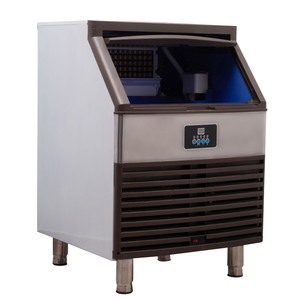

Built In Under Counter Ice Maker

CN

CN

About built in under counter ice maker

Where to Find Built-in Under Counter Ice Maker Suppliers?

China remains the global epicenter for built-in under counter ice maker production, with key manufacturing clusters in Zhejiang, Guangdong, and Shandong provinces. These regions host vertically integrated supply chains that encompass compressor fabrication, stainless steel forming, refrigeration system assembly, and final product testing. Zhejiang’s Ningbo and Cixi zones specialize in compact commercial-grade units, leveraging proximity to port infrastructure for rapid export cycles. Meanwhile, Shandong and Qingdao-based suppliers focus on mid-to-high volume residential and hospitality-sector models, supported by localized sheet metal and insulation material sourcing.

The industrial ecosystem enables economies of scale, with many facilities operating automated production lines capable of 1,000–5,000 units per month. Integrated component suppliers—such as condenser, evaporator, and control panel manufacturers—operate within 50km radii, reducing logistics overhead and lead times. Buyers benefit from average production lead times of 25–40 days for standard orders, 20–30% lower unit costs compared to Western-made equivalents, and flexibility in output capacity ranging from small batches to container-scale shipments.

How to Choose Built-in Under Counter Ice Maker Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Technical & Quality Compliance

Confirm adherence to international standards including CE, RoHS, and ISO 9001 as baseline indicators of quality management. For North American or EU markets, ensure compliance with energy efficiency regulations (e.g., DOE II, ErP Directive) and electrical safety certifications (UL/CSA). Request test reports for refrigerant charge integrity (commonly R-134a or R-600a), noise levels (typically 38–48 dB), and daily ice yield verification under controlled conditions (ASHRAE standards).

Production & Customization Capacity

Assess supplier capabilities through the following benchmarks:

- Minimum monthly output exceeding 1,000 units for stable supply assurance

- In-house engineering teams supporting OEM/ODM customization (e.g., panel color, logo imprinting, digital display interfaces)

- Stainless steel fabrication and powder coating processes for corrosion-resistant cabinetry

Cross-reference declared production volumes with verified online transaction data and on-time delivery rates (target ≥95%) to validate scalability.

Procurement Safeguards

Utilize secure payment mechanisms such as trade assurance or escrow services until post-delivery inspection is completed. Prioritize suppliers offering sample validation programs with clear return or credit policies. Conduct pre-shipment inspections via third-party agencies (e.g., SGS, BV) to verify build quality, ice production performance, and packaging integrity. Demand documentation covering PCB firmware versions, refrigerant handling procedures, and warranty terms (typically 1–3 years).

What Are the Best Built-in Under Counter Ice Maker Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Customization | Min. Order Flexibility |

|---|---|---|---|---|---|---|---|

| TradeTech Innovations Inc | Ice makers, Nightstands, Bar Stools | US $20,000+ | Not specified | ≤2h | Not specified | Limited | 1 piece |

| Cixi Jirui Electric Appliance Co., Ltd. | Ice Makers, Crushers, Blenders | US $1,000+ | 50% | ≤6h | <15% | Limited | 2 pieces / 10 pieces |

| Qingdao Smad Electric Appliances Co., Ltd. | Custom ice makers, Home appliances | US $530,000+ | 85% | ≤2h | 42% | Color, Material, Logo, Packaging | 230–718 units |

| Ningbo Yingyi International Trade Co., Ltd. | Euhomy-branded ice makers | US $210,000+ | 100% | ≤2h | 27% | Color, Size, Logo, Packaging | 10–100 pieces |

| Foshan Libosa Hotel Suppliers Co., Ltd. | Commercial ice makers, Refrigeration equipment | US $160,000+ | 100% | ≤2h | 23% | Limited | 1 set |

Performance Analysis

Foshan Libosa and Ningbo Yingyi demonstrate strong reliability with 100% on-time delivery records and sub-2-hour response times, making them suitable for time-sensitive procurement. Qingdao Smad stands out with a high reorder rate (42%), indicating customer satisfaction and robust after-sales support, though its MOQs are significantly higher (230+ units). Ningbo Yingyi offers balanced flexibility with moderate MOQs (10–100 pieces) and extensive customization options, ideal for branded or private-label buyers. Cixi Jirui, while technically specialized in ice-making systems, shows lower reorder metrics and delayed response windows, suggesting potential service limitations. TradeTech Innovations provides single-unit ordering but lacks transparency in delivery performance and repeat business indicators.

FAQs

How to verify built-in under counter ice maker supplier reliability?

Validate certifications through official registries and request factory audit reports or video walkthroughs of production lines. Analyze transaction history, focusing on consistent order fulfillment, dispute resolution responsiveness, and verifiable customer feedback related to product durability and cooling efficiency.

What is the typical MOQ and pricing range?

MOQs vary widely: from 1 piece for retail-ready models to 230+ units for customized or bulk OEM orders. Unit prices range from $65–$1,300 depending on ice yield (25–130 kg/day), construction (stainless steel vs. laminated), and features like digital controls or reversible doors.

Can suppliers customize ice maker designs?

Yes, select suppliers offer full ODM/OEM services including custom panel colors, branding, control interface layouts, and dimensional adjustments. Companies like Qingdao Smad and Ningbo Yingyi explicitly list graphic, packaging, and material customization options, with lead times extending 5–10 days for tooling setup.

What are standard lead times and shipping options?

Production lead times average 30–40 days after sample approval. Sea freight remains optimal for full-container loads (FCL/LCL), with air shipping viable for samples or urgent small batches (7–14 days transit). Confirm FOB, CIF, or DDP terms during negotiation based on destination logistics capacity.

Do suppliers provide functional samples?

Most suppliers offer samples, typically at 1.5–2x unit price, which may be credited toward first bulk orders. Functional testing should include ice cycle duration, bin capacity verification, drainage performance, and noise measurement in a controlled environment before mass production release.