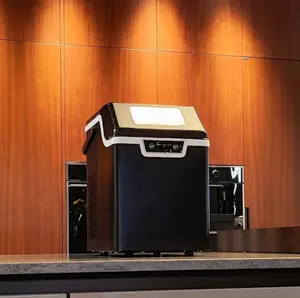

Built In Counter Ice Maker

Top sponsor listing

Top sponsor listing

1/2

1/2

1/28

1/28

1/21

1/21

1/27

1/27

1/19

1/19

1/18

1/18

About built in counter ice maker

Where to Find Built-in Counter Ice Maker Suppliers?

China remains the dominant hub for built-in counter ice maker manufacturing, with key production clusters in Zhejiang and Jiangsu provinces. These regions host vertically integrated supply chains specializing in refrigeration appliances, enabling rapid prototyping and scalable production. Ningbo and Cixi in Zhejiang are recognized for compact commercial-grade ice makers, leveraging localized access to compressors, evaporators, and sheet metal fabrication. Jiangsu-based suppliers focus on high-capacity undercounter models, supported by advanced assembly lines and export-oriented logistics networks.

The industrial ecosystem allows for tight coordination between component suppliers and OEMs, reducing lead times and production costs. Facilities typically integrate injection molding, metal stamping, refrigerant charging, and final testing under one roof. This integration supports MOQ flexibility—from 100 units for countertop models to full container loads for commercial installations—and enables average delivery cycles of 25–40 days for standard orders. Buyers benefit from 15–25% cost advantages over Western manufacturers due to lower labor inputs and domestic material sourcing.

How to Choose Built-in Counter Ice Maker Suppliers?

Selecting reliable suppliers requires systematic evaluation across technical, operational, and transactional dimensions:

Quality & Compliance Verification

Confirm adherence to international safety and performance standards. CE, UL, and RoHS certifications are essential for market entry in Europe and North America. Validate compliance through supplier-provided test reports on electrical safety, cooling efficiency, and refrigerant handling (typically R-134a or R-600a). ISO 9001 certification indicates structured quality management systems, though not universally held among mid-tier exporters.

Production & Customization Capacity

Assess scalability and engineering support through the following indicators:

- Minimum factory area exceeding 3,000m² for stable output

- In-house design teams capable of modifying size, power rating, plug type, and refrigerant charge

- Customization capabilities including color, branding (logo/label), packaging, and control panel graphics

- Monthly production capacity ranging from 5,000 to 20,000 units depending on model complexity

Cross-reference online revenue metrics and reorder rates as proxies for customer satisfaction and fulfillment reliability. Prioritize suppliers with documented after-sales service frameworks and multilingual technical support.

Transaction Risk Mitigation

Utilize secure payment mechanisms such as escrow services to align payment milestones with shipment verification. Favor suppliers enrolled in verified trade programs with dispute resolution history. Request functional samples before bulk orders—especially for customized configurations—to validate build quality, noise levels, and ice production consistency (measured in lbs/24h or kg/day).

What Are the Best Built-in Counter Ice Maker Suppliers?

| Company Name | Main Products | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization Options | Verified Status |

|---|---|---|---|---|---|---|---|

| Jiangsu Eternity Import & Export Co., Ltd. | Ice Machines, Refrigeration Equipment, Ice Crushers | 100% | ≤2h | <15% | US $50,000+ | Color, size, logo, packaging, refrigerant, compressor, plug, power, material | Multispecialty Supplier |

| Ningbo Yingyi International Trade Co., Ltd. | Euhomy-branded Ice Makers | 100% | ≤2h | 27% | US $210,000+ | Color, size, logo, packaging, label, graphic | Multispecialty Supplier |

| Ningbo Lory Electrical Appliances Manufacturing Co., Ltd. | Ice Makers, Food Storage, Air Fryers | 85% | ≤2h | 20% | US $5,000+ | Not specified | Unverified |

| Cixi Jirui Electric Appliance Co., Ltd. | Ice Makers, Blenders, Ice Cream Machines | 50% | ≤6h | <15% | US $2,000+ | Not specified | Unverified |

| TradeTech Innovations Inc | Furniture, Kitchen Appliances | - | ≤2h | - | US $20,000+ | Not specified | Unverified |

Performance Analysis

Jiangsu Eternity and Ningbo Yingyi stand out with 100% on-time delivery records, sub-2-hour response times, and extensive customization capabilities. Their high online revenues reflect consistent export activity and product diversification. Ningbo Yingyi’s 27% reorder rate suggests strong buyer retention, likely driven by brand-aligned designs and reliable performance. In contrast, Cixi Jirui’s 50% on-time delivery rate presents higher fulfillment risk despite competitive pricing. TradeTech Innovations Inc appears to be a generalist distributor rather than a dedicated ice maker manufacturer, indicated by its broad product mix and lack of delivery metrics. Buyers seeking OEM partnerships should prioritize verified suppliers with documented production infrastructure and technical adaptability.

FAQs

How to verify built-in counter ice maker supplier reliability?

Validate certifications (CE, UL, ISO) through official databases or third-party inspection agencies like SGS or TÜV. Request factory audit reports or video tours to confirm production lines and quality control checkpoints. Analyze transaction history, focusing on delivery consistency and post-sale support responsiveness.

What is the typical sampling timeline?

Standard sample production takes 7–14 days. Customized units with specific voltage, plug type, or branding require 15–25 days. Add 5–10 days for international express shipping. Sample costs vary from $70–$400, often creditable against future orders.

Can suppliers accommodate low-volume or custom orders?

Yes, many suppliers accept MOQs as low as 10–100 units for standard models. For custom builds (e.g., unique dimensions, refrigerants, or control panels), MOQs range from 500 to 1,000 units depending on complexity. Verified suppliers are more likely to support iterative prototyping.

Do manufacturers offer private labeling and packaging customization?

Most leading suppliers provide full OEM services, including custom logos, user interface graphics, packaging design, and instruction manuals. Minimum order thresholds for branding typically start at 100–500 units, depending on the supplier.

What are common refrigerants used in built-in counter ice makers?

R-134a and R-600a are most prevalent. R-134a offers stable performance and wide regulatory acceptance, while R-600a is favored for energy efficiency and lower global warming potential. Confirm refrigerant type during specification review to ensure compliance with local environmental regulations.