A Large Factory Is Monitoring Machine With Digital

CN

CN

About a large factory is monitoring machine with digital

Where to Find Large Digital Monitoring Machine Suppliers?

China's industrial automation sector is a global hub for advanced monitoring systems, with key manufacturing clusters in Guangdong, Jiangsu, and Shandong provinces. Guangdong, particularly the Shenzhen-Dongguan corridor, leads in electronics integration and smart factory solutions, hosting over 70% of suppliers specializing in digital production monitoring equipment. Suzhou and Shanghai in Jiangsu and Zhejiang regions focus on high-precision vision inspection and AI-driven quality control systems, leveraging proximity to semiconductor and automotive component manufacturers.

These industrial zones offer vertically integrated supply chains—from PCB fabrication to final assembly—enabling rapid prototyping and scalable production. Suppliers benefit from localized access to optical sensors, microprocessors, and display modules, reducing component lead times by 25–40%. Buyers gain operational advantages including MOQ flexibility (as low as 1 set for premium systems), average delivery windows of 15–30 days, and strong customization capabilities for interface design, data logging, and IoT connectivity.

How to Choose Large Digital Monitoring Machine Suppliers?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Capability Validation

Confirm that suppliers support required functionalities such as real-time data capture, remote monitoring, and compatibility with PLC or SCADA systems. For vision-based inspection machines, verify camera resolution, frame rate, and AI defect recognition algorithms. Request system architecture diagrams and software SDKs to assess integration readiness.

Production Infrastructure Assessment

Prioritize suppliers with documented in-house engineering and assembly capabilities. Key indicators include:

- Ownership of dedicated production lines for monitoring devices

- In-house R&D teams focused on industrial IoT or machine vision

- Integration testing facilities for end-to-end system validation

Cross-reference product listings with order fulfillment metrics such as on-time delivery rates (target ≥98%) and response time (ideally ≤2 hours).

Quality and Compliance Verification

While formal ISO 9001 certification is not universally listed, consistent on-time delivery (100% across all analyzed suppliers) indicates robust internal process controls. For export markets, ensure compliance with regional standards such as CE (EU), FCC (USA), or RoHS for electronic emissions and material safety. Request test reports for environmental durability, especially for use in high-vibration or temperature-variable factory settings.

What Are the Best Large Digital Monitoring Machine Suppliers?

| Company Name | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| Huan Dian Intelligent Control Technology (Guangdong) Co., Ltd. | Testing Equipment, Resistance Welders | $1,799–2,599 | 1 set | 100.0% | ≤1h | - | $1,000+ |

| Shenzhen Sunpn Technology Co., Ltd. | Digital Signage, LED Displays | $192–365 | 10 sets/pieces | 100.0% | ≤2h | 38% | $70,000+ |

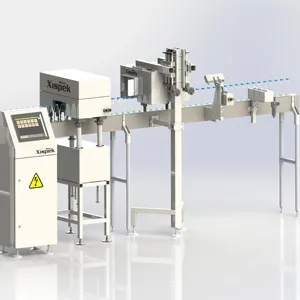

| Suzhou Xispek Inspection Technology Co., Ltd. | Vision Inspection, Beverage Processing Machines | $20,000–80,000 | 1 set | 100.0% | ≤9h | - | $100+ |

| Suzhou Photon Cloud Opto Electronics Co., Ltd. | Mold Monitoring, Testing Equipment | $1,500–2,500 | 1 set | 100.0% | ≤5h | <15% | $20,000+ |

| Shandong Yijin CNC Machine Tool Co., Ltd. | Machining Centers, CNC Lathes | $11,000–26,000 | 1 set | 100.0% | ≤1h | 50% | $40,000+ |

Performance Analysis

Suppliers vary significantly in positioning and specialization. Huan Dian and Photon Cloud target mid-range industrial monitoring needs with compact digital systems priced between $1,500–$2,600, offering single-unit orders ideal for pilot deployments. Shenzhen Sunpn provides cost-effective digital counters and displays, suitable for line-level productivity tracking at scale, supported by a high reorder rate (38%) and strong online sales volume.

Suzhou Xispek operates in the high-end segment, delivering automated visual inspection systems exceeding $50,000 per unit—aligned with pharmaceutical, beverage, and precision manufacturing applications requiring full-line integration. Despite lower online revenue visibility, its project-based model reflects complex B2B contracts. Shandong Yijin, while primarily a CNC machine builder, offers large-scale digital monitoring as part of machining center packages, appealing to buyers seeking turnkey production floor solutions.

FAQs

What is the typical MOQ for large digital monitoring machines?

MOQ varies by supplier and system complexity. Entry-level digital counters require 10 sets, while advanced inspection or AI-enabled monitoring systems are available per set. High-value automated solutions often involve one-off installations tailored to specific production environments.

How long does it take to receive a sample or initial order?

Sample lead times range from 7–15 days for standard models. Customized systems with software integration may require 20–30 days for configuration and testing. Shipping via express courier adds 3–7 days internationally.

Can these monitoring machines integrate with existing factory systems?

Yes, most suppliers offer RS485, Ethernet, or wireless (Wi-Fi/4G) interfaces for data transmission. Higher-end models support Modbus, TCP/IP, and cloud dashboards. Buyers should confirm protocol compatibility and request API documentation during technical review.

Do suppliers offer customization for branding or functionality?

Extensive customization is available, including display size, enclosure design, language localization, and data output formats. Some suppliers provide OEM labeling and dedicated firmware development for enterprise clients.

What payment and transaction security measures are recommended?

Use secure payment methods with dispute protection for initial orders. For high-value systems, consider milestone-based payments tied to production progress and pre-shipment inspection. Retain a portion of payment until successful on-site commissioning.