Production Engineering And Robotics

CN

CN

Top sponsor listing

Top sponsor listing

CN

CN

CN

CN

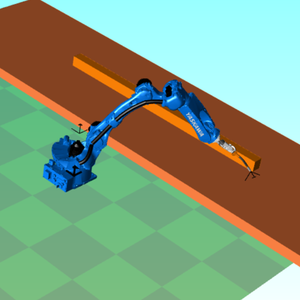

About production engineering and robotics

Where to Find Production Engineering and Robotics Suppliers?

China remains a central hub for production engineering and robotics manufacturing, with key suppliers concentrated in Guangdong, Henan, and Shandong provinces. These regions host vertically integrated facilities that combine robotic R&D, precision machining, and automated assembly under one roof. Guangzhou and Shanghai serve as innovation centers, hosting firms specializing in collaborative robots (cobots), autonomous mobile robots (AMRs), and customized automation systems. Meanwhile, Henan-based manufacturers focus on cost-efficient industrial palletizers, delta robots, and material handling equipment, leveraging regional supply chains for structural components and control systems.

The presence of in-house production lines enables direct oversight of quality control and faster prototyping cycles. Suppliers with dedicated engineering teams can support both standard configurations and client-specific modifications—ranging from payload adjustments to integration with existing factory control systems. Buyers benefit from localized ecosystems where component sourcing, CNC fabrication, and final testing occur within compact geographic zones, reducing lead times by up to 25% compared to offshore alternatives. Typical delivery windows range from 30–45 days for off-the-shelf units, with custom builds requiring an additional 15–20 days depending on complexity.

How to Choose Production Engineering and Robotics Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm the supplier offers documented expertise in core robotic types: articulated arms, SCARA, delta, and collaborative models. Prioritize companies with demonstrated experience in integrating sensors, end-effectors (e.g., grippers, welding heads), and motion control software. For high-precision applications such as laser welding or milling, verify compatibility with industry-standard programming interfaces and safety protocols (e.g., ISO 10218 for industrial robots).

Production Infrastructure Assessment

Evaluate key indicators of manufacturing maturity:

- Ownership of end-to-end production lines including CNC machining, robotic calibration, and functional testing

- Demonstrated customization capacity (e.g., color, size, branding, communication protocols)

- In-house engineering support for integration and troubleshooting

Cross-reference claimed capabilities with verified performance metrics such as on-time delivery rates (target ≥95%) and response times (ideally ≤5 hours).

Quality and Transaction Assurance

While formal certifications (ISO 9001, CE, RoHS) are not explicitly listed in available data, buyers should require evidence of compliance prior to procurement. Insist on third-party inspection services or remote factory audits via video walkthroughs to validate production conditions. Utilize secure payment mechanisms tied to milestone verification, particularly for first-time engagements. Request sample units to assess build quality, repeatability accuracy, and ease of deployment before scaling orders.

What Are the Best Production Engineering and Robotics Suppliers?

| Company Name | Main Products | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|

| Guangzhou Inbot Technology Ltd. | Commercial Reception Robots, Delivery Robots, Security & Cleaning Robots, Toy Robots | 66% | ≤3h | <15% | US $140,000+ | Color, material, size, logo, packaging, label, graphic |

| Henan Addis Technology Co., Ltd. | Parallel Robots, Collaborative Robots, AGVs, Palletizing Systems | 100% | ≤5h | <15% | - | Not specified |

| Jinan Uniontech Machinery Co., Ltd. | 6-Axis Industrial Robots, Milling Robots, 3D Printed Robotic Systems | 100% | ≤2h | 18% | US $990,000+ | Color, material, size, logo, packaging, label, graphic |

| Guangzhou Linfeng Intelligent Technology Co., Ltd. | Collaborative Robots, Welding Robots, Autonomous Industrial Units | 100% | ≤6h | - | - | Not specified |

| Shanghai Jiesheng Robot Co., Ltd. | Articulated Robots, Manipulators, Welding Robots, Track-Mounted Units | 100% | ≤5h | - | - | Yes (customized builds available) |

Performance Analysis

Henan Addis Technology, Guangzhou Linfeng, Jinan Uniontech, and Shanghai Jiesheng all report 100% on-time delivery, indicating strong production planning and order execution. Jinan Uniontech stands out with over US $990,000 in online revenue and a sub-2-hour average response time, suggesting robust customer engagement and likely higher service capacity. While Guangzhou Inbot offers broad product diversity in commercial robotics, its lower on-time delivery rate (66%) may indicate scalability challenges. Customization is explicitly offered by Uniontech and Inbot, providing flexibility for OEM branding and functional adaptation. Reorder rates remain generally low (<15% to 18%), which may reflect the capital-intensive nature of robotic purchases rather than dissatisfaction.

FAQs

How to verify robotics supplier reliability?

Request documentation of design validation, component sourcing policies, and testing procedures. Conduct virtual facility tours to observe assembly workflows and quality checkpoints. Analyze historical transaction data, focusing on consistency in delivery performance and responsiveness. Third-party inspection reports significantly reduce risk for initial large-volume orders.

What is the typical MOQ and pricing range?

Minimum order quantities are typically set at 1 unit/set, allowing for pilot deployments. Pricing varies widely based on configuration: entry-level delta robots start around $5,400, while advanced 6-axis industrial units range from $20,000 to $60,000. High-complexity systems such as laser welding or multi-axis milling robots may exceed $40,000 per unit.

Can suppliers support customization?

Yes, select manufacturers like Jinan Uniontech and Guangzhou Inbot offer comprehensive customization—including mechanical dimensions, materials, control interfaces, and aesthetic elements (color, logos, packaging). Technical modifications require clear specifications and may involve NRE (non-recurring engineering) fees for unique designs.

Do robotics suppliers provide global shipping?

Most established exporters handle international logistics, offering FOB, CIF, or DDP terms. Ensure compliance with destination-country electrical standards, safety regulations, and import classifications for robotic systems. Air freight is recommended for samples; sea freight is economical for bulk shipments.

How long does sampling take?

Standard robot samples are typically ready within 20–35 days. Customized prototypes may require 45–60 days, depending on design complexity and component availability. Allow additional time for international transit and customs clearance.