Pure Ice Cube Maker

About pure ice cube maker

Where to Find Pure Ice Cube Maker Suppliers?

China remains the central hub for pure ice cube maker manufacturing, with key production clusters in Guangdong and Shanghai offering specialized advantages. The Foshan and Guangzhou regions host a high concentration of compact and commercial-grade appliance manufacturers, supported by mature supply chains for compressors, evaporators, and food-grade plastics. These industrial zones enable rapid prototyping and scalable production, with localized access to injection molding, sheet metal fabrication, and refrigeration component suppliers within 30km radii.

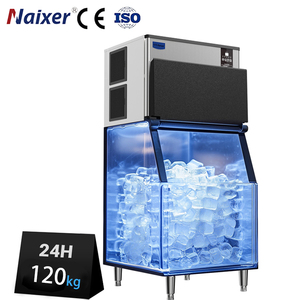

Suppliers in this ecosystem benefit from integrated logistics networks, allowing efficient export via the Pearl River Delta ports. Buyers can leverage proximity to component sources—such as rotary compressors and stainless-steel evaporative trays—to reduce lead times by up to 25% compared to offshore alternatives. Typical production cycles range from 15–30 days for standard models, with economies of scale driving down unit costs for orders exceeding 50 units. This infrastructure supports both household countertop units and high-capacity commercial systems, accommodating diverse power specifications (110V/220V) and ice yield requirements (12–500 kg/day).

How to Choose Pure Ice Cube Maker Suppliers?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical & Quality Compliance

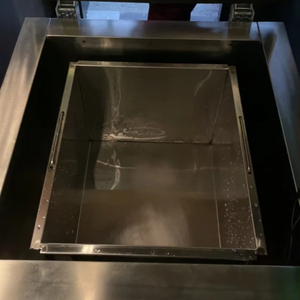

Verify adherence to international safety and performance standards, including CE, RoHS, and UL certifications where applicable. For commercial equipment, ensure compliance with NSF/ANSI Standard 12 for food equipment sanitation. Request test reports on compressor efficiency, water consumption per kilogram of ice, and noise levels (ideally below 45 dB). Stainless steel contact surfaces and BPA-free plastic components are indicators of hygienic design.

Production and Customization Capacity

Assess core capabilities through the following benchmarks:

- Minimum facility size of 2,000m² for consistent output

- In-house R&D or engineering support for custom designs

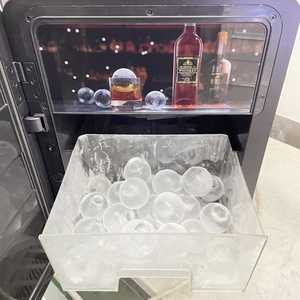

- Customization options confirmed: color, logo, packaging, ice shape (cube, crescent, pellet), and capacity tuning

Prioritize suppliers advertising modular designs and self-cleaning functions, which reflect advanced product development.

Supply Chain Reliability

Analyze delivery performance metrics: target on-time delivery rates above 97%. Cross-reference response times (under 6 hours preferred) and reorder rates as proxies for customer satisfaction. Confirm availability of third-party transaction protection and post-sale service frameworks, especially for warranty claims and spare parts distribution.

What Are the Best Pure Ice Cube Maker Suppliers?

| Company Name | Location | Main Products (Listings) | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization | Min. Order |

|---|---|---|---|---|---|---|---|---|

| Foshan Happy Star Electronics Co., Ltd. | Foshan, CN | Drinkware (278), Juicers (251) | US $50,000+ | 97% | ≤4h | <15% | Not specified | 1–2 pieces |

| Guangzhou Snowland Refrigeration Equipment Co., Ltd. | Guangzhou, CN | Refrigeration Equipment (1025) | US $150,000+ | 100% | ≤6h | 16% | Not specified | 1 set |

| Guangzhou Rongchuan Electrical Equipment Co., Ltd. | Guangzhou, CN | Ice Machines, Block Makers | US $370,000+ | 100% | ≤2h | 17% | Color, material, size, logo, packaging, label, graphic, compressor | 1 set |

| Shanghai Jie Qin Refrigeration Equipment Manufacturing Co., Ltd. | Shanghai, CN | Ice Machines (92) | Data not available | 100% | ≤14h | No data | Not specified | 1 set |

| Guangzhou Sinuolan Technology Co., Ltd. | Guangzhou, CN | Refrigeration Equipment (1016) | US $110,000+ | 50% | ≤2h | 27% | Not specified | 1 piece |

Performance Analysis

Guangzhou-based suppliers dominate in specialization and volume, with Guangzhou Rongchuan leading in customization depth and online revenue ($370,000+). Its ≤2-hour response time and full on-time delivery record indicate strong operational discipline. Foshan Happy Star offers low MOQs (1 piece), making it suitable for trial orders and small-scale buyers, though its lower reorder rate suggests limited post-purchase engagement. Guangzhou Snowland and Shanghai Jie Qin report perfect on-time delivery, critical for inventory-dependent procurement, but Shanghai Jie Qin’s 14-hour average response may delay urgent negotiations. Notably, Guangzhou Sinuolan’s 27% reorder rate reflects high end-user satisfaction despite only 50% on-time delivery—a potential red flag requiring further due diligence into logistical constraints.

FAQs

What is the typical MOQ for pure ice cube makers?

MOQ varies by supplier and model type. Household units often allow 1–2 pieces for initial orders, while commercial systems typically require 1 set (single unit). High-capacity industrial models may mandate container-based minimums for cost-effective shipping.

How long does production and shipping take?

Manufacturing lead time ranges from 15–30 days for standard units. Air freight delivers samples within 7–10 days; sea freight for bulk orders takes 25–40 days depending on destination port congestion and customs processing.

Can suppliers customize ice shape and machine appearance?

Yes, select manufacturers like Guangzhou Rongchuan offer comprehensive customization, including ice cube dimensions, housing color, branding (logo imprinting), and packaging design. Confirm tooling costs and NRE fees before approval.

Are there quality control protocols during production?

Reputable suppliers implement in-process inspections at key stages: welding integrity, refrigerant charging, electrical safety testing, and final functional checks. Request QC checklists and batch test records. Third-party inspection services (e.g., SGS, TÜV) can be arranged pre-shipment.

What payment terms are common in ice maker sourcing?

Standard terms include 30% deposit with balance paid before shipment. Escrow services are recommended for first-time transactions. Letters of Credit (L/C) are used for large commercial orders to mitigate financial risk.