Supplier Performance Management System

1/3

1/3

1/3

1/3

1/39

1/39

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

CN

CN

1/1

1/1

CN

CN

1/19

1/19

1/3

1/3

1/2

1/2

1/1

1/1

1/3

1/3

CN

CN

1/2

1/2

1/3

1/3

0

0

CN

CN

1/6

1/6

1/3

1/3

About supplier performance management system

Where to Find Supplier Performance Management System Providers?

The global market for supplier performance management systems is primarily driven by specialized software developers and electronics manufacturers, with key suppliers concentrated in China’s Shenzhen and Guangzhou technology hubs. These regions host vertically integrated ecosystems combining hardware manufacturing, embedded software development, and cloud-based analytics platforms. Shenzhen alone accounts for over 40% of China’s industrial software and IoT-enabled device output, supported by mature supply chains for PCBs, microcontrollers, and wireless modules.

Suppliers in this sector typically operate hybrid models—offering both standalone software solutions and integrated hardware-software systems tailored for fleet monitoring, battery optimization, or enterprise learning management. The proximity to component suppliers reduces production lead times by 20–30% compared to offshore alternatives, while access to skilled firmware engineers enables rapid customization. Buyers benefit from modular architectures that support API integration, real-time data dashboards, and AI-driven analytics, particularly in logistics, manufacturing, and energy storage sectors.

How to Choose Supplier Performance Management System Providers?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Expertise and Product Scope

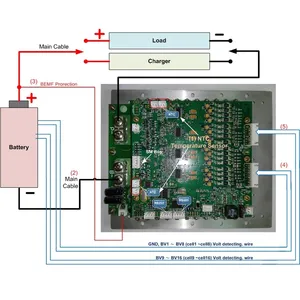

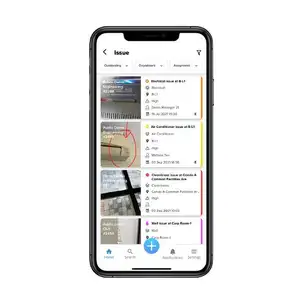

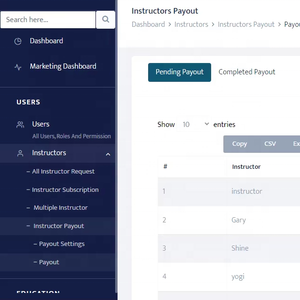

Assess whether the provider specializes in software-only platforms (e.g., LMS or B2B portal systems) or offers embedded hardware solutions (e.g., power management ICs or vehicle performance monitors). Verify compatibility with existing ERP or SCADA systems. For software-centric deployments, confirm support for SaaS licensing, mobile responsiveness, and data encryption standards (e.g., AES-256, TLS 1.3).

Production and Customization Capability

Evaluate customization depth through documented options such as UI branding, report templates, API extensions, or firmware-level modifications. Suppliers like Shenzhen Depcon Auto Electronic Technology Co., Ltd. offer configurable parameters including lift settings, color schemes, memory functions, and logo labeling—indicative of strong OEM/ODM flexibility. Prioritize vendors providing proof-of-concept demos or sandbox environments before full deployment.

Quality and Operational Metrics

Focus on verified performance indicators:

- On-time delivery rate ≥97% as a proxy for supply chain reliability

- Average response time ≤2 hours for post-sale technical queries

- Reorder rates exceeding 25% to gauge customer satisfaction

- Presence of ISO-compliant quality management processes (implied via consistent delivery metrics)

Cross-reference listed product ranges with core competencies—firms listing “PCBA Software,” “Power Management ICs,” or “Alarm Systems” demonstrate stronger electronic integration capabilities than generalist software houses.

Transaction Security and Scalability

Require transparent pricing structures with clear minimum order quantities (MOQs), ranging from single-unit software licenses ($500–$1,800) to bulk IC orders (as low as $0.10/unit at 1+ pieces). Confirm secure payment mechanisms and post-installation support terms. Analyze online revenue disclosures where available—suppliers reporting US$30,000+ annual digital sales indicate established commercial traction.

What Are the Best Supplier Performance Management System Providers?

| Company Name | Main Products | Price Range (Min. Order) | On-Time Delivery | Response Time | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|---|

| HINDUSTANSOFT CORPORATION | Software | $500–$1,800 (1 unit) | Not specified | ≤1h | Not specified | Not specified | Limited (software-focused) |

| INTELLISENSE TECHNOLOGY | PCBA Software, Alarm Systems, Smart Watch Accessories | $7–$500 (2–3 units) | Not specified | ≤5h | Not specified | Not specified | Moderate (hardware-software integration) |

| Shenzhen Depcon Auto Electronic Technology Co., Ltd. | Vehicle Air Ride Management Systems | $300–$1,200 (1 set) | 100% | ≤2h | 25% | US $330,000+ | High (color, size, logo, function) |

| Shenzhen MINCONDA Technology Co., Ltd. | Power Management ICs, PMICs, AC-DC Converters | $0.10–$1.00 (1 piece) | 100% | ≤1h | <15% | US $30,000+ | Low (standard components) |

Performance Analysis

Shenzhen-based suppliers demonstrate superior operational discipline, with two firms achieving 100% on-time delivery and sub-2-hour response times. Shenzhen Depcon stands out for high-value customization and strong reorder behavior, suggesting robust client retention in automotive performance systems. In contrast, MINCONDA Technology excels in volume semiconductor supply with ultra-low pricing but limited personalization, catering to cost-sensitive integrators. HINDUSTANSOFT offers premium software solutions priced above $1,700 per unit, indicating focus on enterprise-grade LMS platforms. INTELLISENSE TECHNOLOGY bridges software and hardware with mid-range pricing, suitable for niche applications like driver monitoring or inventory tools.

FAQs

How to verify supplier performance management system reliability?

Validate operational claims through verifiable metrics: prioritize suppliers with documented on-time delivery ≥97%, response times under 2 hours, and repeat purchase rates above 20%. Request case studies or pilot trials to assess system accuracy, uptime, and integration ease. For hardware-dependent systems, inspect component sourcing practices and firmware update protocols.

What is the typical lead time for custom deployments?

Software-based systems require 2–4 weeks for configuration and testing. Hardware-integrated solutions (e.g., vehicle-mounted controllers) take 4–6 weeks, including prototyping and compliance checks. Component-level orders (e.g., PMICs) ship within 3–7 days after payment confirmation.

Can these suppliers support global shipping and compliance?

Yes, most suppliers export internationally and comply with standard packaging and labeling requirements. For regulated markets, confirm adherence to RoHS, REACH, or CE directives where applicable—particularly critical for electronic components sold into Europe.

Do suppliers offer free samples or trial versions?

Sample availability varies: software providers may offer time-limited demo accounts, while hardware vendors often charge partial fees recoverable against future orders. Semiconductor suppliers frequently provide free IC samples for qualification purposes upon request.

How scalable are these supplier performance management systems?

Systems range from single-user licenses to enterprise-wide deployments supporting thousands of endpoints. Cloud-hosted platforms offer elastic scalability, whereas embedded solutions scale linearly with hardware procurement. Confirm concurrent user limits, database capacity, and API throughput before large-scale rollout.