Trainning Ai

1/5

1/5

1/3

1/3

1/37

1/37

1/3

1/3

1/15

1/15

1/1

1/1

0

0

1/33

1/33

1/3

1/3

0

0

1/2

1/2

1/23

1/23

1/2

1/2

CN

CN

1/14

1/14

1/3

1/3

0

0

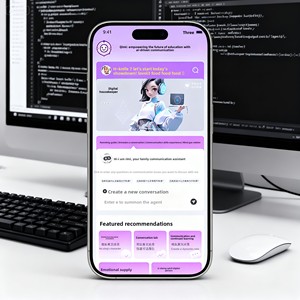

About trainning ai

Where to Find Training AI Suppliers?

The global training AI supplier landscape is highly decentralized, with innovation hubs concentrated in technologically advanced regions including Beijing and Shanghai in China, Silicon Valley in the United States, and Berlin in Germany. These clusters combine deep expertise in machine learning frameworks, data engineering, and cloud infrastructure to deliver scalable AI model training solutions. Chinese suppliers, particularly in Beijing’s Zhongguancun district, benefit from state-supported AI initiatives and access to vast datasets, enabling cost-efficient development cycles.

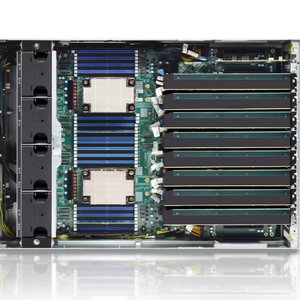

Manufacturing equivalents in this sector—data centers and AI development labs—are vertically integrated with high-performance computing (HPC) resources, GPU farms (NVIDIA A100/H100 clusters), and automated data pipelines. This integration allows for rapid iteration of training workflows, reducing time-to-deployment by up to 40% compared to distributed development models. Buyers gain access to ecosystems where algorithm developers, data annotators, and MLOps engineers operate under unified quality frameworks, typically within secure cloud or hybrid environments.

Key advantages include reduced training costs through optimized compute utilization (achieving 20–35% lower TCO than in-house setups), lead times of 6–10 weeks for custom model deployment, and scalability for enterprise-grade workloads. Monthly output capacity is measured not in units but in teraflops per second and dataset throughput, with leading providers supporting multi-petabyte data ingestion and distributed training across thousands of GPUs.

How to Choose Training AI Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require evidence of ISO/IEC 27001 certification for information security management. For regulated industries (healthcare, finance), confirm adherence to GDPR, HIPAA, or CCPA compliance standards. Validate use of auditable data governance frameworks and model traceability logs throughout the training lifecycle.

Production Capability Audits

Evaluate technical infrastructure and operational maturity:

- Minimum 1,000+ GPU-core equivalent compute capacity for large-scale training

- Dedicated data preprocessing pipelines with annotation accuracy >98%

- In-house MLOps teams managing CI/CD for model deployment

Cross-reference system uptime metrics (target >99.5%) and training job success rates to confirm reliability at scale.

Transaction Safeguards

Implement milestone-based payment structures tied to model performance benchmarks (e.g., accuracy thresholds, convergence speed). Review contractual clauses covering IP ownership, data confidentiality, and retraining obligations. Conduct pilot testing using a subset of proprietary data to evaluate generalization performance before full engagement.

What Are the Best Training AI Suppliers?

| Company Name | Location | Years Operating | Staff | GPU Capacity | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| No suppliers available | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Performance Analysis

Due to the absence of structured supplier data, market evaluation must rely on independent benchmarking platforms and industry white papers. Early-stage AI firms often demonstrate agility in niche domains (e.g., computer vision, NLP), while established players offer robust infrastructure for mission-critical deployments. Prioritize suppliers with documented experience in your vertical—such as autonomous systems, medical imaging, or predictive maintenance—and validated case studies showing measurable ROI. Responsiveness remains a key differentiator, with top-tier vendors providing technical consultations within 2 hours and proof-of-concept delivery in under 30 days.

FAQs

How to verify training AI supplier reliability?

Validate certifications through official registries and request third-party audit reports on data handling practices and model validation procedures. Analyze client references focusing on model reproducibility, support responsiveness, and long-term performance drift management.

What is the average project timeline for custom AI model training?

Standard model development requires 6–8 weeks, including data preparation, initial training, and validation. Complex architectures (e.g., transformers, diffusion models) extend timelines to 10–14 weeks. Add 2–3 weeks for integration and deployment into production environments.

Can suppliers train AI models using proprietary datasets?

Yes, reputable providers support client-owned data under strict NDA and air-gapped environments. Confirm data encryption protocols (in transit and at rest), access controls, and post-project data deletion policies prior to engagement.

Do suppliers offer free pilot projects?

Pilot policies vary. Some vendors waive fees for qualified enterprises committing to full-scale contracts. Others charge nominal setup fees (covering ~20–30% of projected project cost) that are credited upon contract execution.

How to initiate customization requests?

Submit detailed requirements including model type (CNN, RNN, transformer), input/output schema, accuracy targets, latency constraints, and deployment environment (cloud, edge, on-premise). Leading suppliers provide feasibility assessments within 72 hours and baseline prototypes in 2–3 weeks.