Supplier Selection Matrix

CN

CN

About supplier selection matrix

Where to Find Supplier Selection Matrix Providers?

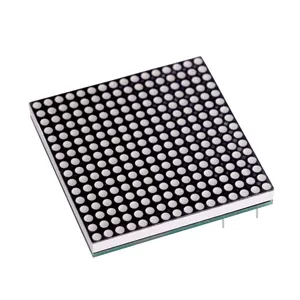

The global supply base for LED dot matrix components—commonly used in industrial displays, signage systems, and embedded control panels—is heavily concentrated in China’s Pearl River Delta region. Shenzhen and Ningbo serve as primary manufacturing hubs, hosting vertically integrated electronics suppliers with specialized expertise in semiconductor packaging, PCB integration, and optical diffusion technologies. These clusters enable rapid prototyping, scalable production, and tight cost control due to proximity to upstream material suppliers and logistics infrastructure.

Suppliers in this ecosystem typically operate multi-line surface-mount technology (SMT) production facilities capable of assembling 5x7, 8x8, and 16x16 configurations using common-anode or common-cathode architectures. Many offer extended customization including color variants (red, green, blue, white), viewing angles (120°–140°), and encapsulation types (through-hole, SMD). The regional concentration supports short lead times—averaging 15–25 days for bulk orders—and facilitates just-in-time inventory models for international buyers.

How to Choose Supplier Selection Matrix Providers?

Effective supplier evaluation requires a structured assessment across technical, operational, and transactional dimensions:

Technical Specifications & Compliance

Verify component-level compliance with industry standards such as RoHS and CE, particularly for export to EU and North American markets. Confirm electrical parameters including forward voltage (typically 1.8–2.2V for red LEDs), luminous intensity (measured in mcd), and multiplexing compatibility (e.g., MAX7219 driver support). Request test reports for thermal stability and solderability to ensure reliability under continuous operation.

Production Capacity & Flexibility

Assess supplier scalability through key indicators:

- Minimum Order Quantity (MOQ) ranging from 1–100 pieces indicates small-batch capability; high-volume suppliers often require 500+ units

- Dedicated R&D resources evidenced by product variations (e.g., multiple pitch sizes, RGB options)

- In-house tooling and molding capacity for custom diffuser films, labeling, or packaging configurations

Cross-reference online revenue data and reorder rates as proxies for market acceptance and fulfillment consistency.

Quality Assurance & Transaction Security

Prioritize suppliers with documented on-time delivery performance exceeding 95%. Evaluate responsiveness (target ≤7 hours) and post-sale service readiness. Where available, utilize secure payment mechanisms that release funds upon inspection confirmation. Pre-shipment sampling is critical—request functional tests on at least three units per batch to validate brightness uniformity and pin alignment accuracy.

What Are the Leading Supplier Selection Matrix Providers?

| Company Name | Location | Main Products (Listings) | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Price (USD) | Lowest MOQ |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Newshine Optics Co., Ltd. | Shenzhen, CN | LED Display, Packaging Label, Graphic Design | US $40,000+ | 100% | ≤7h | 25% | $0.34 | 2 pcs |

| Beijing Graphic International Trade Co., Ltd. | Beijing, CN | Printing Materials, Packaging Machinery | US $250,000+ | 95% | ≤2h | 16% | $17.00 | 1 box |

| Shenzhen Mlk Technology Co., Ltd. | Shenzhen, CN | Electronic Components, ICs, Modules | US $1,000+ | 100% | ≤1h | <15% | $0.62 | 1 pc |

| Ningbo Junsheng Electronics Co., Ltd. | Ningbo, CN | SMD LED, High Power LED, Digital Signage | US $10,000+ | 95% | ≤7h | 20% | $0.10 | 500 pcs |

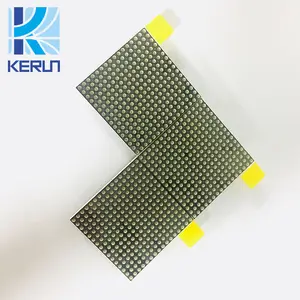

| Shenzhen Kerun Optoelectronics Inc. | Shenzhen, CN | Digital Signage, LED Display | US $80+ | 100% | ≤9h | - | $0.31 | 500 pcs |

Performance Analysis

Shenzhen-based suppliers dominate technical responsiveness and delivery reliability, with three providers achieving 100% on-time fulfillment. Shenzhen Newshine and MLK Technology stand out for low MOQ flexibility and direct factory pricing, making them suitable for prototype development and mid-volume runs. Beijing Graphic offers higher-priced solutions focused on industrial die-cutting matrices, reflecting niche specialization outside standard LED modules. Ningbo Junsheng presents the lowest per-unit cost ($0.10) but enforces a 500-piece minimum, favoring large-scale deployments. Buyers requiring fast iteration should prioritize suppliers with sub-2-hour response times and single-piece sampling availability.

FAQs

How to verify supplier selection matrix quality?

Request sample batches for visual inspection of LED uniformity, lens clarity, and PCB finish. Validate electrical performance using multimeter continuity checks and driver circuit compatibility testing. For regulated applications, confirm RoHS/CE declarations are backed by third-party lab reports.

What is the typical lead time for bulk orders?

Standard production cycles range from 15 to 25 days after order confirmation. Expedited processing (10–14 days) may be available for repeat customers or orders exceeding 10,000 units. Add 5–10 days for air freight delivery to North America or Europe.

Can suppliers customize LED matrix specifications?

Yes, many manufacturers support customization of emission color, beam angle, package size, and labeling. Some offer silk-screening, custom diffusion films, or tailored packaging. Minimum requirements vary—typically 1,000+ units for full customization—with additional tooling fees for mold modifications.

Do suppliers provide free samples?

Sample availability depends on supplier policy. Several providers offer free samples for qualified buyers, especially when followed by volume commitments. Others charge a nominal fee (e.g., $0.10–$1.00/unit) refundable against future orders.

What are common payment terms?

Standard terms include 30% deposit with balance prior to shipment, or use of platform-backed escrow services. Established buyers may negotiate net-30 arrangements after initial transaction history is built. Letters of Credit (L/C) are accepted by larger exporters for container-sized shipments.