Manufacturing Operations Examples

Top sponsor listing

Top sponsor listing

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/36

1/36

0

0

1/21

1/21

1/24

1/24

0

0

0

0

1/23

1/23

1/3

1/3

0

0

1/3

1/3

0

0

1/3

1/3

0

0

About manufacturing operations examples

Where to Find Manufacturing Operations Suppliers?

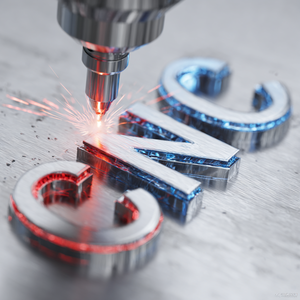

China remains a global hub for contract manufacturing operations, with key industrial clusters in Guangdong and Zhejiang provinces offering specialized capabilities in precision machining, sheet metal fabrication, and custom prototyping. The Shenzhen-Dongguan corridor hosts over 70% of high-mix, low-volume CNC service providers, leveraging mature supply chains for rapid component sourcing and just-in-time delivery. Ningbo and Qingdao serve as centers for heavy machining and investment casting, supported by integrated metallurgical infrastructure that reduces material costs by 18–25% compared to Western-based shops.

These regions feature vertically aligned ecosystems where tooling, heat treatment, surface finishing, and quality inspection services operate within close proximity. This co-location enables lead times as short as 5–7 days for prototype batches and 15–20 days for production runs. Buyers benefit from scalable capacity, localized logistics, and access to technical talent pools, with average labor costs for skilled machinists ranging from $4–6/hour. Customization flexibility is standard, with most suppliers accommodating design revisions up to the first production batch.

How to Choose Manufacturing Operations Suppliers?

Effective supplier selection requires systematic evaluation across three core dimensions:

Technical Capability Verification

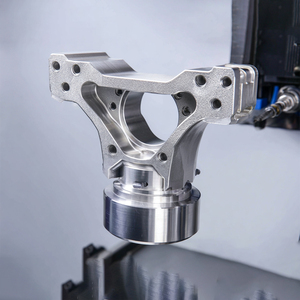

Confirm availability of required processes: CNC milling (3-, 4-, or 5-axis), turning, EDM, sheet metal stamping, injection molding, or investment casting. For mission-critical components, verify tolerance capabilities (±0.005mm typical for precision machining) and secondary operation support such as anodizing, passivation, or sandblasting. Review product listings for evidence of complex geometries, multi-material assemblies, or tight-tolerance gears and threaded components.

Production Infrastructure Assessment

Evaluate operational scale through measurable indicators:

- Facility size exceeding 2,000m² indicates capacity for dedicated production lines

- In-house tooling and mold-making capabilities reduce dependency on third parties

- On-site metrology labs with CMM or optical comparators ensure process control

Cross-reference reported online revenue with on-time delivery rates—suppliers maintaining >95% punctuality at revenue levels above US $500,000 demonstrate proven workflow management.

Transaction Risk Mitigation

Prioritize suppliers with documented response times ≤2 hours and reorder rates >30%, indicating customer satisfaction and operational reliability. Use incremental engagement strategies: begin with small-batch prototypes before scaling. Require dimensional reports and material certifications (e.g., mill test reports) with initial shipments. Where applicable, confirm compliance with ISO 9001, RoHS, or REACH standards—though formal certification may be limited among smaller but technically capable workshops.

What Are the Leading Manufacturing Operations Suppliers?

| Company Name | Location | Main Services | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization | Min. Order Volume |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Ruichenxing Industry Co., Ltd. | Guangdong, CN | Machining, Forging, Tool Sets | US $900,000+ | 100% | ≤1h | 34% | Full CAD/Design Support | 1 piece |

| Dongguan Zhixi Precision Hardware Co., Ltd. | Guangdong, CN | Machining Services | US $1,000+ | 100% | ≤1h | 50% | Material & Finish Options | 1 unit/dozen |

| Huizhou Hefa Electronic Co., Ltd. | Guangdong, CN | Machining, Sheet Metal, Molding | US $50,000+ | 98% | ≤2h | 19% | Multi-process Integration | 100 pieces |

| Ningbo Aoling Machinery Manufacturing Co., Ltd. | Zhejiang, CN | Machining, Casting, Sheet Metal | US $40,000+ | 92% | ≤5h | 62% | OEM/ODM Supported | 5–10 pieces |

| 24K Investment (Qingdao) Co., Ltd. | Shandong, CN | Machining, Casting, Moulds | US $8,000+ | 93% | ≤2h | 15% | Prototyping & Mass Production | 1–100 cm |

Performance Analysis

Shenzhen Ruichenxing and Dongguan Zhixi stand out for responsiveness and technical agility, both achieving 100% on-time delivery with sub-1-hour response times—critical for time-sensitive development cycles. Notably, Dongguan Zhixi maintains a 50% reorder rate despite modest transaction volume, suggesting strong client retention through consistent quality. Ningbo Aoling demonstrates high customer loyalty (62% reorder rate), indicative of reliable execution in OEM/ODM engagements. Huizhou Hefa offers broadest service integration, supporting end-to-end production across machining, molding, and surface treatment. For prototyping, suppliers accepting single-piece orders provide critical flexibility during R&D phases.

FAQs

How to assess manufacturing operations supplier capability?

Review product listings for evidence of precision tolerances, multi-axis machining, and secondary processing. Request sample workpieces or digital inspection reports. Verify in-house capabilities via facility videos or photo documentation of CNC controls, tooling racks, and quality stations.

What are typical MOQs and pricing structures?

MOQs range from 1 piece (prototypes) to 100+ units for cost-optimized runs. Unit prices vary by complexity: simple aluminum parts start at $0.50/unit, while multi-feature steel components exceed $5.00. Per-unit costs decrease significantly beyond 1,000-piece volumes due to setup amortization.

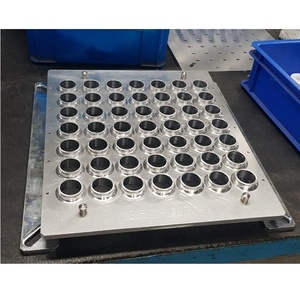

Do suppliers support full customization?

Yes, all listed suppliers offer design-to-production services. Common customization includes material selection (aluminum, stainless steel, brass, titanium), surface treatments (anodizing, plating, sandblasting), and integration of magnets, threads, or embedded features. Technical drawings, 3D models, or physical samples are accepted as input.

What lead times should be expected?

Prototype lead times average 5–7 days after design finalization. Production batches (100–1,000 units) typically require 10–18 days, including quality checks and packaging. Add 5–10 days for international air freight or 25–35 days for sea shipping.

Are quality certifications available?

While not all suppliers list ISO certification, many implement internal quality systems validated by repeat business and high on-time delivery rates. For regulated industries, request process control documentation, first-article inspection (FAI) reports, or PPAP submissions where applicable.