Assembly Lines In Automobile Manufacturing

1/30

1/30

CN

CN

1/18

1/18

CN

CN

CN

CN

1/10

1/10

CN

CN

1/21

1/21

1/18

1/18

1/17

1/17

1/25

1/25

About assembly lines in automobile manufacturing

Where to Find Assembly Lines for Automobile Manufacturing Suppliers?

China remains the global epicenter for automotive assembly line manufacturing, with specialized industrial hubs in Guangdong, Jiangsu, and Henan provinces driving innovation and scale. Guangdong’s Pearl River Delta region hosts advanced automation suppliers leveraging proximity to electronics and robotics R&D centers, enabling rapid integration of smart manufacturing technologies. Suzhou in Jiangsu province has emerged as a hub for high-end industrial automation, where German-influenced engineering practices converge with cost-efficient production models. Henan's Zhengzhou zone specializes in mid-range automated systems, supported by a dense network of mechanical component suppliers that reduce lead times by 20–30% compared to offshore alternatives.

These clusters offer vertically integrated ecosystems—spanning structural fabrication, control system programming, and final testing—allowing suppliers to deliver turnkey solutions within 60–90 days for standard configurations. Buyers benefit from localized supply chains that lower production costs by 18–25% while maintaining compatibility with international standards. The concentration of technical labor, logistics infrastructure, and machining capabilities within 50-km radii enables agile customization and faster prototyping cycles, particularly for EV and hybrid vehicle production lines.

How to Choose Assembly Line Suppliers for Automotive Manufacturing?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Certifications

Verify adherence to ISO 9001 quality management systems as a baseline. For export markets, confirm CE marking or compliance with IEC 60204-1 (safety of machinery) to ensure regulatory acceptance. Request documentation on PLC programming standards (e.g., Siemens, Allen-Bradley), motor efficiency ratings, and safety interlock integration. Suppliers serving European OEMs should demonstrate functional safety validation per ISO 13849.

Production Capability Assessment

Evaluate key infrastructure indicators:

- Minimum factory area of 3,000m² for full-line integration and staging

- In-house engineering teams capable of 3D modeling (SolidWorks/AutoCAD) and simulation testing

- On-site CNC machining, welding, and conveyor assembly capabilities

Cross-reference delivery performance (target ≥95%) with order volume to assess scalability and workflow stability.

Customization & Quality Control Protocols

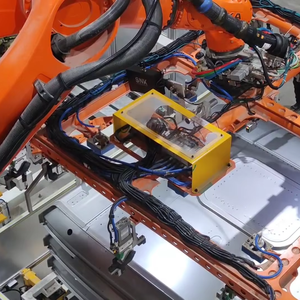

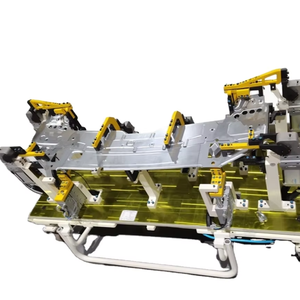

Confirm availability of modular design frameworks for flexible body shop, paint shop, or powertrain line adaptation. Leading suppliers offer configurable pallet systems, robotic interface protocols, and IoT-enabled monitoring. Demand evidence of end-of-line testing procedures, including load cycle validation and fault diagnostics. Onsite QC checkpoints and FMEA documentation should be standard for custom projects.

Transaction Security & Logistics Planning

Utilize secure payment mechanisms such as escrow services tied to milestone inspections. Prioritize suppliers with experience in containerized disassembly and reassembly documentation to streamline customs clearance. Sea freight is standard for complete lines; allocate 30–45 days for global shipping. Pre-shipment inspection reports and commissioning support are critical for minimizing downtime post-installation.

What Are the Leading Assembly Line Suppliers in Automobile Manufacturing?

| Company Name | Location | Verified Type | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Product Range | Min. Order Value |

|---|---|---|---|---|---|---|---|---|

| Guangdong Chaomai Automation Technology Co., Ltd. | Guangdong, CN | Custom Manufacturer | US $280,000+ | 100% | ≤3h | 60% | Tire, seat, ring, and general automotive lines | $980/piece |

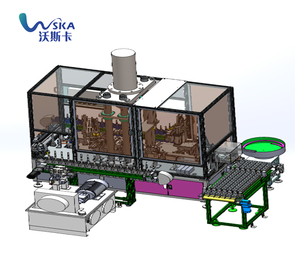

| Schnoka (Suzhou) Intelligent Equipment Co., Ltd. | Suzhou, CN | Multispecialty Supplier | - | 100% | ≤11h | - | Full-car automated assembly plants | $700,000/set |

| Zhengzhou Duoyuan Intelligent Equipment Co., Ltd. | Henan, CN | - | - | 100% | ≤8h | - | Van, car, and lifting sling lines | $5,800/2 sets |

| Anyang Zhengcheng Mechanical Co., Ltd. | Henan, CN | - | - | 100% | ≤13h | - | EV, semi-auto, and customer-made lines | $46,000/set |

| Shenzhen Carst Technology Co., Ltd. | Guangdong, CN | - | US $50,000+ | 90% | ≤1h | 28% | Motorbike, bicycle, electric vehicle sub-lines | $150/10 meters |

Performance Analysis

Guangdong Chaomai stands out with a 60% reorder rate and strong customization options across tire and seating applications, indicating high client retention and niche specialization. Schnoka (Suzhou) targets large-scale OEMs with multi-million-dollar turnkey plants, reflecting deep expertise in fully automated environments. Zhengzhou Duoyuan and Anyang Zhengcheng offer mid-tier solutions ideal for emerging EV manufacturers requiring scalable yet cost-controlled setups. Shenzhen Carst excels in rapid response (≤1h) and component-level flexibility but shows lower on-time performance, suggesting potential bottlenecks in complex integrations. Suppliers in Guangdong emphasize modularity and branding customization, while Henan-based firms focus on core mechanical robustness and affordability.

FAQs

How to verify an assembly line supplier’s technical capability?

Request facility tour videos highlighting CNC stations, control panel assembly, and test runs. Validate engineering team size and software proficiency. Ask for project references involving similar throughput requirements (e.g., 30 JPH for compact cars). Third-party audit reports and PLC code samples add further assurance.

What is the typical lead time for a custom automotive assembly line?

Standard configurations take 45–60 days. Fully customized turnkey systems require 90–120 days, including design approval, fabrication, pre-assembly testing, and packaging. Expedited builds may reduce timelines by 15–20% at additional cost.

Can suppliers provide installation and commissioning support?

Yes, most established suppliers offer remote guidance and on-site technician deployment for startup and calibration. Service fees vary based on duration and travel scope. Confirm availability of multilingual engineers for overseas installations.

Do suppliers accept partial payments and milestones?

Common payment terms include 30% deposit, 40% upon completion of fabrication, 20% before shipment, and 10% after commissioning. Escrow-based transactions are recommended for first-time partnerships to mitigate risk.

What level of customization is available?

Suppliers typically support adjustments in line speed, product width, height, carrier type, and automation level. Custom branding, color coding, HMI interfaces, and integration with MES/SCADA systems are widely offered. Submit detailed process flow diagrams and load specifications to initiate design discussions.