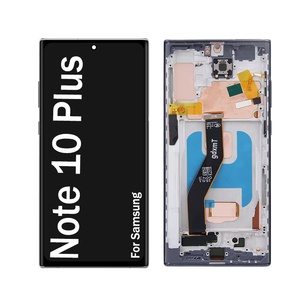

Galaxy Note 10 Plus Display Producer

1/3

1/3

1/24

1/24

1/5

1/5

1/3

1/3

1/3

1/3

1/1

1/1

1/2

1/2

0

0

1/3

1/3

1/2

1/2

1/31

1/31

0

0

1/3

1/3

0

0

1/1

1/1

1/15

1/15

About galaxy note 10 plus display producer

Where to Find Galaxy Note 10 Plus Display Producers?

China remains the central hub for mobile display component manufacturing, with Shenzhen emerging as a dominant cluster for high-resolution OLED and AMOLED panel production. The city's electronics ecosystem supports specialized suppliers capable of producing complete LCD/OLED display assemblies for flagship smartphones like the Galaxy Note 10 Plus. These manufacturers operate within vertically integrated supply chains, combining in-house production lines with access to advanced materials such as Corning Gorilla Glass alternatives and driver ICs sourced from regional semiconductor suppliers.

Suppliers in this sector typically maintain dedicated cleanroom facilities for display module assembly, enabling precision bonding of touch sensors, digitizers, and front glass. Many operate under ISO 9001-aligned quality management systems, though formal certification is not universally declared. Lead times for standard orders range from 7–15 days, with express shipping options reducing delivery to international buyers within 5–7 business days via air freight. Economies of scale are achieved through high-volume component procurement and automated testing protocols, allowing competitive pricing without compromising functional integrity.

How to Choose Galaxy Note 10 Plus Display Suppliers?

Procurement decisions should be guided by structured evaluation criteria focused on technical accuracy, operational reliability, and transaction security:

Technical Specifications & Compatibility

Verify exact match of resolution (3040 x 1440), screen size (6.8 inches), and curvature type (edge-to-edge curved AMOLED). Confirm whether the offered unit is an original-grade replacement or compatible replica. Suppliers listing “original” or “OEM” specifications must provide test reports confirming color gamut (≥100% DCI-P3), brightness levels (>1200 nits peak), and touchscreen responsiveness.

Production Capability Verification

Assess supplier infrastructure based on available indicators:

- Ownership of in-house production lines (explicitly stated in product keywords)

- Diverse portfolio including other Samsung flagship models (e.g., S-series, Note-series)

- Monthly output capacity inferred from inventory depth and reorder rates

- Customization capabilities such as logo printing, packaging variation, or housing integration

Cross-reference response time and on-time delivery performance—suppliers achieving ≤3h response and 100% fulfillment indicate robust internal coordination.

Transaction Risk Mitigation

Prioritize suppliers with verifiable transaction histories and third-party validation mechanisms. Evaluate online revenue tiers (e.g., US $70,000+ annual volume) as proxy indicators of market presence. Request sample units before bulk ordering to assess build quality, adhesive uniformity, and pixel alignment. Use secure payment methods that support post-delivery verification, especially when MOQs start at one piece, indicating direct-to-consumer sales models.

What Are the Leading Galaxy Note 10 Plus Display Producers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Quantity | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Shenzhen Heshunyi Technology Limited | LCD Monitors (5780), Mobile Phone LCDs (3174) | US $40,000+ | 100% | ≤18h | 40% | 1 piece | $10.00–50.00 |

| Shenzhen Shanxin Network Technology Co., Ltd. | AMOLED LCDS, Samsung Mobile Displays | US $110,000+ | 100% | ≤3h | 29% | 1–2 pieces | $12.00–99.00 |

| Shenzhen Bestpon Technology Co., Ltd. | Curved LCD Combos, Refurbished Modules | US $70,000+ | 100% | ≤3h | 47% | 2 pieces | $3.20–209.65 |

| Shenzhen He Quan Qing Nuo Technology Co., Ltd. | OEM Lcd Displays, Digitizer Assemblies | US $110,000+ | 97% | ≤4h | 18% | 1–2 pieces | $6.70–85.00 |

| Shenzhen Myhome Technology Co., Ltd. | OLED Touch Screens, Super AMOLED Panels | US $20,000+ | 100% | ≤6h | 33% | 2–50 pieces | $39.80–186.60 |

Performance Analysis

Shenzhen Bestpon leads in customer retention with a 47% reorder rate, suggesting consistent quality and service delivery. Both Shenzhen Shanxin and Bestpon achieve sub-3-hour response times, reflecting efficient customer support operations critical for urgent repair chain sourcing. Suppliers with higher price dispersion—such as Shenzhen Myhome ($39.80–186.60)—likely offer tiered quality grades, including refurbished, compatible, and original-grade modules. In contrast, Shenzhen Heshunyi provides broad affordability but slower communication, potentially impacting order resolution speed. Buyers seeking volume consistency should prioritize suppliers exceeding US $70,000 in reported revenue and maintaining MOQs above two units, which often signals B2B-oriented production rather than retail arbitrage.

FAQs

How to verify Galaxy Note 10 Plus display authenticity?

Request batch-level test data including IC authentication codes, factory markings, and optical performance metrics. Compare physical samples against OEM units using professional tools such as magnified edge inspection and touchscreen latency measurement. Suppliers offering "original" labels should confirm source traceability from authorized Samsung subcontractors like BOE, AUO, or Tianma.

What is the typical lead time for display shipments?

Standard processing takes 3–7 days after order confirmation. International delivery via express courier (DHL, FedEx) adds 5–7 business days. Sea freight is uncommon due to low weight and high value per unit, making air shipment the default logistics method.

Can suppliers customize packaging or branding?

Yes, multiple suppliers list customization options for housing, label design, and logo imprinting. Minimum requirements vary; some accept changes at two-unit quantities, while others require larger batches. Confirmation through pre-production samples is recommended.

Do manufacturers provide warranty or after-sales support?

Warranty terms are rarely standardized. Some suppliers offer limited replacements for dead pixels or non-responsive touch panels within 30 days. Buyers should clarify return policies and defect classification criteria prior to purchase, particularly for non-sealed or tested units.

What are common quality risks in aftermarket displays?

Risks include inconsistent color calibration, reduced brightness, ghost touch issues, and poor adhesive bonding leading to delamination. Units priced below $40 may use recycled components or lower-tier driver ICs. Independent electrical stress testing and burn-in cycles are advised before integration into service inventories.