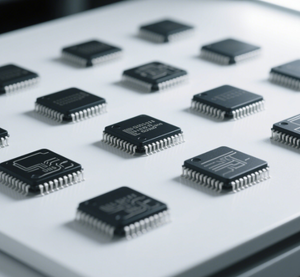

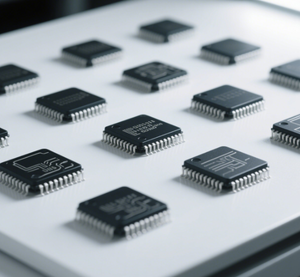

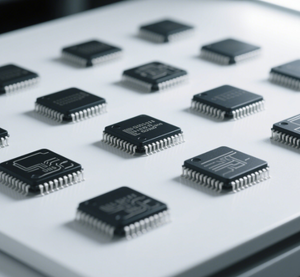

Silicon Wafer Processing

About silicon wafer processing

Where to Source Silicon Wafer Processing Equipment Suppliers?

China remains a central hub for silicon wafer processing equipment and materials, with key suppliers concentrated in industrial regions including Shanghai, Tianjin, and Jiangsu. These areas host specialized manufacturing ecosystems focused on semiconductor components, optical systems, and precision industrial tools. Clusters in Shanghai and Tianjin benefit from proximity to research institutions and high-tech fabrication zones, enabling tighter integration between material supply and downstream semiconductor production.

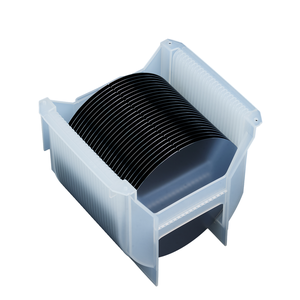

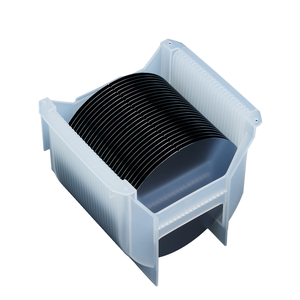

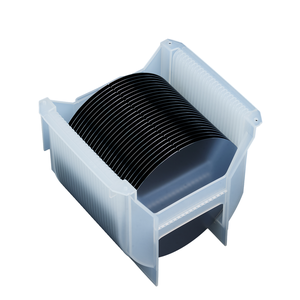

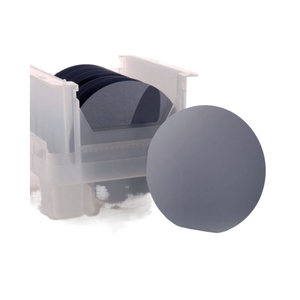

Suppliers in these regions operate within vertically integrated networks that support full-cycle processing—from raw silicon ingot slicing to polishing, thinning, and coating. This infrastructure enables competitive pricing and scalable output, particularly for standard wafer formats (4", 6", 8") used in power electronics, photovoltaics, and sensor applications. Buyers gain access to flexible production runs, with lead times typically ranging from 15 to 30 days for stock items and 35–45 days for custom specifications. Localization of material sourcing and machining reduces costs by 20–35% compared to Western or Southeast Asian alternatives.

How to Evaluate Silicon Wafer Processing Suppliers?

Selecting reliable partners requires rigorous assessment across technical, operational, and transactional dimensions:

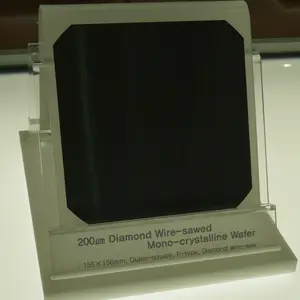

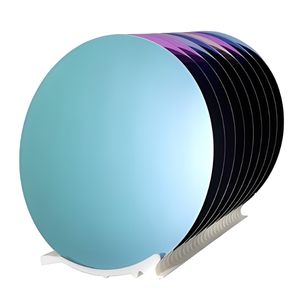

Material & Process Specifications

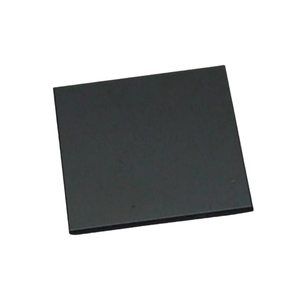

Confirm wafer type (monocrystalline, polycrystalline, multicrystalline, SiC), diameter (2" to 12"), thickness (180µm to 1mm+), and surface finish (polished, epitaxial, textured). For processing equipment, verify compatibility with standard cleanroom protocols and integration into automated handling systems. Suppliers should provide detailed spec sheets covering resistivity, doping type (P/N), crystal orientation (e.g., <100>, <111>), and flatness tolerances (TTV, warp).

Quality Assurance Protocols

While formal ISO 9001 certification is not universally listed, consistent on-time delivery (≥96%) and documented response times (≤7 hours) indicate operational discipline. Prioritize suppliers with verifiable reorder rates above 30%, suggesting customer satisfaction. For critical applications, request test reports on particle counts, oxygen/carbon content, and defect density (COP, DSSC).

Customization & Scalability

Assess customization capabilities such as:

- Non-standard diameters (e.g., 200mm, 300mm)

- Ultra-thin wafers (<100µm) for MEMS and advanced packaging

- OEM branding, laser marking, or IR-transparent coatings

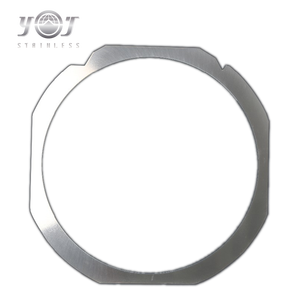

- Diamond tooling for grinding and dicing (bond type, grit size, concentricity)

Cross-reference product listings with supplier specialization—optical-focused vendors may emphasize IR-grade silicon, while industrial machinery suppliers offer bulk polycrystalline wafers at lower price points.

What Are the Leading Silicon Wafer Processing Suppliers?

| Company Name | Main Products | Min. Order Quantity | Price Range (USD) | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| Zoolied Inc. | Optical Filters, Lenses, Semiconductors | 5–25 pieces | $49 – $9.87 | 100% | ≤7h | <15% | US $1,000+ |

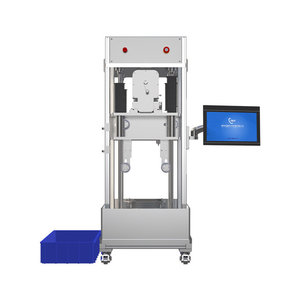

| Shanghai Uniweigh System Co., Ltd. | Other Machinery, Special Transportation | 100 pieces | $2 – $5 | 100% | ≤2h | 33% | US $40,000+ |

| Tianjin Century Electronics Co., Ltd. | Thyristors, Semiconductors | 25–200 pieces | $1.50 – $46 | 100% | ≤2h | - | - |

| Nantong Ruisen Optical Co., Ltd. | Optical Filters, Lenses | 1–50 pieces | $0.50 – $50 | 100% | ≤6h | <15% | US $7,000+ |

| Zhengzhou Ruizuan Diamond Tool Co., Ltd. | Diamond Wheels, Grinding Tools | 10 pieces | $1,858 – $3,058.80 | 96% | ≤2h | 18% | US $410,000+ |

Performance Analysis

Shanghai Uniweigh and Tianjin Century Electronics offer cost-effective bulk options with aggressive pricing ($2–$5/unit) and high reorder rates, indicating strong buyer retention in industrial segments. Nantong Ruisen caters to low-volume, high-precision needs with sub-$1 pricing tiers and single-piece availability, ideal for prototyping and optical applications. Zhengzhou Ruizuan specializes in diamond-based processing tools (grinding wheels, dicing blades), serving back-end wafer thinning and singulation lines with premium equipment priced over $1,800 per unit. Zoolied Inc. targets niche semiconductor substrates, including SiC wafers, though its lower reorder rate suggests limited repeat engagement.

FAQs

What are typical MOQs for silicon wafers?

MOQs vary by supplier and application: bulk polycrystalline wafers require 100+ units, while specialized or optical-grade variants allow orders as low as 1–10 pieces. Customized or OEM-labeled products may require higher minimums depending on setup costs.

How long do production and shipping take?

Standard wafer orders ship within 15–25 days after confirmation. Custom thickness, doping, or coating modifications extend lead times to 30–45 days. Air freight delivers samples in 5–7 days; sea freight takes 25–35 days for full container loads.

Can suppliers provide certified test reports?

Yes, reputable suppliers issue material test reports upon request, including four-point probe resistivity measurements, SEM/EDS analysis, and surface roughness data. For mission-critical applications, third-party lab verification is recommended prior to volume procurement.

Do suppliers support OEM/ODM services?

Multiple suppliers offer OEM labeling, custom packaging, and tailored wafer dimensions. Nantong Ruisen and Zhengzhou Ruizuan explicitly list color, logo, size, and packaging customization options, supporting private-label strategies for distributors and system integrators.

What payment and transaction protections exist?

Buyers should utilize secure transaction platforms offering escrow services to ensure funds are released only after inspection. Verified online revenue and consistent on-time delivery records serve as indirect indicators of financial stability and fulfillment reliability.