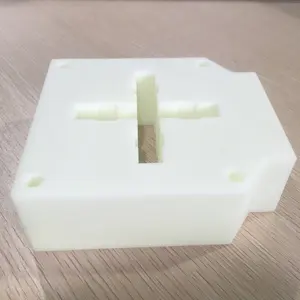

Cnc Rapid Prototyping China

About cnc rapid prototyping china

Where to Find CNC Rapid Prototyping Suppliers in China?

China remains the global epicenter for CNC rapid prototyping services, with key manufacturing clusters concentrated in Guangdong and Jiangsu provinces. These regions host vertically integrated precision engineering hubs that combine advanced CNC machining centers, 3D printing facilities, and secondary processing capabilities under one ecosystem. Dongguan, Shenzhen, and Guangzhou alone account for over 40% of China’s rapid prototyping output, supported by dense networks of material suppliers, tooling experts, and logistics providers operating within tight geographic proximity.

The industrial infrastructure enables agile production cycles—typical lead times range from 5–12 days for machined prototypes, depending on complexity and finishing requirements. Localized supply chains reduce material procurement delays, while automation in CNC milling, turning, and multi-axis machining ensures repeatability down to ±0.005mm tolerances. Buyers benefit from scalable capacity: low-volume batches (1–100 units) are cost-competitive due to minimal setup overhead, while high-mix environments support concurrent prototyping across metals (aluminum, stainless steel, brass) and engineering plastics (ABS, PC, PMMA, PEEK).

How to Choose CNC Rapid Prototyping Suppliers?

Selecting a reliable partner requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm access to multi-axis CNC machines (3-axis, 4-axis, and 5-axis), Swiss-type lathes for turned components, and auxiliary processes such as EDM, grinding, and surface finishing. Review machine park size and control systems (Fanuc, Siemens, or Mitsubishi preferred). For complex geometries, assess integration with CAD/CAM software and DFM feedback turnaround (target: ≤24 hours).

Quality Management Systems

Prioritize suppliers with ISO 9001 certification or equivalent quality frameworks. While not always publicly listed, consistent on-time delivery rates above 90% and documented inspection protocols (first-article inspection reports, CMM data) indicate process discipline. Reorder rates exceeding 35% suggest customer retention driven by dimensional accuracy and surface finish consistency.

Operational Responsiveness

Evaluate communication efficiency using response time benchmarks:

- Target initial reply within ≤5 hours

- Quotation delivery within 24 hours of inquiry submission

- Design-for-manufacturability (DFM) analysis provided proactively

- Real-time order tracking via digital dashboards or regular status updates

Cross-reference these metrics with verified performance tags where available, particularly on-time delivery compliance and historical reorder behavior.

What Are the Leading CNC Rapid Prototyping Suppliers in China?

| Company Name | Main Materials | Processing Techniques | On-Time Delivery | Reorder Rate | Avg. Response | Min. Order Quantity | Price Range (USD) | Revenue Tier |

|---|---|---|---|---|---|---|---|---|

| Dongguan Lize Precision Mold Co., Ltd. | Stainless Steel, Aluminum, Brass, Acrylic | CNC Milling, Turning, Broaching, Chamfering | 85% | 17% | ≤3h | 1 piece | $0.01–2.80 | $50K+ |

| Shenzhen GH Prototype Technology Co., Ltd | ABS, Resin, Metal Alloys | CNC Machining, 3D Printing (SLA/SLS), Low-Volume Production | 100% | 57% | ≤2h | 1 piece | $0.11–6.00 | $10K+ |

| Guangzhou Gaojie Model Design & Manufacturing Co., Ltd. | ABS, Polycarbonate, PMMA, SLA Resin | 3D Printing, Vacuum Casting, CNC Milling | 100% | 85% | ≤5h | 1 unit | $0.20–8.90 | $30K+ |

| Dongguan Sinbo Precision Mechanical Co., Ltd. | Stainless Steel, Aluminum, Carbon Steel | CNC Milling, Turning, Casting Integration | 91% | 36% | ≤11h | 1 piece | $0.10–2.10 | $1.2M+ |

| Hsr Prototype Limited | PMMA, Aluminum, ABS, Engineering Plastics | CNC Machining, Injection Molding, Die-Casting | 100% | 22% | ≤3h | 1 piece (up to 100 pcs for molding) | $0.20–1.50 | $10K+ |

Performance Analysis

Guangzhou Gaojie stands out with an 85% reorder rate—the highest among sampled suppliers—indicating strong client satisfaction in prototype fidelity and service reliability. Shenzhen GH Prototype and Hsr Prototype achieve perfect 100% on-time delivery records, suggesting robust production planning despite mid-tier revenue volumes. Dongguan Sinbo commands the largest reported online revenue ($1.2M+), reflecting scalability and potential OEM engagement, though its 11-hour average response time may impact agility for urgent RFQs. Multiple suppliers offer sub-dollar pricing for simple CNC-turned or milled parts, making them viable for iterative design validation at minimal cost.

FAQs

What materials are commonly used in CNC rapid prototyping?

Common metals include aluminum 6061/7075, stainless steel 303/316, brass, and mild steel. Engineering plastics like ABS, polycarbonate (PC), acrylic (PMMA), and PEEK are frequently machined for functional testing. Material selection depends on mechanical requirements, environmental exposure, and post-processing needs such as anodizing or painting.

What is the typical lead time for CNC prototypes?

Standard lead times range from 5 to 9 business days after design approval. Complex parts requiring secondary operations (heat treatment, plating, laser engraving) may extend to 12 days. Express services (3–5 days) are often available at a premium, subject to machine availability.

Do suppliers support full customization?

Yes, all listed suppliers offer custom CNC machining based on customer-provided 2D drawings or 3D models (STEP, IGES, STL formats). Most provide free DFM feedback to optimize manufacturability, reduce costs, and prevent design errors prior to production.

Are there minimum order quantity (MOQ) constraints?

MOQs are typically flexible, starting at 1 piece for machined prototypes. However, processes like injection molding or die-casting may require minimum runs of 100 units due to tooling setup. Low-volume batch production (10–100 units) is standard for validation and pre-launch phases.

How can buyers verify supplier credibility?

Beyond platform-verified metrics (on-time delivery, response time), request evidence of quality controls such as inspection reports, equipment lists, or facility walkthrough videos. For high-value engagements, consider third-party audits or sample testing against specified tolerances before scaling orders.