Factory Cybersecurity

About factory cybersecurity

Where to Find Factory Cybersecurity Suppliers?

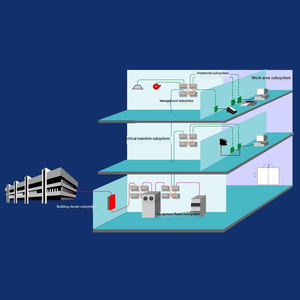

China remains a central hub for factory cybersecurity product manufacturing, with key suppliers concentrated in technology-driven regions such as Shenzhen, Chengdu, and Beijing. These cities host specialized electronics and IoT development zones, enabling tight integration between hardware production and software-based security solutions. Shenzhen, as a global electronics manufacturing epicenter, supports rapid prototyping and high-volume output of network security devices, while Chengdu and Beijing foster advanced R&D in secure communication systems and industrial IoT protection.

Suppliers in these clusters operate vertically integrated production lines capable of delivering both standalone cybersecurity hardware and comprehensive system solutions. The proximity to component suppliers, firmware developers, and testing facilities allows for reduced lead times—typically 15–25 days for standard orders—and cost efficiencies due to localized sourcing. Buyers benefit from access to scalable manufacturing ecosystems where customization, compliance testing, and cloud integration services are readily available within a single supply chain network.

How to Choose Factory Cybersecurity Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm that suppliers offer products aligned with core cybersecurity functions: intrusion detection, data encryption, secure boot mechanisms, and remote monitoring. For industrial applications, prioritize vendors providing devices compatible with OT (Operational Technology) network segmentation and supporting protocols such as TLS 1.3 or IEEE 802.1X. Request documentation on firmware update mechanisms and vulnerability patch cycles.

Production Infrastructure Assessment

Evaluate the following indicators of manufacturing maturity:

- In-house production lines with control over PCB assembly, firmware flashing, and final device calibration

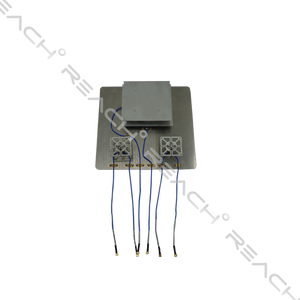

- Demonstrated capability in producing network-attached devices (e.g., firewalls, IP surveillance components, signal jammers)

- Evidence of quality testing procedures, including EMI/EMC, thermal stress, and network penetration resistance

Cross-reference listed product ranges with on-time delivery performance (target ≥98%) and response time (≤3 hours) to assess operational reliability.

Customization and Compliance Readiness

Verify support for OEM/ODM services including logo imprinting, packaging design, language localization (e.g., English display), and cloud storage integration. Ensure the supplier can meet regional regulatory requirements such as CE, FCC, or RoHS compliance upon request. For enterprise deployments, confirm compatibility with centralized management platforms and API-level integrations.

What Are the Best Factory Cybersecurity Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Customization Options |

|---|---|---|---|---|---|---|---|

| Yf Protector Co., Ltd. | Fujian, CN | Tactical gear with embedded personal security electronics | US $450,000+ | 98% | ≤3h | 36% | Color, material, size, logo, packaging, label, graphic |

| Beijing Jinyingtai System Technology Co., Ltd. | Beijing, CN | Network switches (540), firewalls & VPN (99), servers, routers | US $240,000+ | 100% | ≤2h | 34% | Full product line with enterprise-grade networking focus |

| Yiwu Safe Electronic Technology Co., Ltd. | Zhejiang, CN | Security network cables, IP-related transmission devices | US $290,000+ | 100% | ≤2h | 17% | Color, material, size, cloud storage, logo, packaging, label, graphic |

| Shenzhen Zidian Technology Co., Ltd | Guangdong, CN | Bug detectors, GPS trackers, anti-recording devices, personal alarms | US $20,000+ | 100% | ≤2h | 17% | Color, material, size, logo, packaging, label, graphic, English display |

| Chengdu Pinfeng Technology Co., Ltd. | Sichuan, CN | IoT-based smart agriculture, residential, and prison security systems | US $4,000+ | 40% | ≤3h | <15% | Color, material, size, logo, packaging, label, graphic |

Performance Analysis

Yf Protector and Beijing Jinyingtai demonstrate strong reorder rates (36% and 34%, respectively), indicating customer satisfaction and repeat business. Beijing-based Jinyingtai stands out for its enterprise networking specialization, offering firewall, switch, and server solutions critical for industrial cybersecurity infrastructure. All top-performing suppliers maintain on-time delivery rates at or above 98%, with sub-3-hour response times enhancing procurement efficiency. Shenzhen and Yiwu-based firms provide niche physical-layer security devices ideal for covert operations or endpoint protection, while Chengdu Pinfeng’s low reorder rate suggests limited market traction despite IoT solution offerings. Prioritize suppliers with documented production control and robust after-sales technical support for mission-critical deployments.

FAQs

How to verify factory cybersecurity supplier reliability?

Audit suppliers for verifiable production capabilities, including ownership of assembly lines and firmware development resources. Request evidence of compliance testing (e.g., ESD protection ratings, network intrusion resilience). Analyze transaction history through verified revenue metrics, on-time delivery records, and customer feedback focusing on post-purchase technical assistance.

What is the typical MOQ and pricing range?

Minimum Order Quantities vary by product type: detection units and personal alarms often require 2–100 units (from $4.86/unit), while enterprise network devices may have MOQs of 1 set or box (priced between $300–$6,000 per unit). Tactical gear typically starts at 1–2 pieces per order.

Do suppliers support customization?

Yes, all listed suppliers offer customization options including color, material, size, branding (logo/packaging), and functional modifications such as multilingual interface support and cloud storage integration. Lead time extension should be expected for ODM projects involving new housing designs or firmware revisions.

What are common lead times and shipping options?

Standard production lead time ranges from 10–20 days post-payment confirmation. Air freight enables global delivery within 5–10 days; sea freight is recommended for bulk orders exceeding 500 kg to reduce logistics costs by up to 60%.

Can I request samples before placing a bulk order?

Sample availability depends on product type and supplier policy. Most manufacturers allow sample purchases at 1.5x–2x unit price, with partial reimbursement upon subsequent full-order placement. Sample lead time averages 7–12 days, including preparation and dispatch.