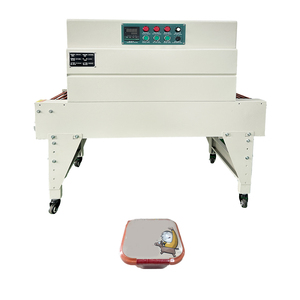

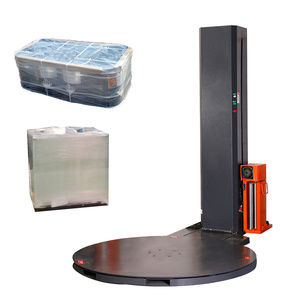

Shrink Wrapping Machine For Water Bottles

Top sponsor listing

Top sponsor listing

CN

CN

About shrink wrapping machine for water bottles

Where to Find Shrink Wrapping Machine Suppliers for Water Bottles?

China remains the global hub for shrink wrapping machine manufacturing, with key production clusters in Guangdong, Shanghai, Shandong, and Jiangsu provinces. These regions host vertically integrated supply chains specializing in packaging automation, offering scalable solutions from semi-automatic tabletop units to fully automated inline systems for water bottle packaging lines. Guangdong and Shanghai serve as innovation centers, focusing on precision engineering and export-oriented production, while Shandong leverages lower operational costs and proximity to raw material suppliers—particularly for PE and POF shrink films.

The industrial ecosystems in these zones enable rapid prototyping and high-volume output, supported by localized networks of component manufacturers, CNC fabricators, and thermal system engineers. Buyers benefit from compressed lead times (typically 20–40 days), cost efficiencies (15–30% below Western market rates), and access to modular designs adaptable to various bottle formats and throughput requirements. With over 1,000+ listings across major suppliers, the market demonstrates strong specialization in sleeve-wrapping technology tailored for cylindrical containers like water bottles.

How to Choose Shrink Wrapping Machine Suppliers for Water Bottles?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capabilities and Compliance

Verify adherence to international safety and quality standards such as CE and ISO 9001. Machines designed for food-grade applications must utilize stainless steel contact surfaces (e.g., SUS304) and comply with hygiene regulations. Confirm compatibility with common shrink film types—POF, PVC, and PE—and validate tunnel heater efficiency (typically 5–15kW range) based on line speed requirements (up to 10 meters per minute).

Production Capacity and Customization

Assess supplier infrastructure through key indicators:

- Minimum factory area exceeding 3,000m² for sustained production capacity

- In-house R&D or engineering teams supporting custom film feed systems, sealing jaw configurations, or integration with upstream fillers

- Customization scope including color, logo printing, label placement, and packaging layout adjustments

Cross-reference product listings with on-time delivery performance (target ≥95%) and reorder rates (>30% indicates customer satisfaction).

Transaction Reliability and Quality Assurance

Prioritize suppliers with documented quality control processes, including pre-shipment testing protocols for seal integrity and temperature consistency. Utilize secure payment mechanisms with milestone-based releases. Request sample units to evaluate build quality, ease of operation, and film consumption efficiency before scaling procurement. Response time ≤2 hours and online revenue above US $100,000 annually indicate active, service-oriented operations.

What Are the Best Shrink Wrapping Machine Suppliers for Water Bottles?

| Company Name | Location | Main Products (Listings) | On-Time Delivery | Reorder Rate | Avg. Response | Online Revenue | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Jining Keepway Machinery Company Ltd. | Shandong, CN | Wrapping Machines (789) | 97% | 36% | ≤2h | $600,000+ | $750–$3,600 |

| Shandong Yizhou Science And Technology Development Co., Ltd. | Shandong, CN | Wrapping Machines (1041) | 97% | 30% | ≤2h | $110,000+ | $1,100–$2,100 |

| Guangdong Xinzhiyuan Machinery Equipment Co., Ltd. | Guangdong, CN | Wrapping Machines (570) | 93% | 33% | ≤3h | $80,000+ | Not specified |

| Shanghai Gebo Machinery Co., Ltd. | Shanghai, CN | Wrapping Machines (N/A) | 92% | <15% | ≤1h | $40,000+ | $1,200–$2,500 |

| Foshan Jiajun Willie Pak Co., Ltd. | Guangdong, CN | Wrapping Machines (317) | 100% | <15% | ≤2h | $30,000+ | $169–$959 |

Performance Analysis

Jining Keepway stands out with the highest reorder rate (36%) and substantial online revenue ($600,000+), indicating consistent buyer trust and robust after-sales support. Shandong Yizhou leads in product diversity with over 1,000 packaging machine listings and competitive pricing, making it suitable for mid-range automation needs. Foshan Jiajun achieves perfect on-time delivery (100%), ideal for low-risk entry procurement, though its sub-$1,000 models are better suited for small-scale or pilot operations. Guangdong Xinzhiyuan offers broad customization capabilities across multiple packaging subcategories, while Shanghai Gebo provides fast response times but a lower reorder rate, suggesting room for improvement in long-term customer retention.

FAQs

What certifications should shrink wrapping machine suppliers have?

Essential certifications include CE for European market compliance and ISO 9001 for quality management. For food and beverage applications, verify use of non-toxic materials and hygienic design principles in construction.

What is the typical MOQ and lead time?

Most suppliers set a minimum order quantity of 1 unit, enabling flexible procurement. Lead times range from 15 to 30 days for standard models, extending to 40 days for customized configurations requiring specific film handling or integration features.

Can shrink wrapping machines be customized for different bottle sizes?

Yes, reputable suppliers offer adjustable side-sealing frames, variable tunnel apertures, and programmable controllers to accommodate bottle diameters from 50mm to 100mm and heights up to 300mm. Custom molds or guides may be required for irregular shapes.

Do suppliers provide technical support and installation guidance?

Leading suppliers offer remote setup assistance via video tutorials or live calls. Some provide detailed operation manuals, troubleshooting guides, and spare parts kits. On-site commissioning support is available upon negotiation, typically at additional cost.

How to evaluate energy efficiency in shrink tunnels?

Assess heater power (kW), insulation quality, and fan circulation design. High-efficiency models use PID temperature control and reflector panels to minimize heat loss, reducing energy consumption by up to 25% compared to basic units.