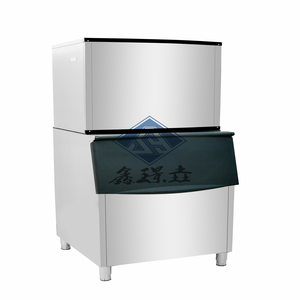

Personal Ice Cube Maker

CN

CN

About personal ice cube maker

Where to Find Personal Ice Cube Maker Suppliers?

China remains the central hub for personal ice cube maker manufacturing, with key supplier clusters located in Zhejiang and Guangdong provinces. Ningbo in Zhejiang hosts a dense network of compact appliance manufacturers specializing in countertop and portable ice-making units, leveraging mature supply chains for compressors, molds, and food-grade plastics. Meanwhile, Guangzhou-based producers in Guangdong focus on mid-to-large volume commercial-grade personal ice makers, integrating stainless steel fabrication and advanced cooling systems.

These regional ecosystems enable streamlined production through vertically integrated component sourcing—reducing lead times by 20–30% compared to offshore alternatives. Suppliers benefit from localized access to injection molding facilities, refrigeration engineering teams, and logistics hubs, supporting MOQs as low as 500 pieces for standard models. Buyers gain flexibility in customization while maintaining competitive pricing, with average unit costs ranging from $40–$60 for entry-level 12kg/day models. Export readiness is widespread, with most suppliers equipped for FOB Shenzhen or Ningbo port shipments within 25–35 days after order confirmation.

How to Choose Personal Ice Cube Maker Suppliers?

Procurement decisions should be guided by structured evaluation criteria to ensure product quality, compliance, and operational reliability:

Technical and Safety Compliance

Verify adherence to international electrical and food safety standards, including CE, RoHS, and UL certifications where applicable. For units using compressor-based cooling, confirm refrigerant type (e.g., R134a) complies with environmental regulations in target markets. Demand test reports for noise levels (ideally ≤45 dB), energy consumption, and ice clarity performance.

Production and Customization Capability

Assess supplier infrastructure based on the following benchmarks:

- Minimum factory area exceeding 3,000m² for sustained output

- In-house design and tooling capabilities for mold development

- Capacity to support customization across color, logo, packaging, and control panel interfaces

Cross-reference stated production volumes with online transaction data; suppliers reporting annual revenues above US $100,000 are more likely to maintain consistent quality control and inventory stability.

Order Fulfillment Metrics

Prioritize suppliers demonstrating verified on-time delivery rates ≥98% and response times under 4 hours. Reorder rates above 30% indicate customer satisfaction and product reliability. Confirm minimum order quantities align with procurement scale—most suppliers require 500–1,000 pieces for customized orders, though some accommodate trial runs at 5–10 units for high-value commercial models.

What Are the Best Personal Ice Cube Maker Suppliers?

| Company Name | Location | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | MOQ Range | Price Range (USD) | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Zhengzhou Yize Machinery Co., Ltd. | Henan, CN | US $450,000+ | 98% | 31% | ≤2h | 1 set | $390–4,400 | Color, material, size, logo, packaging, label, graphic |

| Ningbo Yutong Electric Appliance Co., Ltd. | Zhejiang, CN | US $700+ | 100% | <15% | ≤1h | 500 pieces | $40.60–53.20 | Color, material, size, logo, packaging, label, graphic |

| Ningbo Aquart Electrical Appliance Co., Ltd. | Zhejiang, CN | US $140,000+ | 100% | 33% | ≤4h | 500–1,000 pieces | $40.33–135.83 | Nugget, color, material, size, logo, packaging, label, graphic |

| Guangzhou Jinguangyue Catering Equipment Co., Ltd. | Guangdong, CN | US $100,000+ | 88% | <15% | ≤3h | 2 sets | $58–680 | Color, material, size, logo, packaging, label, graphic, water bottle inlet |

| Guangzhou Anhe Catering Equipment Co., Ltd. | Guangdong, CN | US $880,000+ | 100% | 31% | ≤4h | 1–5 pieces | $203–3,627 | Multiple technical parameters including cooling method, capacity, compressor type, storage volume, and controller configuration |

Performance Analysis

Suppliers like Ningbo Yutong and Ningbo Aquart offer cost-effective solutions for high-volume buyers seeking standardized personal ice makers, with competitive pricing below $45/unit at MOQ 500. Zhengzhou Yize and Guangzhou Anhe provide greater technical flexibility, supporting deep customization and lower MOQs for specialized applications. Guangzhou Anhe stands out with the highest reported online revenue (US $880,000+) and full parametric control over design elements, making it suitable for OEM partnerships. While Ningbo-based suppliers lead in responsiveness (sub-1 hour replies), Guangdong manufacturers dominate in export-scale production capacity. Prioritize partners with reorder rates above 30% and on-time delivery >95% for long-term supply chain stability.

FAQs

How to verify personal ice cube maker supplier reliability?

Cross-check ISO 9001 certification status and request product compliance documentation (CE, RoHS). Evaluate supplier credibility through verifiable transaction history, customer reviews, and third-party inspection services. Conduct virtual audits to assess production lines and quality control checkpoints.

What is the typical lead time for bulk orders?

Standard production lead time ranges from 25 to 35 days after deposit and design approval. Expedited production may reduce timelines to 18–22 days, depending on factory workload and component availability.

Can suppliers customize ice cube shape and size?

Yes, many suppliers offer mold modifications for cube dimensions and shapes, including crescent, square, and nugget styles. Minimum modification fees apply, typically waived for orders exceeding 1,000 units.

Do suppliers provide samples before mass production?

Most suppliers offer pre-production samples for $80–$200, refundable upon order placement. Sample lead time averages 7–14 days, with express shipping adding 3–7 days globally.

What payment terms are common in supplier contracts?

Standard terms include 30% T/T deposit with balance paid before shipment. Larger buyers may negotiate LC at sight or use platform-backed escrow services for transaction security.