Robotic Process Automation In Manufacturing Industry

Top sponsor listing

Top sponsor listing

1/28

1/28

1/5

1/5

1/33

1/33

About robotic process automation in manufacturing industry

Where to Find Robotic Process Automation Suppliers in the Manufacturing Industry?

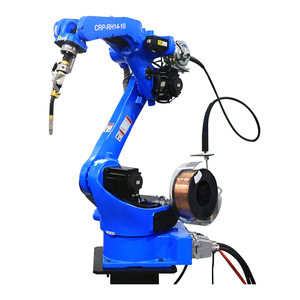

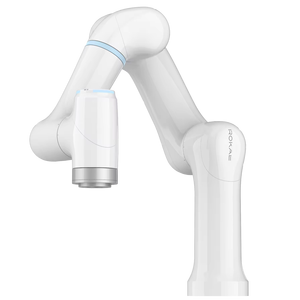

China remains a dominant force in the global supply of robotic process automation (RPA) solutions for manufacturing, with key industrial clusters located in Shandong, Guangdong, and Henan provinces. These regions host specialized robotics manufacturers that integrate advanced motion control systems, precision mechanics, and AI-driven programming into scalable automation platforms. Shandong’s machinery corridor supports high-capacity production of CNC-integrated robotic arms, while Guangdong's electronics ecosystem enables rapid development of PLC-controlled collaborative robots (cobots) and smart actuators.

The concentration of component suppliers—servo motors, grippers, controllers, welding modules—and engineering talent within these zones allows for vertically integrated production. This localization reduces lead times by 20–30% compared to offshore alternatives and supports flexible customization for payload capacity, axis configuration, and integration with existing assembly lines. Buyers benefit from mature ecosystems where design, prototyping, testing, and volume manufacturing occur within tightly coordinated networks, enabling standard delivery windows of 30–60 days depending on complexity and order size.

How to Choose Robotic Process Automation Suppliers in Manufacturing?

Selecting reliable suppliers requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Integration Capability

Verify compatibility with common industrial protocols (e.g., Modbus, Profibus, EtherCAT) and confirm support for integration with CNC machines, conveyor systems, or MES/SCADA environments. While formal certifications such as ISO 9001 or CE are not universally listed, prioritize suppliers demonstrating compliance through documented testing procedures, especially for safety-critical applications like MIG welding or plasma cutting. Request validation of controller firmware stability and robot path repeatability (±0.02mm is typical for mid-tier models).

Production and Customization Capacity

Assess supplier capability based on observable indicators:

- Offerings spanning articulated robots (4–6 axis), collaborative units, gantry systems, and end-effectors indicate broader engineering expertise

- Presence of customization tags—such as load capacity adjustment, arm length modification, or gripper/plasma head integration—signals flexibility

- In-house development teams can support OEM/ODM projects involving custom programming, labeling, or multi-robot coordination

Cross-reference product listings with reorder rates and response times: suppliers achieving >65% reorder rates (e.g., SWJD LIMITED at 66%) suggest strong post-sale performance and reliability.

Transaction Risk Mitigation

Utilize secure payment frameworks and insist on pre-shipment inspection rights. Analyze historical performance metrics where available—on-time delivery rates exceeding 94%, response times under 3 hours, and verifiable online revenue streams enhance confidence. For high-value automation lines (e.g., $250K+ welding systems), require facility documentation or video audits to validate production scale and quality assurance workflows before commitment.

What Are the Leading Robotic Process Automation Suppliers in Manufacturing?

| Company Name | Main Products | On-Time Delivery | Reorder Rate | Response Time | Online Revenue | Notable Features |

|---|---|---|---|---|---|---|

| Shandong Rayman Cnc Equipment Co., Ltd. | Laser Cutting Machines, Articulated Robots, CNC Plasma Cutters | 94% | 20% | ≤2h | US $800,000+ | High customization options; integration support for gantry design, load radius, and controller systems |

| Guangdong Borunte Robot Technology Co., Ltd. | Articulated Robots, Collaborative Robots, Industrial Robotic Kits | 75% | 50% | ≤3h | US $20,000+ | Mid-range precision arms ($999–$22,800); PLC-controlled kits suitable for electronics automation |

| SWJD LIMITED | Collaborative Robots, Articulated Robots, Welding Equipment | 100% | 66% | ≤2h | US $10,000+ | Perfect on-time record; hollow welding arms and stainless steel integration solutions |

| Changingtek Robotics Technology (Suzhou) Co., Ltd. | Collaborative Robots, Articulated Robots, Electric Grippers | 100% | 33% | ≤2h | US $6,000+ | Offers high-load mechanical claws and finger grippers; 6-axis cobot CNC integration |

| Zhengzhou Duoyuan Intelligent Equipment Co., Ltd. | Automated Welding Lines, Assembly Systems, Processing Lines | 100% | - | ≤8h | - | Specializes in full-scale robotic production lines ($45K–$250K); ideal for automotive manufacturing |

Performance Analysis

SWJD LIMITED stands out with a 100% on-time delivery rate and the highest reorder rate (66%), indicating consistent customer satisfaction despite moderate online revenue. Multiple suppliers report perfect delivery records, including Changingtek and Zhengzhou Duoyuan, though the latter’s slower response time (≤8h) may affect communication efficiency. Shandong Rayman demonstrates significant commercial scale (>$800K revenue) and broad customization capabilities, making it suitable for complex automation integrations. For turnkey manufacturing lines, Zhengzhou Duoyuan offers enterprise-grade solutions, albeit with limited transparency on reorder behavior and financial activity. Buyers seeking responsive, agile partners should favor suppliers with sub-3-hour response times and proven component-level innovation.

FAQs

What is the typical MOQ and pricing range for industrial robotic arms?

Minimum order quantities are typically 1 unit/set across suppliers. Pricing varies significantly by specification: entry-level collaborative arms start at $999, while high-precision 6-axis systems reach $22,800. Full automated production lines exceed $250,000. No volume-based discounts are explicitly stated, but bulk orders may allow negotiation leverage.

How long does it take to receive a sample or production order?

Sample lead times average 15–30 days depending on customization level. Standard production orders take 30–60 days, with potential delays for fully integrated systems requiring PLC programming or safety certification checks. Shipping via air freight adds 7–10 days internationally.

Can robotic automation systems be customized for specific manufacturing tasks?

Yes, most suppliers offer customization in load capacity (up to 120kg), arm reach, end-effector type (gripper, plasma torch, welding head), and control software. Some provide gantry designs, label integration, and multi-axis coordination programming upon request. Technical specifications must be submitted in detail to initiate design adjustments.

Do suppliers provide technical support and integration assistance?

While not explicitly guaranteed, suppliers advertising controller integration, robot programming, and system debugging imply post-purchase support availability. Confirm remote or on-site assistance options prior to purchase, particularly for complex deployments involving multiple robots or legacy equipment interfacing.

Are there export-ready robotic automation solutions compliant with international standards?

Compliance details are not uniformly disclosed. However, suppliers listing CE-like performance benchmarks or serving global clients likely adhere to functional safety principles. Buyers should explicitly request conformity documentation (e.g., EMC, LVD, RoHS) and verify electrical safety ratings for deployment in North America, Europe, or other regulated markets.