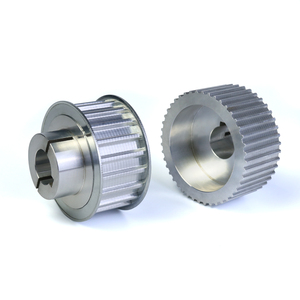

Precision Engineered Components

Top sponsor listing

Top sponsor listing

About precision engineered components

Where to Find Precision Engineered Components Suppliers?

China remains the global hub for precision engineered components manufacturing, with key production clusters concentrated in Guangdong and Zhejiang provinces. Shenzhen and Dongguan in Guangdong province host advanced machining ecosystems specializing in high-tolerance CNC processing, supported by mature supply chains for raw materials such as aluminum alloys, stainless steel (AISI 304/316), and brass. Ningbo in Zhejiang offers integrated fabrication services including casting, forging, and sheet metal forming, enabling end-to-end component production under one regional network.

These industrial zones provide access to vertically aligned operations—ranging from rapid prototyping to mass production—with average lead times of 15–25 days for custom orders. Suppliers benefit from localized tooling and material sourcing, reducing unit costs by 20–35% compared to Western counterparts. Buyers can leverage proximity to specialized service providers in metrology, heat treatment, and surface finishing, ensuring compliance with tight tolerances (±0.005mm) and industry-specific standards.

How to Choose Precision Engineered Components Suppliers?

Evaluate potential partners using these critical criteria:

Technical Capabilities

Confirm availability of multi-axis CNC machining (including 5-axis systems), EDM, and automated inspection equipment. Prioritize suppliers offering full documentation of geometric dimensioning and tolerancing (GD&T), first-article inspection reports (FAIR), and process capability studies (Cp/Cpk). Materials expertise should include aerospace-grade aluminum (6061, 7075), titanium, and corrosion-resistant alloys.

Quality Assurance Systems

ISO 9001 certification is a baseline requirement for systematic quality control. For regulated industries (medical, automotive, aerospace), verify adherence to AS9100, IATF 16949, or ISO 13485 where applicable. Request evidence of in-process inspections, final QA protocols, and traceability records per batch or serial number.

Production Scalability & Responsiveness

Assess operational scale through facility size, workforce composition, and monthly output capacity. Key indicators include:

- On-time delivery rate exceeding 95%

- Average response time under 6 hours

- Dedicated engineering support for DFM (Design for Manufacturing) feedback

- Minimum Order Quantity (MOQ) flexibility down to 1 piece for prototypes

Cross-reference performance metrics with transaction history and reorder rates to validate reliability and customer satisfaction.

What Are the Best Precision Engineered Components Suppliers?

| Company Name | Main Services | Materials Specialization | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | Online Revenue |

|---|---|---|---|---|---|---|---|

| Ningbo Asaisi Industry & Trading Co., Ltd. | Casting, Machining, Forging, Sheet Metal, Aluminum Profiles | Aluminum, Steel, Alloys | 100% | ≤2h | 100% | Not specified | US $10,000+ |

| Shenzhen Rollyu Precision Machining Co., Ltd. | Machining, Sheet Metal, Fasteners | Stainless Steel (AISI 316), Brass, Aluminum 6061 | 100% | ≤6h | - | Not specified | US $10,000+ |

| Shenzhen 917 Precision Machinery Co., Ltd. | Machining, Sheet Metal, Prototyping | Stainless Steel, General Metals | 100% | ≤25h | - | Low-volume custom parts | - |

| Dongguan Dare Hardware Machinery Co., Ltd. | Machining, Casting, Moulds, Thermal Solutions | Metal Alloys, Custom Composites | 100% | ≤2h | 50% | Modular, thermal, and flexible designs | US $6,000+ |

| Shenzhen City Pengxinglong Hardware Products Co., Ltd. | 5-Axis CNC Machining, Custom Fabrication | Aluminum Alloy, Metal Washers/Shims | 92% | ≤1h | 31% | Color, size, logo, packaging, labeling | US $160,000+ |

Performance Analysis

Suppliers like Ningbo Asaisi and Shenzhen Rollyu demonstrate strong technical breadth with full-service capabilities across machining and fabrication, backed by 100% on-time delivery. Dongguan Dare stands out with a 50% reorder rate, indicating high client retention for engineered thermal and modular solutions. Shenzhen City Pengxinglong leads in customization depth and digital responsiveness (≤1h), despite a slightly lower delivery rate, while reporting the highest online revenue—suggesting significant export volume and market trust. Buyers requiring rapid prototyping should prioritize firms like Shenzhen 917, which supports low MOQs (100–500 pcs), though slower response times may affect project agility.

FAQs

How to verify precision engineered components supplier reliability?

Request documented proof of quality certifications, facility audits, and sample test results. Validate technical claims through video tours of CNC floors and inspection labs. Analyze transaction history for consistency in delivery performance and dispute resolution.

What is the typical MOQ and lead time?

Standard MOQ ranges from 1 piece (prototypes) to 100–500 units for production runs. Average lead time is 10–20 days post-approval, depending on complexity and finishing requirements. Rush processing may reduce timelines by 3–5 days at additional cost.

Can suppliers handle complex material specifications?

Yes, leading manufacturers process high-performance materials including Inconel, PEEK, titanium, and hardened steels. Confirm prior experience with your specific alloy and required post-processing (anodizing, plating, passivation).

Do suppliers offer design-for-manufacturability (DFM) support?

Most established suppliers provide free DFM analysis to optimize part geometry, reduce machining time, and improve yield. Submit STEP or IGES files for technical evaluation within 24–72 hours.

Are samples available before bulk ordering?

Yes, functional or cosmetic samples are typically available. Costs vary based on complexity; some suppliers offset fees against future orders. Expect 5–15 days for sample production and 3–7 days for international express delivery.