Asynchronous Serial Interface

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/2

1/2

1/2

1/2

1/3

1/3

1/1

1/1

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

About asynchronous serial interface

Where to Find Asynchronous Serial Interface Suppliers?

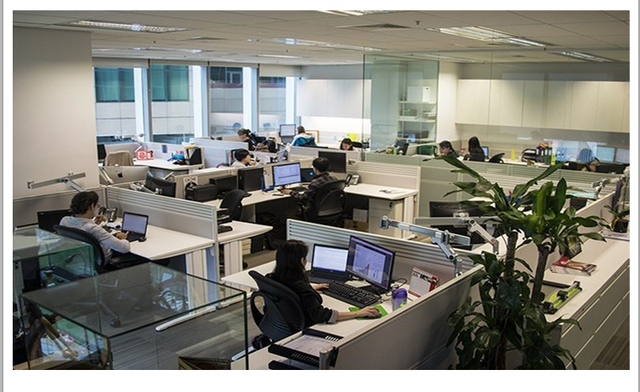

China remains a central hub for semiconductor and integrated circuit component manufacturing, with key suppliers of asynchronous serial interface ICs concentrated in Shenzhen and Dongguan. These regions host specialized electronics trading firms and technology companies that operate within mature supply chain ecosystems, offering access to both legacy and modern serial communication controllers. The proximity to tier-one PCB fabricators, logistics centers, and component distributors enables rapid prototyping and fulfillment for global buyers.

Suppliers in this sector primarily focus on legacy UART (Universal Asynchronous Receiver-Transmitter) chips and CMOS-based serial controllers such as the IS82C52, SC16C550B, and ST16C550 series. Production is typically outsourced to OEM/ODM partners, while trading firms manage inventory, BOM (Bill of Materials) services, and order fulfillment. This model supports low-to-mid volume procurement, with many suppliers offering single-piece sampling and small batch orders. Economies of scale are achieved through consolidated sourcing and direct relationships with original component manufacturers or authorized distributors.

How to Choose Asynchronous Serial Interface Suppliers?

Evaluating suppliers requires verification across technical, operational, and transactional dimensions:

Technical Authenticity

Confirm component authenticity by requesting datasheets, manufacturer traceability codes, and batch numbers. For legacy ICs like the D8251A or IS82C52, verify compatibility with existing system architectures. Suppliers should provide clear specifications including voltage tolerance, baud rate support, package type (e.g., TQFP, LCC), and temperature range.

Operational Reliability Metrics

Assess supplier performance using measurable indicators:

- On-time delivery rate ≥90% indicates consistent logistics execution

- Response time ≤4 hours reflects operational responsiveness

- Reorder rate below 15% may suggest niche specialization or limited demand, whereas higher rates (>30%) can indicate broader market acceptance

- Minimum order quantities (MOQs) ranging from 1–10 pieces accommodate R&D and replacement needs

Cross-reference product listings with stated online revenue to gauge business scale—suppliers reporting US $2M+ annual digital sales typically maintain larger inventories and structured operations.

Transaction Security & Quality Assurance

Prioritize suppliers with verifiable quality control processes. While formal certifications (ISO 9001, RoHS) are not always listed, look for evidence of component testing, anti-counterfeit policies, and packaging standards. Use secure payment methods and request sample validation before scaling orders. Verify if ICs are new, original, or pulled/refurbished based on application criticality.

What Are the Best Asynchronous Serial Interface Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Quantity | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Biguang Tech Co., Ltd. | Shenzhen, CN | Oscillators, PMICs, Microcontrollers, FPGA | US $5,000+ | 100% | ≤2h | <15% | 2 pcs | $0.11–$120.30 |

| Shenzhen Longgang Ruru Trading Firm | Shenzhen, CN | Oscillators, PMICs, Capacitors, FPGA | US $2,000,000+ | 100% | ≤4h | <15% | 10 pcs | $0.13–$17.82 |

| Dongguan Shijie Chipin Electronic Trading Firm | Dongguan, CN | Oscillators, PMICs, Capacitors, FPGA | US $7,400,000+ | 90% | ≤2h | 44% | 10 pcs | $0.63–$318.11 |

| Shenzhen Asia Ocean Electronics Co., Ltd. | Shenzhen, CN | Other ICs, Sensors, Transistors, Connectors | US $10,000+ | 91% | ≤9h | 30% | 1–157 pcs | $0.60–$61.08 |

| Shenzhen Apex-Chip Technology Co., Ltd. | Shenzhen, CN | Other ICs, Development Boards, RF Modules | US $500+ | 100% | ≤15h | <15% | 1–28 pcs | $0.60–$35.94 |

Performance Analysis

Shenzhen-based firms dominate responsiveness and reliability, with three suppliers achieving 100% on-time delivery and sub-4-hour average response times. Shenzhen Longgang Ruru stands out with over US $2M in reported online revenue and competitive pricing on high-volume UART controllers like the SC16C550B. Dongguan Shijie Chipin offers the highest financial throughput (US $7.4M+) but has a 90% delivery rate and 44% reorder rate, suggesting potential variability in fulfillment consistency. For low-MOQ prototyping, Shenzhen Asia Ocean and Shenzhen Apex-Chip support single-unit purchases, ideal for engineering validation. Buyers seeking cost-effective bulk procurement should prioritize suppliers with MOQs of 10 pieces and unit prices below $1.00 for standard serial I/O controllers.

FAQs

How to verify asynchronous serial interface component authenticity?

Request original manufacturer documentation, top-marking photos, and batch traceability. Cross-check part numbers against official datasheets from NXP, Texas Instruments, or Intel. Avoid suppliers who do not disclose origin or offer unusually low pricing inconsistent with market averages.

What is the typical lead time for sample orders?

Standard samples ship within 3–7 business days after payment confirmation. International delivery adds 5–10 days via express courier. Complex or out-of-stock components may require 2–4 weeks for sourcing.

Do suppliers support custom programming or labeling?

Most suppliers do not offer programming services for UART chips, as these are typically configured at the system level. However, some provide labeled tape-and-reel packaging or anti-static bag labeling upon request for volume orders.

Are asynchronous serial interface ICs RoHS compliant?

Compliance varies by batch and manufacturer. Request RoHS certificates or material declarations, especially for EU shipments. Many modern equivalents (e.g., SC16C2550B) are inherently lead-free, but legacy parts may be non-compliant.

Can I purchase just one piece for testing?

Yes, several suppliers—including Shenzhen Asia Ocean and Shenzhen Apex-Chip—offer single-piece MOQs, enabling prototype testing and board validation without large upfront investment.