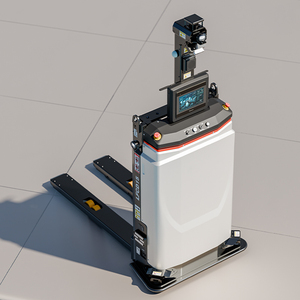

Autonomous Mobile Robots In Warehouse

Top sponsor listing

Top sponsor listing

CN

CN

CN

CN

About autonomous mobile robots in warehouse

Where to Find Autonomous Mobile Robots in Warehouse Suppliers?

China serves as the global epicenter for autonomous mobile robot (AMR) manufacturing, with key industrial clusters concentrated in Shenzhen, Hangzhou, and Suzhou. These regions host vertically integrated supply chains that combine advanced robotics R&D with precision manufacturing capabilities, enabling rapid prototyping and scalable production. Shenzhen's ecosystem excels in smart logistics automation, supported by a dense network of component suppliers specializing in LiDAR, SLAM navigation systems, and motor control units.

The clustering effect reduces lead times by 20–30% compared to non-specialized regions due to proximity between design houses, electronics manufacturers, and testing facilities. Buyers benefit from localized access to firmware development teams, open SDK platforms, and modular chassis designs that support fast customization. Average delivery cycles range from 15 to 45 days depending on configuration complexity, with some suppliers offering pre-certified models compliant with international safety standards. This integration also drives cost efficiency—Chinese AMR producers typically offer 25–40% lower pricing than Western counterparts without compromising performance metrics such as payload accuracy or navigation reliability.

How to Choose Autonomous Mobile Robots in Warehouse Suppliers?

Evaluate potential partners using these critical criteria:

Technical Capability Verification

Confirm expertise in core technologies including SLAM (Simultaneous Localization and Mapping), obstacle detection algorithms, and fleet management software integration. Prioritize suppliers with documented experience in deploying multi-robot coordination systems and compatibility with warehouse management systems (WMS). For operations requiring high-payload handling, validate mechanical design credentials for load-bearing structures and battery endurance under continuous operation.

Production & Quality Infrastructure

Assess operational scale through verifiable indicators:

- Minimum factory area exceeding 3,000m² for stable output

- In-house engineering teams capable of customizing navigation logic, UI interfaces, and communication protocols

- Integration of automated test benches for motion control and sensor calibration

Cross-reference on-time delivery rates (target ≥90%) and response time benchmarks (≤6 hours) to ensure operational responsiveness.

Transaction Security & Support

Require transparent transaction records via verified assurance programs. Analyze reorder rates as an indicator of customer satisfaction—suppliers with reorder rates below 15% often demonstrate consistent quality and service. Insist on sample validation before full-scale orders, particularly for customized variants involving unique size, color, or labeling requirements. Post-delivery technical support and firmware update policies should be formally documented.

What Are the Best Autonomous Mobile Robots in Warehouse Suppliers?

| Company Name | Main Products | Customization Options | On-Time Delivery | Response Time | Reorder Rate | Online Revenue | Verified Supplier Type |

|---|---|---|---|---|---|---|---|

| Shenzhen Aivison Intelligent Technology Co., Ltd | AGV, Smart Robot, Material Handling Equipment | Color, material, size, logo, packaging, label, graphic | 100% | ≤6h | <15% | US $240,000+ | Custom Manufacturer |

| HangZhou Janz Intelligent Technology Co., Ltd. | AGV, AMR, Heavy-Duty Mobile Robots | Color, material, size, logo, packaging, label, graphic | 100% | ≤2h | <15% | US $5,000+ | Multispecialty Supplier |

| Zhejiang Kecong Control Technology Co., Ltd. | AMR, AGV Forklift, Logistics Robot | Color, material, size, logo, packaging, label, graphic | 100% | ≤1h | - | US $600+ | Custom Manufacturer |

| Suzhou Alpha Robotics Co., Ltd. | Logistics Robots, Commercial Delivery Robots | Limited customization available | 80% | ≤3h | 33% | US $50,000+ | Not specified |

| Shenzhen Youwt Industrial Co., Ltd. | Robot Chassis, Autonomous Cargo Trolley, Open-SDK Platforms | Limited customization available | 90% | ≤4h | 37% | US $80,000+ | Not specified |

Performance Analysis

Suppliers like Shenzhen Aivison and HangZhou Janz demonstrate strong reliability with 100% on-time delivery and low reorder rates, indicating consistent product quality and buyer confidence. Zhejiang Kecong stands out for exceptional responsiveness (≤1h average), making it suitable for time-sensitive procurement cycles. In contrast, Suzhou Alpha Robotics and Shenzhen Youwt exhibit higher reorder rates (33–37%), suggesting opportunities for improvement in long-term client retention despite competitive pricing. Custom manufacturers dominate high-value segments, offering tailored solutions for payload-specific applications ranging from 300kg to 5,000kg capacities. Buyers seeking open-architecture platforms should prioritize suppliers listing SDK support and modular chassis options.

FAQs

How to verify autonomous mobile robot supplier reliability?

Validate technical compliance through direct inquiry into navigation system architecture (e.g., laser vs. vision-based SLAM). Request evidence of real-world deployment case studies, especially in dynamic warehouse environments. Review transaction history focusing on dispute resolution outcomes and post-sale support responsiveness.

What is the typical minimum order quantity (MOQ) for AMRs?

Standard MOQ ranges from 1 to 2 units, with some suppliers waiving MOQ for sample testing. High-capacity models (e.g., 1,000kg+ AGVs) may require minimum batch sizes of two units due to assembly line constraints.

Are customization options widely available?

Yes, leading suppliers offer comprehensive customization including structural dimensions, load interface design, branding elements, and communication protocols. Full turnkey solutions with WMS integration are available from manufacturers with dedicated software development teams.

Do suppliers provide technical documentation and SDK access?

Most established suppliers provide detailed technical manuals, API documentation, and simulation environments. Open SDK availability is common among companies listing robot chassis or modular platforms as main products.

How to assess robot performance before procurement?

Request live demo videos or remote access to test units operating in simulated warehouse layouts. Benchmark key parameters: positioning accuracy (±5–10mm), maximum speed (0.8–1.5 m/s), charging cycle duration, and obstacle avoidance reaction time. Validate battery life under continuous 8-hour operation scenarios.