting configuration, color, and branding (e.g., logo overlay, custom housing)

- Integration support for third-party software or API connectivity

Cross-reference online revenue metrics and reorder rates as proxies for market acceptance and reliability.

Quality Assurance and Transaction Security

Prioritize suppliers with documented quality control processes, including burn-in testing and visual inspection logs. On-time delivery rates above 95% and response times under 4 hours indicate operational discipline. Utilize secure payment mechanisms and request sample units to validate build quality, screen uniformity, and thermal performance under continuous operation.

What Are the Leading Digital Retail Hardware Suppliers?

| Company Name | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization |

|---|---|---|---|---|---|---|---|---|

| Guangzhou Aurora Electronic Technology Development Co., Ltd. | Digital Signage, LCD Displays, Advertising Equipment | $99–450 | 1 piece | 94% | ≤4h | <15% | $90,000+ | Limited |

| CMS TECHNOLOGY LIMITED | Digital Signage, Touch LCDs, Payment Kiosks | $199–1,899 | 1 piece | Data not available | ≤4h | Data not available | Data not available | Moderate |

| Guangzhou Anning Technology Co., Ltd. | Digital Menu Boards, Interactive Displays, Advertising Screens | $99–169 | 1 piece | 97% | ≤1h | 15% | $160,000+ | High |

| Suzhou Rebirth Technology Co., Ltd. | Commercial Refrigerators with Digital Facings | $216–358/set | 1 set | 96% | ≤1h | 19% | $70,000+ | Low |

| Guangzhou Hushida Electronic Co., Ltd. | Digital Signage, Advertising Machines, Shopping Center Displays | $199–395 | 1 set | 96% | ≤5h | 17% | $240,000+ | High |

Performance Analysis

Guangzhou-based suppliers exhibit strong responsiveness and customization agility, with Anning Technology and Hushida offering high reorder rates and extensive personalization options. CMS TECHNOLOGY LIMITED targets premium applications with 4K and high-brightness models, though limited performance data complicates risk assessment. Hushida stands out with the highest reported online revenue, suggesting robust market demand and distribution capability. Suzhou Rebirth represents a niche integrator, combining refrigeration and digital display functions for grocery and convenience retail environments. Buyers seeking turnkey solutions should prioritize suppliers with sub-4-hour response times and proven after-sales support records.

FAQs

What certifications should digital retail hardware suppliers have?

Essential certifications include CE (Europe), FCC (USA), and RoHS for environmental compliance. For commercial installations, UL listing may be required. Suppliers should provide test reports for electrical safety, EMC, and thermal stability.

What is the typical lead time for digital signage orders?

Standard units ship within 15–25 days after order confirmation. Custom configurations involving unique sizes, outdoor enclosures, or software integration may require 30–45 days. Air freight adds 5–10 days for international delivery.

Can suppliers provide content management systems (CMS)?

Some suppliers offer proprietary or third-party CMS platforms for remote updates and scheduling. Confirm compatibility with common formats (H.264, MP4, JPEG) and support for multi-zone layouts before procurement.

Is sample testing recommended before bulk ordering?

Yes. Request a functional unit to evaluate screen brightness, color accuracy, boot time, network stability, and structural durability. Sample costs typically range from 1x to 2x the unit price and may be credited toward future orders.

How do MOQ and pricing scale for large deployments?

Most suppliers list 1-piece MOQs but offer tiered pricing at 10+, 50+, and 100+ units. Discounts of 10–25% are achievable for container-load quantities. Negotiate bundled services such as pre-installed software, extended warranties, or on-site training for enterprise-scale rollouts.