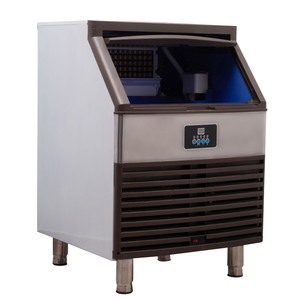

Below Counter Ice Maker

Top sponsor listing

Top sponsor listing

CN

CN

About below counter ice maker

Where to Find Below Counter Ice Maker Suppliers?

China remains a dominant force in the global below counter ice maker manufacturing sector, with key production hubs concentrated in Jiangsu, Guangdong, and Shanghai. These regions host vertically integrated supply chains encompassing compressor fabrication, refrigeration system assembly, and stainless steel fabrication—enabling cost efficiencies of 20–35% compared to Western manufacturers. Jiangsu and Foshan-based suppliers benefit from proximity to component suppliers for compressors, condensers, and control systems, reducing lead times by up to 18%.

The industrial clusters support rapid prototyping and scalable production, with many facilities operating automated assembly lines capable of producing 1,000–5,000 units monthly. Suppliers leverage localized access to raw materials such as food-grade stainless steel (SUS304), eco-friendly refrigerants (R404A, R290), and energy-efficient compressors from brands like Secop or Embraco. This integration allows for faster order fulfillment, with standard lead times averaging 25–35 days for containerized shipments. Buyers gain flexibility in both volume procurement and technical customization, supported by mature logistics networks that facilitate direct export via Shanghai, Ningbo, and Shenzhen ports.

How to Choose Below Counter Ice Maker Suppliers?

Procurement decisions should be guided by structured evaluation criteria focused on technical capability, compliance, and transaction reliability:

Technical and Quality Compliance

Verify adherence to international standards including CE, RoHS, and ETL certifications, particularly for North American and European markets. Confirm electrical safety compliance (e.g., 110V/60Hz or 220V/50Hz configurations) and refrigerant environmental regulations (e.g., low-GWP alternatives). Request test reports for cooling performance, energy consumption, and noise levels (typically 40–48 dB). ISO 9001 certification indicates established quality management systems, though not all suppliers explicitly disclose this.

Production and Customization Capacity

Assess supplier capabilities based on the following indicators:

- Minimum factory area exceeding 3,000m² for sustained output

- In-house design and engineering teams supporting OEM/ODM projects

- Customization options confirmed: cabinet dimensions, plug type, voltage, color, logo branding, refrigerant type, and ice shape (crescent, cube, nugget)

- Material specifications: SUS304 stainless steel construction, copper or aluminum evaporators, and insulated panels

Cross-reference product listings with response time and on-time delivery metrics to validate operational efficiency. Suppliers advertising ≤2-hour response times and 100% on-time delivery are more likely to maintain dedicated customer service teams and real-time inventory tracking.

Transaction and Risk Mitigation

Prioritize suppliers offering third-party transaction protection mechanisms. Conduct sample testing before full-scale orders to evaluate build quality, cooling cycle consistency, and ease of maintenance. Insist on post-delivery support, including spare parts availability and technical documentation. Analyze reorder rates as an indirect measure of customer satisfaction—rates above 50% suggest strong product reliability and service performance.

What Are the Best Below Counter Ice Maker Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Customization Options | Product Range |

|---|---|---|---|---|---|---|---|

| Jiangsu Eternity Import & Export Co., Ltd. | Ice Machines, Refrigeration Equipment, Ice Crushers | US $50,000+ | 100% | <15% | ≤2h | Yes (color, size, logo, refrigerant, power, compressor) | Wide (multiple models, outputs 30–130kg/day) |

| Foshan Libosa Hotel Suppliers Co., Ltd. | Refrigeration Equipment, Commercial Bakery Machines | US $150,000+ | 100% | 23% | ≤2h | Limited (model-specific features) | Moderate (25–130kg/day, various ice types) |

| Nuelead Technologies Inc | Commercial Kitchen Refrigeration, Wine Coolers, Ice Makers | Data Unavailable | Not Available | Not Available | ≤2h | No explicit mention | Narrow (focused on 120kg/day models) |

| Shanghai Bingsu Refrigeration Technology Co., LTD. | Ice Machines, Cold Room Storage, Beverage Machines | US $20,000+ | 100% | <15% | ≤1h | Implied through model variation | Broad (45–120kg/day, undercounter & standalone) |

| Shanghai Langtuo Intelligence Technology Co., Ltd. | Smart Ice Machines, Commercial Refrigeration | US $5,000+ | 100% | 50% | ≤13h | Yes (color, size, logo, packaging) | Extensive (90–250kg/day, multiple configurations) |

Performance Analysis

Jiangsu Eternity and Foshan Libosa demonstrate strong market presence with high online revenue and verified on-time delivery, making them suitable for medium- to large-volume buyers. Foshan Libosa stands out with a higher reorder rate (23%), suggesting consistent product satisfaction. Shanghai Bingsu offers the fastest average response time (≤1h) and competitive pricing, ideal for time-sensitive procurement cycles. Shanghai Langtuo, despite lower reported revenue, exhibits a remarkably high reorder rate (50%), indicating strong customer retention likely due to customization flexibility and product adaptability. Nuelead Technologies provides competitively priced units but lacks verifiable performance metrics, representing higher risk for first-time buyers.

FAQs

What is the typical MOQ for below counter ice makers?

Most suppliers set a minimum order quantity of 1 set for sample validation. For wholesale pricing, MOQs range from 5 to 20 sets depending on model complexity and customization level.

What are common lead times for production and shipping?

Production lead time averages 20–30 days after order confirmation. Add 15–25 days for sea freight to North America or Europe. Air shipping reduces transit time to 5–10 days but increases costs significantly.

Can suppliers customize ice maker specifications?

Yes, select manufacturers offer OEM/ODM services including dimensional adjustments, voltage conversion, plug type (NEMA, BS, EU), stainless steel finish, control panel language, and branded labeling. Confirm customization scope during initial inquiry.

What refrigerants are commonly used?

R404A is widely used for commercial units due to high cooling capacity. Eco-friendly alternatives like R290 (propane) and R134a are increasingly available for markets enforcing low-GWP regulations.

How to verify product quality before shipment?

Request factory inspection reports, cooling cycle test videos, and third-party certification copies. Conduct pre-shipment inspections (PSI) through independent agencies to assess build quality, functionality, and packaging integrity.