Lcd Segmented Display Manufacturer

Top sponsor listing

Top sponsor listing

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/38

1/38

0

0

CN

CN

1/37

1/37

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

1/54

1/54

1/3

1/3

CN

CN

1/60

1/60

1/3

1/3

0

0

1/1

1/1

1/3

1/3

1/3

1/3

About lcd segmented display manufacturer

Where to Find LCD Segmented Display Manufacturers?

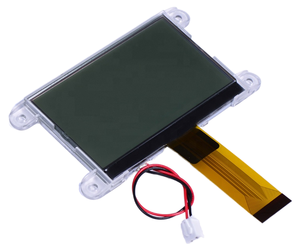

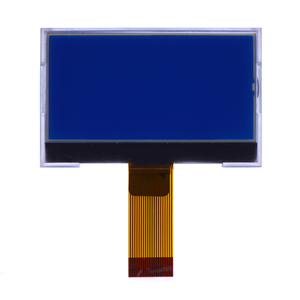

China remains the global epicenter for segmented LCD manufacturing, with Shenzhen and Guangdong serving as primary hubs due to concentrated electronics supply chains and specialized optoelectronic industrial zones. These regions host vertically integrated facilities capable of full-cycle production—from glass substrate processing and ITO patterning to module assembly and driver IC integration—enabling rapid prototyping and scalable output. The proximity of raw material suppliers, precision component vendors, and logistics networks reduces lead times by up to 30% compared to non-specialized regions.

Manufacturers in this ecosystem typically support monthly production volumes ranging from 500,000 to over 2 million units, catering to industries such as consumer electronics, industrial instrumentation, medical devices, and utility metering. Key advantages include access to mature technical talent pools, compliance-ready production systems (RoHS, REACH), and flexible configuration options including custom segment layouts, backlight types (LED, EL), and mounting methods (SMT, COB). Buyers benefit from short development cycles—often 10–15 days for prototype delivery—and competitive pricing structures driven by localized economies of scale.

How to Choose LCD Segmented Display Suppliers?

Evaluating suppliers requires a structured assessment across technical, operational, and transactional dimensions:

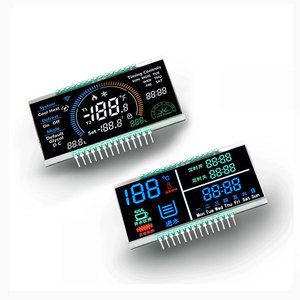

Technical Capabilities & Customization

Confirm support for required display specifications: operating temperature range (-20°C to +70°C standard), voltage (3V–5V typical), contrast type (TN, HTN, STN), and viewing mode (transmissive, transflective, reflective). Leading manufacturers offer customization in segment count (3-digit to multi-line), glass thickness (0.55mm–1.1mm), and polarizer selection. Verify compatibility with common driver ICs (e.g., HT1621, PCF8544) and interface types (parallel, SPI).

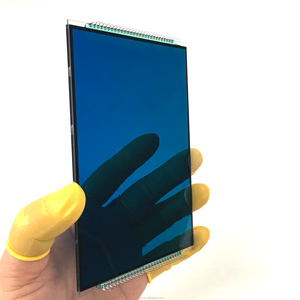

Production Infrastructure Verification

Assess core manufacturing capabilities through documented evidence:

- Class 10K cleanroom environments for cell assembly

- In-house photomask design and FPC/PCB bonding lines

- Automated optical inspection (AOI) and electrical testing stations

Prioritize suppliers with dedicated R&D teams capable of layout validation and Gerber file optimization. Cross-reference on-time delivery performance (target ≥95%) with response time metrics (≤2 hours ideal) to gauge operational responsiveness.

Quality Assurance & Compliance

Require adherence to ISO 9001 quality management standards and product-level compliance with RoHS and REACH directives. Request test reports for key parameters: multiplex rate stability, contrast ratio (>5:1), and high-temperature storage resilience (85°C/500hrs). For regulated sectors (medical, automotive), confirm extended lifecycle support and batch traceability protocols.

What Are the Top LCD Segmented Display Manufacturers?

| Company Name | Location | Main Products | Customization Options | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate | Min. Order Quantity |

|---|---|---|---|---|---|---|---|---|

| Shenzhen JHDLCM Electronics Co., Ltd. | Shenzhen, CN | LCD Modules, Character & Graphic Displays, OLED/E-Paper | Color, material, size, graphic layout | 100% | ≤2h | US $20,000+ | <15% | 10 pcs |

| Guangdong SCCdisplay Technology Co.,Ltd. | Guangdong, CN | LCD Modules, OLED/E-Paper Modules | Custom segment configurations, HTN variants | 100% | ≤1h | US $60,000+ | 34% | 2,000 pcs |

| Shenzhen Hexing Optoelectronic Technology Co., Ltd. | Shenzhen, CN | LCD Modules, Segment & Character Displays, Touch Screens | Multi-size industrial screens, TN technology | 92% | ≤5h | US $50,000+ | <15% | 1–8,000 pcs |

| Shenzhen Zhongheda Technology Co., Ltd. | Shenzhen, CN | LCD Modules, OLED/E-Paper Modules | High-segment-count displays (up to 886 segments) | 100% | ≤2h | US $30,000+ | <15% | 1–9 pcs |

| Shenzhen Saef Technology Ltd. | Shenzhen, CN | LCD Modules, Mobile Phone LCDs, Digital Watch Modules | Monochrome panels, HT1621 integration | 97% | ≤8h | US $250,000+ | 33% | 5 pcs |

Performance Analysis

Guangdong SCCdisplay and Shenzhen Zhongheda stand out for high-volume reliability, both achieving 100% on-time delivery with strong customization depth in segment architecture and liquid crystal modes. While SCCdisplay commands higher reorder rates (34%), it enforces larger MOQs (2,000+ units), making it better suited for established production runs. In contrast, Shenzhen JHDLCM and Zhongheda accommodate low-volume sampling (as low as 1 piece), offering agility for prototyping and niche applications. Saef Technology leads in online transaction volume (US $250,000+), reflecting robust export activity and diversified product deployment, though response times lag behind peers. Buyers seeking fast turnaround should prioritize suppliers with sub-2-hour response benchmarks and verified design-for-manufacturing (DFM) feedback loops.

FAQs

How to verify LCD segmented display manufacturer reliability?

Validate certifications through official registries and request factory audit reports or video walkthroughs confirming cleanroom operations and automated testing lines. Analyze customer reviews focusing on consistency in optical performance and defect rates (target <0.5% DOA).

What is the typical sample lead time?

Standard samples are typically delivered within 7–12 days. Custom designs involving new glass etching or FPC layout adjustments may require 15–20 days. Air shipping adds 5–7 business days internationally.

Do manufacturers support small orders?

Yes, several suppliers offer MOQs as low as 1–5 pieces for initial testing. However, unit costs decrease significantly at 1,000+ quantities due to fixed setup charges amortization.

Are RoHS and REACH compliance documents provided?

Reputable manufacturers supply compliance certificates and material declarations upon request. Confirm that these cover all components, including adhesives, polarizers, and solder finishes.

How does customization affect pricing and lead time?

Minor modifications (color, pinout) have minimal impact. Full custom tooling (new glass mask, FPC) incurs NRE fees ($200–$800) and extends lead time by 5–7 days. Volume discounts apply after 5,000 units.