Precision Machine And Tool

CN

CN

About precision machine and tool

Where to Find Precision Machine and Tool Suppliers?

China remains a central hub for precision machine and tool manufacturing, with key production clusters in Guangdong, Jiangsu, and Shanghai. These regions host vertically integrated facilities that specialize in CNC machining, grinding systems, and manual milling equipment. Dongguan and Yangzhou, in particular, have developed mature ecosystems for mold processing and industrial-grade tooling, supported by localized supply chains for high-tensile alloys and hardened steel components.

The concentration of technical expertise and component suppliers within 50km radii enables streamlined production cycles and rapid prototyping. Suppliers in these zones typically operate under ISO-aligned quality management frameworks, offering lead times of 20–40 days for standard orders. Cost efficiencies stem from in-house spindle manufacturing, automated assembly lines, and access to raw materials, resulting in 15–25% lower pricing compared to equivalent Western-made machinery. Buyers benefit from scalable output, with many factories capable of fulfilling bulk orders (10+ units) while maintaining tight tolerances (±0.005mm).

How to Choose Precision Machine and Tool Suppliers?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Quality Assurance Verification

Confirm adherence to international standards such as ISO 9001 or CE marking, particularly for equipment intended for regulated markets. Review documentation on material traceability, heat treatment processes, and calibration procedures. For grinding and milling systems, request proof of spindle runout testing and dynamic balancing reports.

Production Capacity Assessment

Evaluate infrastructure indicators:

- Facilities exceeding 3,000m² with dedicated R&D or customization departments

- In-house capabilities in CNC turning, surface grinding, and gear cutting

- Integration of metrology tools (e.g., CMM, laser interferometers)

Cross-reference response time metrics (target ≤5 hours) and on-time delivery rates (ideal ≥95%) to assess operational reliability.

Customization and Transaction Security

Prioritize suppliers offering configurable options for motor power, chuck size, feed rate, and control interface. Verify support for OEM labeling, packaging modifications, and technical drawings. Utilize secure payment mechanisms and require sample validation before full-scale ordering. Inspect product samples for surface finish quality, dimensional accuracy, and noise levels under load.

What Are the Best Precision Machine and Tool Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Notable Capabilities |

|---|---|---|---|---|---|---|

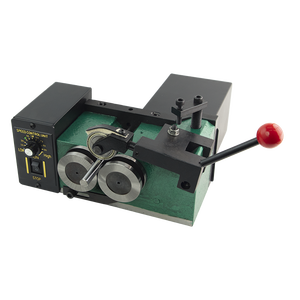

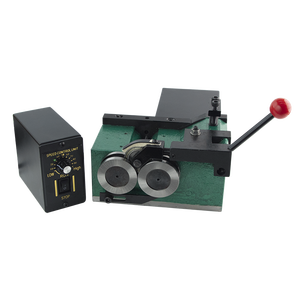

| Dongguan Lize Precision Mold Co., Ltd. | Machining Services, Spindle, Vise, Chamfering Machine | US $50,000+ | 89% | ≤3h | 18% | Specializes in mold tooling accessories; offers multi-function punch grinders with precise milling capability |

| PRECISION MACHINE TOOLS | Cylindrical Grinding Machine, CNC Engraving Machines, Boring Machines | Not disclosed | Not disclosed | ≤12h | Not disclosed | Supplies high-precision attachments including internal grinding units and steady rests for lathes |

| Yangzhou Enyun Precision Machinery Factory | Manual Mills, Manual Lathe, Drilling Machines | US $10,000+ | 100% | ≤3h | <15% | Produces universal knee-type milling machines and automatic tool feeders; demonstrates perfect delivery record |

| SJR Machinery Co., Ltd. | Custom Manufacturer of Horizontal Lathes, Hydraulic Presses | US $490,000+ | 94% | ≤2h | <15% | Offers extensive customization in size, color, material, and branding; caters to specialized industrial configurations |

| Shanghai Sihao Machinery Equipment Co., Ltd. | Manual Lathe, Mini Metal Lathe, Drilling-Milling Systems | US $1,700,000+ | 98% | ≤5h | 15% | High-volume producer of benchtop lathes; strong export performance and short response windows |

Performance Analysis

Suppliers like Yangzhou Enyun and SJR Machinery demonstrate high operational discipline with on-time delivery rates at or above 94%, making them suitable for time-sensitive procurement. Shanghai Sihao leads in transaction volume, indicating robust production throughput and market confidence. Dongguan Lize focuses on niche tooling solutions with competitive pricing in the $139–$465 range. While reorder rates remain modest across the segment (typically below 18%), this reflects the capital-intensive nature of the equipment rather than dissatisfaction. For custom engineering projects, SJR Machinery’s design flexibility and Shanghai Sihao’s responsive communication offer strategic advantages.

FAQs

How to verify precision machine and tool supplier reliability?

Validate certifications through official registries and request factory audit reports. Examine product specifications for compliance with DIN, JIS, or ANSI standards. Analyze customer feedback on build quality, post-sale service, and consistency in dimensional accuracy.

What is the typical minimum order quantity (MOQ)?

Most suppliers set MOQ at 1 unit for standard models. Bulk discounts apply at 5+ units. Some mini-lathe suppliers require 20 sets for specific configurations.

Are customization options available?

Yes, select manufacturers support adjustments in motor voltage, spindle speed, bed length, and control panel layout. Full OEM services—including logo imprinting and branded packaging—are offered by verified custom producers like SJR Machinery.

What are common lead times?

Standard orders ship within 20–30 days. Customized or high-tonnage systems (e.g., 220t hydraulic presses) may require 45–60 days for fabrication and testing.

Do suppliers provide samples?

Sample availability depends on equipment size and cost. Smaller units (e.g., benchtop lathes) may be supplied at reduced rates, while large systems often require down payments or pre-shipment inspections instead of physical sampling.