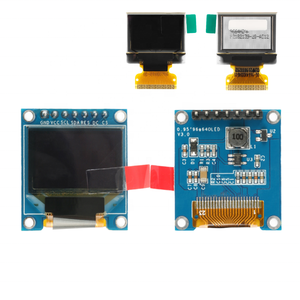

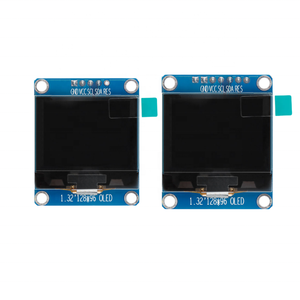

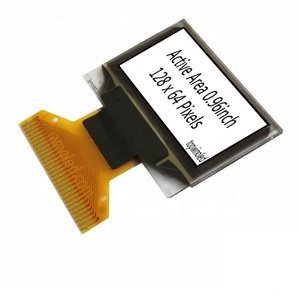

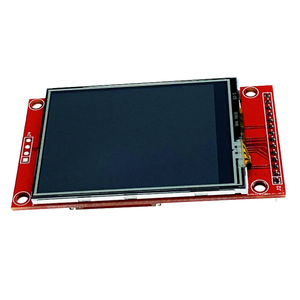

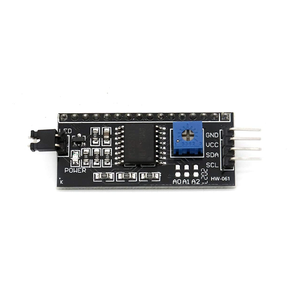

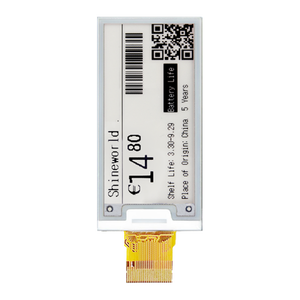

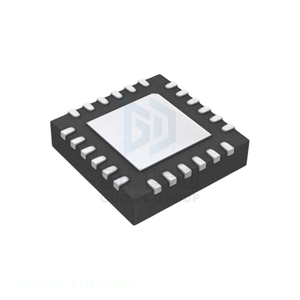

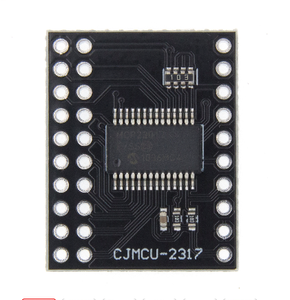

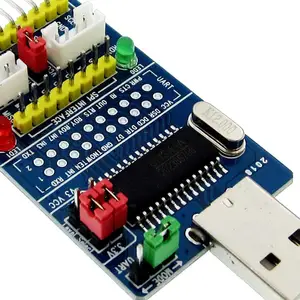

Spi Serial Parallel Interface

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/13

1/13

1/3

1/3

1/3

1/3

1/37

1/37

1/3

1/3

1/3

1/3

1/2

1/2

1/1

1/1

1/4

1/4

0

0

1/2

1/2

1/2

1/2

1/20

1/20

0

0

About spi serial parallel interface

Where to Find SPI Serial Parallel Interface Suppliers?

China remains the central hub for electronic interface component manufacturing, with key production clusters in Guangdong and Jiangsu provinces driving efficiency and innovation. Guangdong, particularly the Pearl River Delta region, hosts over 70% of China’s electronics OEMs and ODMs, supported by Shenzhen’s advanced semiconductor supply chain and rapid prototyping infrastructure. Jiangsu’s Changzhou and Suzhou zones specialize in precision PCB assembly and embedded systems integration, leveraging proximity to research institutions and wafer fabrication facilities.

These industrial ecosystems enable streamlined production through vertically integrated workflows—from IC design and PCB layout to surface mount technology (SMT) and final testing. Suppliers within these regions benefit from localized access to raw materials (e.g., FR-4 substrates, copper foil, solder paste), reducing material lead times by 25–40%. Buyers gain advantages including MOQ flexibility (as low as 100 units), lead times averaging 15–25 days for batch orders, and strong customization support for protocol-specific variants (e.g., full-duplex SPI, multi-slave configurations).

How to Choose SPI Serial Parallel Interface Suppliers?

Implement structured evaluation criteria to ensure technical and operational reliability:

Quality & Compliance Verification

Confirm adherence to ISO 9001:2015 for quality management and IEC 61131-9 for industrial communication interface standards. For export to regulated markets, validate RoHS and REACH compliance to ensure lead-free, environmentally compliant assemblies. Request test reports for signal integrity (rise/fall time, clock jitter) and EMI performance under load conditions.

Production Capability Assessment

Evaluate core manufacturing competencies:

- Minimum 2,000m² cleanroom facility with ESD-safe production lines

- In-house SMT and THT assembly lines with placement accuracy ≤±0.05mm

- Dedicated firmware programming and functional testing stations

Verify throughput capacity—target suppliers capable of 50,000+ units/month with automated optical inspection (AOI) and flying probe testing.

Procurement & Transaction Security

Utilize secure payment terms such as irrevocable LC at sight or escrow-based settlements for initial orders. Prioritize suppliers with documented export experience to North America and EU, including proper HS code classification (8542.31 or 8537.10) and CE/FCC documentation. Conduct pre-shipment inspections via third-party auditors (e.g., SGS, TÜV) to verify PCB quality, pin alignment, and labeling accuracy.

What Are the Best SPI Serial Parallel Interface Suppliers?

No supplier data is currently available for this product category. Procurement professionals are advised to initiate sourcing inquiries through verified B2B channels and conduct preliminary audits focusing on technical documentation, sample performance, and factory certifications. Given the standardized nature of SPI interfaces, differentiation typically arises in customization capability, firmware integration support, and batch traceability systems.

Performance Analysis

In the absence of published supplier metrics, emphasis should be placed on demonstrable engineering expertise and process transparency. Leading candidates typically provide detailed datasheets, reference designs, and Gerber file compatibility. Strong contenders offer configurable clock polarity (CPOL) and phase (CPHA) settings, support for daisy-chained topologies, and built-in level-shifting for mixed-voltage systems. For high-reliability applications (industrial automation, medical devices), confirm IPC Class 2 or Class 3 compliance and thermal cycling test records.

FAQs

How to verify SPI interface supplier reliability?

Request evidence of certified quality management systems (ISO 9001) and product conformity reports. Conduct remote or on-site audits to assess traceability systems, component sourcing (preferably original manufacturer or franchised distributors), and failure mode analysis procedures. Review customer references for long-term field performance and after-sales technical support responsiveness.

What is the average sampling timeline?

Standard SPI module samples are typically produced within 7–14 days. Custom variants requiring modified PCB layouts or embedded configuration may require 20–30 days. Air shipping adds 5–7 business days for international delivery. Sample costs generally reflect 40–60% of unit production cost, often creditable against future orders exceeding 1,000 units.

Can suppliers ship SPI interface modules worldwide?

Yes, experienced manufacturers support global logistics via DHL, FedEx, or sea freight for bulk consignments. Confirm Incoterms (FOB Shenzhen, CIF Rotterdam, etc.) and packaging standards (ESD-safe boxes, humidity indicators). Ensure compliance with destination regulations, especially for programmable logic-integrated variants subject to export controls.

Do manufacturers provide free samples?

Free samples are uncommon for fully assembled SPI modules due to component and programming costs. However, some suppliers waive fees for qualified buyers placing forecasted volume orders. Evaluation kits with basic functionality may be offered at reduced cost for design-in consideration.

How to initiate customization requests?

Submit detailed technical requirements including voltage levels (3.3V/5V), clock frequency range (up to 50MHz), slave select count, and form factor constraints. Provide preferred connector types (e.g., 2.54mm pitch headers, FPC) and environmental ratings (operating temperature, vibration resistance). Reputable suppliers respond with schematic reviews, layout proposals, and timeline estimates within 5–7 business days.