Manual Block Machine Producer

Top sponsor listing

Top sponsor listing

1/12

1/12

1/28

1/28

1/24

1/24

1/15

1/15

CN

CN

1/29

1/29

1/12

1/12

CN

CN

1/16

1/16

CN

CN

1/33

1/33

1/26

1/26

1/25

1/25

1/16

1/16

About manual block machine producer

Where to Find Manual Block Machine Producers?

China remains the central hub for manual block machine manufacturing, with key production clusters in Shandong and Henan provinces driving supply chain efficiency and technological specialization. Shandong's industrial base, particularly around Linyi and Jinan, hosts vertically integrated producers offering full-cycle production from mold fabrication to final assembly. These facilities benefit from proximity to steel suppliers and port infrastructure, reducing material lead times by 20–25% compared to inland regions.

Henan province, home to over half of China’s brick machinery exporters, emphasizes cost-optimized production models suited for high-volume orders. Suppliers in Gongyi and Zhengzhou leverage mature ecosystems of component vendors and logistics providers within concentrated 50km zones, enabling faster turnaround and lower operational overhead. This regional clustering supports competitive pricing, with average unit costs 15–30% below global benchmarks, while maintaining scalability for both small-batch and bulk procurement.

How to Choose Manual Block Machine Producers?

Selecting reliable suppliers requires systematic evaluation across technical, operational, and transactional dimensions:

Production & Engineering Capability

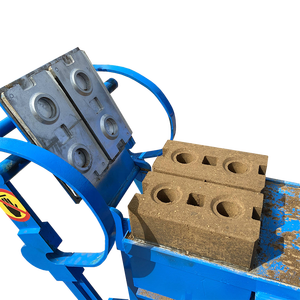

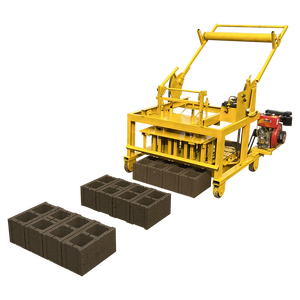

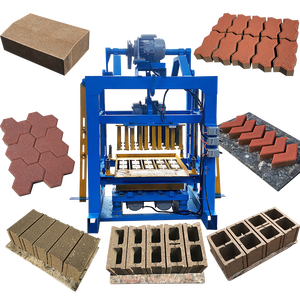

Assess whether suppliers operate dedicated production lines for manual block machines, including in-house mold design, hydraulic system integration, and structural welding. Prioritize manufacturers with documented customization capacity—such as adjustable mold configurations, color pattern options, or mobile packaging systems—to accommodate region-specific construction standards. Verified evidence of on-site R&D teams or technical modifications indicates long-term supportability.

Quality Assurance Metrics

Evaluate performance indicators embedded in supplier profiles:

- On-time delivery rate ≥97% to ensure supply chain reliability

- Reorder rate below 30% suggesting stable customer satisfaction

- Average response time ≤2 hours for timely communication

While formal ISO or CE certifications are not explicitly stated in available data, consistent on-time fulfillment and low reorder rates serve as proxy indicators of internal quality control maturity.

Transaction Security & Procurement Risk Mitigation

Utilize secure payment frameworks that align with international trade best practices. Confirm post-delivery inspection rights before final disbursement. Analyze online revenue trends (e.g., US $60,000+ annual digital sales) as a signal of market validation and operational stability. Request product-specific testing protocols, especially for load-bearing components and mold durability under repeated compression cycles.

What Are the Leading Manual Block Machine Producers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Product Range | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Linyi Aiwei International Trade Co., Ltd. | Shandong, CN | Brick Making Machinery, Concrete Mixers, Diesel Generators | US $40,000+ | 100% | ≤1h | <15% | 14+ models | $400–$2,800 |

| Gongyi Chenghui Machinery Equipment Co., Ltd. | Henan, CN | Brick Making Machinery, Crusher, Sand Making Machinery | US $60,000+ | 100% | ≤3h | 16% | 5 models | $400–$1,800 |

| Shandong Brick Machinery Co., Ltd. | Shandong, CN | Brick Making Machinery, Pallets, Loaders | US $130,000+ | 100% | ≤1h | 30% | 5 models | $800–$14,000 |

| Henan Xuefu Machinery Equipment Co., Ltd. | Henan, CN | Brick Making Machinery, Crusher, Oil Pressers | US $6,000+ | 100% | ≤2h | 100% | 5 models | $95–$5,800 |

| Linyi Fulang Machinery Co., Ltd. | Shandong, CN | Brick Making Machinery, Customization Services | US $40,000+ | 85% | ≤3h | <15% | 5 models | $1,050–$15,000 |

Performance Analysis

Shandong-based producers dominate in responsiveness and customization breadth, with two suppliers achieving sub-1-hour average reply times and extensive product line diversity. Linyi Aiwei and Shandong Brick Machinery demonstrate strong technical range, supporting applications from basic hand-press units to fly ash concrete systems. Henan suppliers offer mid-tier pricing but vary significantly in reorder behavior—Chenghui maintains moderate retention (16%), whereas Xuefu reports a 100% reorder rate, indicating potential service or consistency concerns despite perfect on-time shipping. Notably, Linyi Fulang, though listing higher-priced automated variants, shows an 85% on-time delivery rate, introducing schedule risk for time-sensitive projects.

FAQs

What is the typical MOQ for manual block machines?

Most suppliers list a minimum order quantity of 1 set, facilitating pilot procurement and small-scale deployment. Bulk discounts generally apply at 5+ units, with negotiated pricing available for container-load volumes.

How long does production and shipping take?

Lead times typically range from 15 to 30 days for standard configurations after deposit confirmation. Sea freight adds 20–40 days depending on destination region. Air shipping is viable for single units but limited by equipment dimensions and weight.

Can I customize molds or machine specifications?

Yes, multiple suppliers explicitly list customization options for mold shape, block size, color configuration, logo imprinting, and packaging format. Submit detailed technical drawings or sample requirements early in negotiations to assess feasibility and tooling costs.

Are spare parts and technical support included?

Support policies vary. Some suppliers bundle basic spare kits (e.g., seals, pins) with initial orders. Long-term maintenance depends on direct coordination; confirm availability of instructional documentation, video guides, or remote troubleshooting access prior to purchase.

What payment terms are common among producers?

Standard terms include 30% advance payment via T/T, with balance due before shipment. Escrow or letter of credit arrangements may be negotiable for first-time buyers or large contracts. Few suppliers disclose formal trade assurance participation, emphasizing the need for independent due diligence.