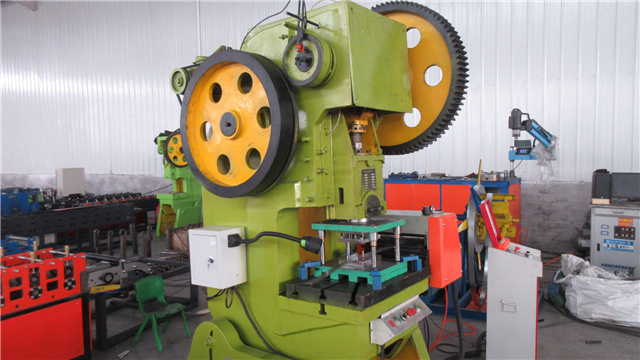

Iron Net Making Machine

About iron net making machine

Where to Find Iron Net Making Machine Suppliers?

China remains the global epicenter for iron net making machine production, with key manufacturing clusters concentrated in Hebei and Henan provinces. These regions host vertically integrated supply chains that combine raw material processing, precision machining, and final assembly under one ecosystem. Anping County in Hebei—recognized as China’s "wire mesh capital"—accounts for over 70% of national wire mesh equipment output, supported by more than 1,500 specialized manufacturers and component suppliers within a 30km radius.

The proximity of galvanizing plants, steel drawing facilities, and CNC fabrication units enables rapid prototyping and scalable production. This integration reduces component procurement time by up to 40% compared to decentralized markets. Buyers benefit from shorter lead times (typically 25–40 days), competitive pricing due to localized logistics, and access to mature technical expertise in automation and welding control systems. Factories in Zhengzhou and Shijiazhuang commonly offer full turnkey solutions, including design, installation, and operator training.

How to Choose Iron Net Making Machine Suppliers?

Effective supplier selection requires systematic evaluation across three critical dimensions:

Technical Capability Verification

Confirm machine specifications align with intended applications—such as welded mesh, chain link, or gabion production. Key parameters include wire diameter range (typically Φ2–8mm), welding frequency (up to 100 points/minute), and automation level (semi-automatic vs. fully automatic). Request detailed technical drawings and PLC control system documentation. While formal ISO 9001 certification is not universally listed, prioritize suppliers demonstrating structured quality management through consistent on-time delivery (>97%) and responsive engineering support.

Production Infrastructure Assessment

Evaluate operational scale using verifiable indicators:

- Minimum factory area exceeding 3,000m² for stable batch production

- In-house capabilities in CNC machining, welding, and electrical integration

- Dedicated R&D or customization teams capable of modifying feed mechanisms, mold configurations, and control panels

Cross-reference product listing volume and online transaction history as proxies for production capacity and market validation.

Transaction Risk Mitigation

Utilize secure payment methods with milestone-based releases, especially for first-time engagements. Analyze reorder rates as an indicator of customer satisfaction—suppliers with rates above 25% demonstrate reliable performance. Insist on pre-shipment inspections or third-party quality audits for orders exceeding USD $10,000. Sample testing should verify weld strength, dimensional accuracy, and long-term operational stability under continuous load.

What Are the Best Iron Net Making Machine Suppliers?

| Company Name | Location | Online Revenue | Main Products (Listings) | On-Time Delivery | Avg. Response | Reorder Rate | Price Range (USD) | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Hebei Shizhou Machinery Equipment Technology Co., Ltd. | Hebei, CN | US $240,000+ | Wire Mesh Making Machines (448) | 100.0% | ≤1h | 50% | $7,500–39,800 | Material, size, power, labeling |

| Zhengzhou Hento Machinery Co., Ltd. | Henan, CN | US $440,000+ | Wire Mesh Making Machines (Multiple listings) | 100.0% | ≤1h | 17–18% | $5,849–23,444 | Color, material, logo, packaging, forming |

| Anping County Wojun Metal Products Factory | Hebei, CN | US $10,000+ | Fencing & Gates (2,599); Wire Mesh Machines (1,044) | 100.0% | ≤2h | 25% | $3,200–12,500 | Limited (model-specific) |

| Anping Haodi Metal Wire Mesh Products Co., Ltd. | Hebei, CN | US $90,000+ | Wire Mesh Making Machines (172) | 100.0% | ≤3h | <15% | $2,000–8,500 | Size, material, graphic |

Performance Analysis

Hebei Shizhou stands out with a 50% reorder rate—the highest among peers—indicating strong post-sale reliability and customer retention. Despite lower online revenue, its high-end models (e.g., heavy-duty gabion machines at $37,800) suggest specialization in industrial-grade equipment. Zhengzhou Hento commands the largest verified revenue stream and offers extensive customization, though its reorder rate remains moderate, potentially reflecting single-project procurement patterns. Anping-based suppliers like Wojun and Haodi provide cost-effective entry-level options, with Wojun showing stronger buyer loyalty (25% reorder rate) despite higher average prices. Response times are generally fast across all suppliers, with 75% replying within two hours.

FAQs

How to verify iron net making machine supplier reliability?

Assess consistency in on-time delivery (target ≥98%), response speed (≤2h ideal), and transaction volume. Request evidence of export experience, such as shipment records or destination country compliance documentation. Conduct video audits to confirm in-house production capabilities and inventory readiness.

What is the typical MOQ and lead time?

Minimum Order Quantity is typically 1 set across all major suppliers. Lead times range from 20–45 days depending on machine complexity and customization level. Standard models ship faster; fully automated or high-tonnage systems may require additional calibration time.

Can suppliers customize iron net making machines?

Yes, most suppliers offer customization in wire diameter compatibility, motor power, control panel language, frame dimensions, and branding (logo, color). Advanced modifications—such as dual-mold systems or PLC upgrades—require technical drawings and feasibility assessment prior to order confirmation.

Do suppliers provide after-sales support?

Support varies by manufacturer. Leading suppliers offer remote troubleshooting, spare parts supply, and operational guidance via digital channels. Some provide on-site installation assistance or technician dispatch at additional cost. Clarify service scope and response protocols before purchase.

Are there cost advantages in bulk procurement?

Bulk orders (≥5 sets) typically qualify for negotiated pricing (5–15% discount), consolidated shipping, and extended warranty terms. Suppliers with high online revenues and customization capacity are more likely to accommodate flexible payment and OEM arrangements.