Pcb Print And Assembly

Top sponsor listing

Top sponsor listing

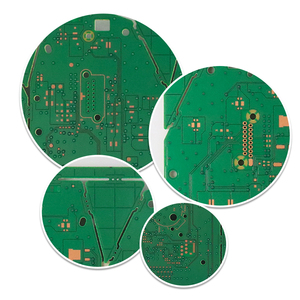

About pcb print and assembly

Where to Find PCB Print and Assembly Suppliers?

China remains the global epicenter for printed circuit board (PCB) manufacturing and assembly, with key industrial hubs in Guangdong, Jiangsu, and Zhejiang provinces driving innovation and scale. Shenzhen and Huizhou in Guangdong province host high-density clusters of electronics manufacturers specializing in rapid prototyping and high-volume PCBA production, supported by vertically integrated supply chains for substrates, solder masks, and surface finishes. Suzhou and Zhongshan offer mature ecosystems combining design engineering with automated SMT lines, enabling turnkey solutions from layout to functional testing.

These regions benefit from concentrated technical labor pools and proximity to semiconductor distributors, reducing component procurement lead times by 10–15 days compared to offshore alternatives. Suppliers leverage economies of scale through shared logistics networks and standardized fabrication processes, achieving cost efficiencies of 20–35% on multilayer and HDI boards. Buyers gain access to agile production environments capable of fulfilling low-volume prototypes (1–100 units) within 5–7 days and scaling to monthly outputs exceeding 50,000 units for established clients.

How to Choose PCB Print and Assembly Suppliers?

Evaluate suppliers using the following criteria to ensure technical compliance and operational reliability:

Design and Engineering Capabilities

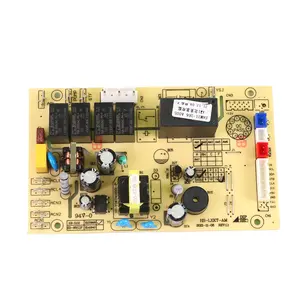

Confirm support for advanced design parameters including impedance control, blind/buried vias, and rigid-flex integration. Leading suppliers offer free DFM (Design for Manufacturability) analysis and collaborative engineering services for layout optimization. Prioritize vendors with in-house CAD tools and experience in high-frequency (RF), automotive, or medical-grade PCBs where traceability and IPC-6012 Class 3 standards apply.

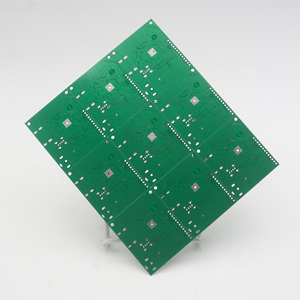

Production Capacity and Technology

Assess infrastructure based on:

- Automated SMT and THT assembly lines with AOI and X-ray inspection

- Layer capability: 2–16+ layers for standard production; up to 32 layers for specialized applications

- Material compatibility: FR-4, Rogers, polyimide, aluminum substrates

Cross-reference equipment lists with on-time delivery performance (target ≥95%) and reorder rates to validate consistency under volume pressure.

Quality Assurance and Certifications

Require ISO 9001 certification as a baseline. For export to regulated markets, verify compliance with RoHS, REACH, and UL recognition. Request test reports for solder joint integrity (IPC-A-610), plating thickness, and thermal cycling resilience. Suppliers should maintain documented QC checkpoints at stencil printing, reflow, and final functional testing stages.

What Are the Best PCB Print and Assembly Suppliers?

| Company Name | Location | Main Products (Listings) | On-Time Delivery | Reorder Rate | Avg. Response | Online Revenue | Customization Options | Min. Order Quantity |

|---|---|---|---|---|---|---|---|---|

| Zhongshan Huishine Pcba Co., Ltd. | Guangdong, CN | PCBA (1,699) | 94% | 50% | ≤2h | US $290,000+ | Design, assembly, engineering | 1 piece |

| Suzhou Engine Electronic Technology Co., Ltd. | Jiangsu, CN | PCBA, OEM Electronics | 91% | 15% | ≤3h | US $50,000+ | Pcb design, color, size, logo, packaging | 1 piece |

| Shenzhen Seeme Technology Co., Ltd. | Guangdong, CN | PCBA (103), GPS Tracker | 100% | 33% | ≤5h | US $10,000+ | Limited customization | 2 pieces |

| Shenzhen Yongchangtai Electronics Co., Ltd. | Guangdong, CN | OEM/ODM, Multilayer PCB | 100% | <15% | ≤2h | US $1,000+ | Color, material, size, logo, packaging | 100 pieces |

| Huizhou Yiping Technology Co., Ltd. | Guangdong, CN | PCBA (38), Electronics Machinery | 100% | - | ≤3h | - | Standard configurations | 1 piece / 1 m² |

Performance Analysis

Zhongshan Huishine stands out with the highest online revenue and a 50% reorder rate, indicating strong customer retention and scalable operations. Shenzhen Seeme and Shenzhen Yongchangtai both achieve 100% on-time delivery, reflecting robust production planning despite differing MOQ structures—Seeme caters to low-volume buyers (2 pcs), while Yongchangtai targets bulk orders (100 pcs minimum). Suzhou Engine offers broad customization but has a lower reorder rate, suggesting potential gaps in post-sale satisfaction. Huizhou Yiping’s focus on production machinery indicates dual-use capabilities, potentially offering vertical integration for OEM clients. Buyers seeking rapid iteration should prioritize suppliers with sub-3-hour response times and 1-piece MOQs, whereas high-volume contracts benefit from partners with proven scalability and ISO-aligned quality systems.

FAQs

How to verify PCB supplier quality?

Cross-check ISO and RoHS compliance documentation. Request sample batches for electrical testing and visual inspection against IPC-A-600H standards. Evaluate process control via factory audit reports or video tours highlighting SMT line automation and QC stations.

What is the typical lead time for PCB assembly?

Prototype orders take 5–7 days for single-layer and 7–10 days for multilayer boards. Mass production (1,000+ units) typically requires 15–20 days, including component sourcing and functional testing. Expedited services may reduce timelines by 3–5 days at premium rates.

Do suppliers support full turnkey assembly?

Yes, many offer turnkey solutions managing BOM procurement, assembly, and testing. Confirm component sourcing policies, especially for long-lead ICs, and clarify liability for obsolescence or counterfeit parts. Partial turnkey (consignment of critical components) is also widely available.

What are common customization options?

Suppliers typically allow adjustments in board thickness, copper weight (1–3 oz), solder mask color, silkscreen labeling, and edge plating. Advanced options include impedance matching, gold finger plating, and conformal coating for environmental protection.

How does pricing scale with order volume?

Unit costs decrease significantly beyond 100 units due to fixed setup amortization. A 10-layer PCB may cost $5/unit at 10 units but drop to $1.20/unit at 1,000 units. Negotiate tiered pricing and consider warehouse consignment programs for recurring builds to lock in favorable rates.