Computer Numerical Control Cnc Machining

1/24

1/24

1/16

1/16

1/21

1/21

1/31

1/31

About computer numerical control cnc machining

Where to Find Computer Numerical Control (CNC) Machining Suppliers?

China remains the global epicenter for CNC machining services and equipment manufacturing, with specialized industrial hubs in Guangdong, Shandong, and Liaoning provinces. These regions host vertically integrated ecosystems combining precision component suppliers, advanced machining centers, and export logistics networks. Dongguan and Shenzhen in Guangdong province alone account for over 40% of China’s CNC service providers, supported by dense clusters of tooling, automation, and electronics manufacturers.

The concentration enables rapid prototyping and scalable production, with many suppliers operating multi-axis CNC lathes, milling machines, and turning centers capable of tight tolerances (±0.005 mm). Integrated supply chains reduce material lead times by 20–30%, while proximity to Shenzhen and Guangzhou ports streamlines international shipping. Buyers benefit from flexible MOQs, ranging from single prototypes to high-volume runs exceeding 10,000 units monthly per facility.

How to Choose CNC Machining Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capability Assessment

Confirm access to multi-axis CNC machines (3-axis, 4-axis, 5-axis) and secondary processing such as grinding, polishing, anodizing, or heat treatment. Suppliers should support a range of materials including aluminum alloys, stainless steel, brass, titanium, and engineering plastics. For OEMs requiring complex geometries, verify CAD/CAM compatibility and GD&T (Geometric Dimensioning and Tolerancing) expertise.

Quality Management Verification

Prioritize suppliers with documented quality control systems. While ISO 9001 certification is not explicitly stated in available data, consistent on-time delivery rates (100% across all listed suppliers) suggest structured production planning. Request inspection reports, first-article testing (FAI), and process capability (Cp/Cpk) data for critical features. CE or RoHS compliance may be required for European markets, particularly for electronic or medical-grade components.

Production Scalability & Responsiveness

Evaluate key performance indicators derived from supplier profiles:

- On-time delivery rate ≥97% indicates reliable scheduling

- Response time ≤3 hours ensures timely communication

- Reorder rates above 25% reflect customer satisfaction and service consistency

- Online transaction volume (e.g., US $150,000+) correlates with operational scale

Cross-reference these metrics with facility capabilities—larger enterprises often maintain dedicated R&D teams and in-house mold or casting services to support end-to-end manufacturing.

Transaction Security & Sampling Protocols

Utilize secure payment mechanisms such as escrow or trade assurance programs where available. Request physical or digital samples before full-scale orders; typical lead time for prototype machining ranges from 7–14 days depending on complexity. Negotiate clear terms for revisions, non-conformance handling, and IP protection, especially when sharing proprietary designs.

What Are the Leading CNC Machining Suppliers?

| Company Name | Main Products | Price Range (Unit) | Min. Order Quantity | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| Dongguan Zhixi Precision Hardware Co., Ltd. | Machining Services, Aluminum Alloy Parts | $0.60–1.50 | 1 dozen | 100% | ≤2h | 66% | US $1,000+ |

| Shenzhen X&Y Technology Co., Ltd. | Machining Services, Moulds, Casting | $0.35–1.58 | 1 piece | 100% | ≤3h | <15% | US $70,000+ |

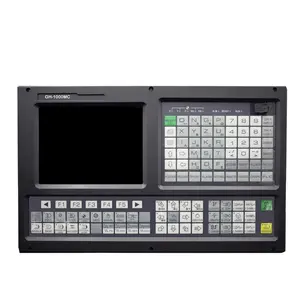

| Guangzhou Finger Technology Co., Ltd. | CNC Controllers, Control Systems | $700–1,690 | 1 set | 100% | ≤3h | 30% | US $120,000+ |

| Taian Haishu Machinery Co., Ltd. | CNC Lathes, Grinding Machines | $3,000–25,000 | 1–2 sets | 100% | ≤3h | 27% | US $150,000+ |

| Dalian Longxing Machinery Equipment Co., Ltd. | Machining Centres, CNC Mills, Siemens/FANUC Systems | $82,550–266,000 | 1 unit/set | 100% | ≤1h | - | - |

Performance Analysis

Dongguan Zhixi stands out with the highest reorder rate (66%), indicating strong client retention for precision hardware machining, likely due to competitive pricing and low MOQs. Shenzhen X&Y offers the lowest per-unit cost ($0.35) and accepts single-piece orders, making it ideal for prototyping despite a lower reorder rate. Guangzhou Finger specializes in CNC control systems rather than parts fabrication, serving integrators and machine builders. Taian Haishu provides mid-range CNC lathes suitable for small workshops, while Dalian Longxing focuses on high-end, FANUC- and Siemens-controlled machining centers for industrial automation, reflected in six-figure price points. All suppliers report 100% on-time delivery, suggesting robust internal scheduling, though response times vary from ≤1 hour (Dalian) to ≤3 hours (most others).

FAQs

How to verify CNC machining supplier reliability?

Request evidence of quality control processes, including inspection equipment (CMM, profilometers), material traceability, and process documentation. Conduct virtual or on-site audits to assess machine utilization, workforce training, and inventory management. Analyze historical transaction data and customer feedback for patterns in defect rates or communication delays.

What is the typical lead time for CNC machined parts?

Standard prototypes take 7–10 days. Batch production (100–1,000 units) typically requires 15–25 days, including QC and packaging. Complex assemblies or exotic materials may extend timelines by 5–10 days. Machine tool deliveries (e.g., CNC lathes) require 30–60 days post-payment.

Can suppliers handle custom materials and finishes?

Yes, most offer customization in material selection (e.g., 6061-T6, 7075 aluminum, SS304/316) and surface treatments such as anodizing, plating, powder coating, or passivation. Confirm capability alignment early in the sourcing cycle, especially for aerospace, medical, or marine applications requiring certified materials.

Do suppliers provide design for manufacturability (DFM) feedback?

Many experienced providers offer DFM analysis to optimize part geometry, reduce machining time, and minimize waste. This is particularly valuable for complex components involving deep cavities, thin walls, or tight tolerances. Engage suppliers during the design phase to avoid costly iterations.

What are common MOQ and pricing structures?

MOQs range from 1 piece (prototypes) to 1 dozen or more for serialized parts. Pricing is typically tiered based on volume, material cost, setup time, and finishing requirements. High-volume orders often qualify for negotiated rates and extended payment terms. Machine equipment is sold per unit with no volume discount implied.