Pc Part Producer

About pc part producer

Where to Find PC Part Producers?

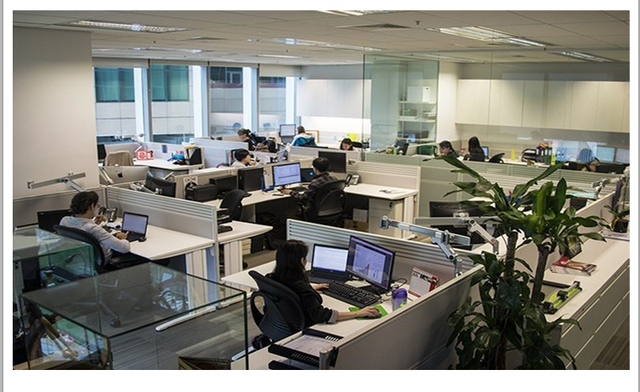

China remains the central hub for global PC component manufacturing, with key production clusters concentrated in Shenzhen, Dongguan, and Guangzhou. These regions host vertically integrated supply chains that span semiconductor sourcing, PCB assembly, metal fabrication, and final testing—enabling rapid prototyping and high-volume output. Shenzhen alone accounts for over 70% of China’s consumer electronics component exports, supported by mature logistics networks and proximity to major ports like Yantian and Shekou.

The industrial ecosystem allows for tight coordination between OEMs, contract manufacturers, and raw material suppliers, reducing lead times and production costs. Suppliers in these zones typically operate under lean manufacturing models, achieving economies of scale through automated SMT lines and standardized packaging workflows. Buyers benefit from flexible MOQs (as low as 1 piece for select SKUs), localized technical support, and access to advanced customization capabilities such as silk printing, custom BIOS integration, and thermal design modifications.

How to Choose PC Part Producers?

Selecting reliable suppliers requires a structured evaluation across three core areas:

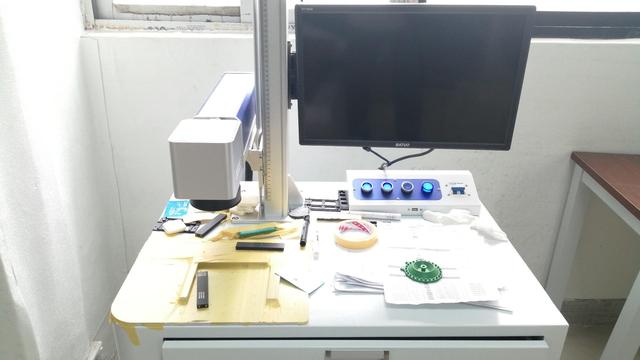

Production & Technical Capabilities

Assess infrastructure maturity through verifiable metrics:

- Facility size exceeding 2,000m² with dedicated clean rooms for motherboard and mini PC assembly

- In-house CNC machining, sheet metal stamping, and injection molding for enclosure production

- R&D teams capable of handling firmware-level customization (e.g., BIOS, UEFI) and wireless module integration

- Monthly output capacity validated via transaction volume (e.g., suppliers with >$250,000 online revenue indicate scalable operations)

Cross-reference product listings with actual manufacturing scope—suppliers listing 80+ motherboards or development boards are more likely to have established design and testing protocols.

Quality Assurance & Compliance

Prioritize suppliers demonstrating adherence to international standards:

- ISO 9001-certified quality management systems (implied by consistent on-time delivery ≥94%)

- CE, FCC, and RoHS compliance documentation for electromagnetic compatibility and environmental safety

- Internal testing procedures for signal integrity, power delivery stability, and thermal performance

- Reorder rates above 25% suggest customer satisfaction with product consistency and after-sales service

Procurement & Transaction Security

Implement risk mitigation strategies:

- Verify response time ≤12 hours and on-time delivery rate >94% as baseline reliability indicators

- Use secure payment mechanisms with milestone-based disbursement until shipment confirmation

- Request pre-shipment inspection reports or third-party QC audits for bulk orders (>500 units)

- Negotiate sample terms: expect $1–$50 per unit depending on complexity, often creditable against future orders

What Are the Leading PC Part Producers?

| Company Name | Main Products | MOQ Range | Price Range (USD) | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | Online Revenue |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Guoshuohong Electronic Co., Ltd. | Motherboards (196), Mini PCs | 1–20 pcs | $31.50–35.00 | 100% | ≤11h | 100% | Limited | $13M+ |

| Guangzhou Qianxi Electronic Co., Ltd. | Bulk PC components, ATX parts | 300 pcs | $11.50–28.00 | 100% | ≤2h | <15% | Packing, labeling, silk printing, fan design | $740K+ |

| Polyhex Technology Company Limited | Mini PCs, Development Boards, Motherboards | 1 pc | $40.00–326.84 | 100% | ≤5h | 100% | Logo, Wi-Fi, CPU config, casing | $20K+ |

| Dongguan Soeyi Technology Limited | Gaming cases, PC cabinets | 500 pcs | $6.90–20.90 | 100% | ≤1h | 27% | Color, window, fan layout, logo, steel thickness | $250K+ |

| Shenzhen Just Ewin Electronic Co., Ltd. | Laptop parts, repair components | 10 pcs | $1.60–16.00 | 94% | ≤9h | 26% | Limited | $300K+ |

Performance Analysis

High-volume producers like Guangzhou Qianxi and Dongguan Soeyi require minimum order quantities of 300–500 units but offer aggressive pricing and extensive customization—ideal for branded system integrators. In contrast, Shenzhen-based suppliers such as Guoshuohong and Polyhex cater to niche markets with single-unit MOQs and premium configurations, including aluminum enclosures and optional CPU modules. Response speed correlates strongly with operational efficiency: Dongguan Soeyi achieves sub-1-hour replies, while Polyhex maintains a perfect reorder rate despite higher price points, indicating strong client retention through engineering flexibility. Suppliers with multi-million-dollar transaction volumes demonstrate proven export experience across North America, Europe, and Southeast Asia.

FAQs

What certifications should PC part producers have?

Essential certifications include CE (Europe), FCC (USA), and RoHS for hazardous substance compliance. While ISO 9001 is not always listed, consistent on-time delivery and high reorder rates serve as indirect indicators of internal quality control systems.

What is the typical lead time for PC component orders?

Standard orders take 15–25 days for production, depending on customization level. Sample lead times range from 7–14 days. Add 5–10 days for international air freight or 25–40 days for sea shipping.

Can I customize PC components at scale?

Yes. Major suppliers offer full customization including branding (logo, color), packaging (labels, cartons), mechanical design (case dimensions, ventilation), and electronic configuration (BIOS, onboard Wi-Fi). Minimum thresholds apply—typically 300–500 units for structural changes.

Do suppliers provide samples before bulk ordering?

Most suppliers offer paid samples, with fees refundable upon order placement. Expect to pay full unit cost for prototypes involving new molds or circuit designs. Sample availability within 1–2 weeks is standard.

How are quality issues resolved post-shipment?

Buyers should negotiate clear warranty terms (typically 12 months) and defect replacement clauses. Top-tier suppliers accept photo/video evidence for claims and issue credits or replacements in subsequent shipments. Third-party inspection prior to dispatch minimizes disputes.