Using A Bow Maker

1/20

1/20

1/16

1/16

1/16

1/16

1/39

1/39

1/16

1/16

1/9

1/9

1/18

1/18

1/14

1/14

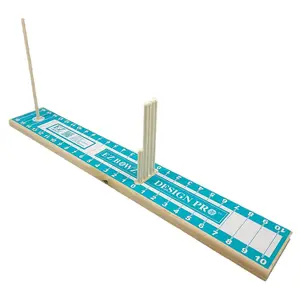

About using a bow maker

Where to Find Bow Maker Suppliers?

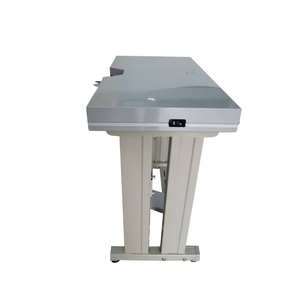

China leads global production of bow-making equipment and tools, with key manufacturing hubs in Guangdong, Zhejiang, and Jiangsu provinces. Shenzhen and Yiwu serve as primary centers for consumer-grade ribbon bow makers and crafting tools, leveraging dense networks of plastic and textile component suppliers. Meanwhile, Ningbo and Nanjing specialize in industrial-scale automatic bow-making machinery, integrating advanced CNC fabrication and hydraulic systems for high-volume output.

These regional clusters enable vertically integrated supply chains—spanning material extrusion, die-cutting, assembly, and packaging—reducing lead times by 20–30% compared to decentralized manufacturing models. Buyers benefit from localized access to raw materials such as PP ribbon, stainless steel molds, and fiberglass composites, which contribute to a 15–25% cost advantage over Western-produced alternatives. Average production cycles range from 25–40 days for standard orders, with express fulfillment options available for pre-stocked models.

How to Choose Bow Maker Suppliers?

Selecting reliable partners requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical & Production Capabilities

Assess whether suppliers operate dedicated production lines for bow-making equipment. Prioritize manufacturers with in-house tooling design, CNC machining, and automation integration. For industrial machines, confirm minimum motor power ratings (≥750W) and cycle speeds (≥80 bows/minute). Suppliers offering customization should provide engineering support for ribbon width compatibility (typically 25–100mm), material feed systems, and gluing mechanisms.

Quality Assurance and Compliance

Verify adherence to international quality standards such as ISO 9001. While not universally required, CE marking indicates compliance with EU safety directives—critical for commercial deployment in regulated markets. Request test reports on machine durability, electrical safety, and material resistance to wear. For craft-oriented wooden bow makers, evaluate moisture resistance, dimensional accuracy, and surface finish consistency.

Order Flexibility and Transaction Metrics

Analyze supplier performance indicators: on-time delivery rates above 95%, response times under 6 hours, and reorder rates exceeding 30% signal operational reliability. Minimum Order Quantities (MOQs) vary significantly—from 1 set for automated machines to 300–1,000 sets for handheld tools. Unit prices range from $1.60 for basic wooden models to over $13,000 for fully automatic ribbon bow production lines. Confirm scalability for bulk procurement and flexibility in packaging, labeling, or OEM branding.

What Are the Best Bow Maker Suppliers?

| Company Name | Location | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|---|

| Ningbo Credit Ocean Machinery & Electron Co., Ltd. | Zhejiang, CN | Automatic bow making machines | $12,000–14,000 | 1 set | 97% | ≤6h | 37% | $510,000+ |

| Nanjing Byfo Machinery Co., Ltd. | Jiangsu, CN | Hydraulic/elbow-type bow machines | $2,600–13,500 | 1 set | 95% | ≤2h | 62% | $320,000+ |

| Yiwu Billion Krypton E-Commerce Co., Ltd. | Zhejiang, CN | Wooden/fiberglass hand tools | $1.62–8.80 | 300–1,000 sets | 87% | ≤7h | <15% | $280,000+ |

| Shenzhen Guangyunda Technology Co., Ltd. | Guangdong, CN | High-speed plastic ribbon machines | $4,650–6,000 | 1–2 sets | 100% | ≤6h | 25% | $4,000+ |

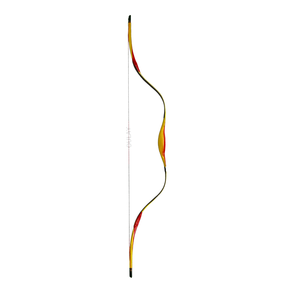

| Xiamen Oulay Imp.&Exp. Co., Ltd. | Fujian, CN | Archery-related components | $1.55–345 | 1–100 pieces | 82% | ≤5h | <15% | $50,000+ |

Performance Analysis

Ningbo Credit Ocean and Nanjing Byfo stand out for industrial automation capability, with high reorder rates and robust online transaction volumes indicating market confidence. Nanjing Byfo’s 62% reorder rate reflects strong customer retention, likely driven by competitive pricing and rapid technical responsiveness. Shenzhen Guangyunda achieves perfect on-time delivery despite lower revenue volume, suggesting niche specialization and efficient logistics execution. Yiwu-based suppliers dominate low-cost manual tool segments, though lower reorder rates may indicate higher competition or commoditization in this segment. Xiamen Oulay caters primarily to archery product buyers, representing a divergent interpretation of "bow maker"—a critical distinction for procurement clarity.

FAQs

How to verify bow maker supplier reliability?

Cross-check claimed certifications with official databases. Request facility videos demonstrating active production lines and quality control checkpoints. Evaluate transaction history through verified revenue data, on-time delivery rates, and buyer feedback focused on post-sale support and defect resolution.

What is the typical sampling timeline for bow-making machines?

Standard sample production takes 10–20 days for mechanical tools and 25–35 days for automated systems. Shipping via air freight adds 5–10 days internationally. Some suppliers offer digital mockups or CAD drawings within 72 hours for design validation prior to physical prototyping.

Can suppliers accommodate custom specifications?

Yes, many manufacturers support customization in size, material compatibility, voltage requirements (110V/220V), and automation level. Leading suppliers provide engineering consultations to adapt spindle counts, ribbon feed widths, and gluing units. Custom tooling may require NRE fees ranging from $300–$1,500, refundable against future orders.

Do suppliers offer after-sales service and technical support?

Reputable manufacturers provide remote troubleshooting, operating manuals, and spare parts supply. Some offer video tutorials or on-site technician dispatch for large installations. Confirm warranty terms (typically 12 months) and availability of English-speaking support teams before finalizing contracts.

Are there differences between “bow maker” interpretations in sourcing?

Yes. The term refers to either ribbon bow crafting tools/machines or archery bow components—distinct product categories. Procurement strategies must clarify intended use: packaging/decoration versus sports/equipment. Misalignment can result in incorrect product selection. Always validate product images, technical descriptions, and application context during supplier screening.