Flex Circuit Prototype

CN

CN

1/20

1/20

1/34

1/34

1/31

1/31

1/37

1/37

1/29

1/29

1/44

1/44

1/24

1/24

1/29

1/29

1/21

1/21

1/24

1/24

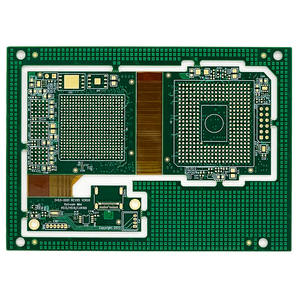

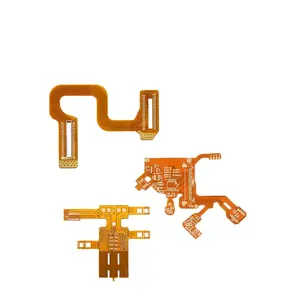

About flex circuit prototype

Where to Find Flex Circuit Prototype Suppliers?

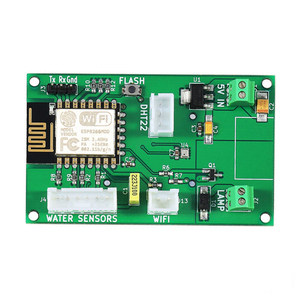

China remains a dominant hub for flex circuit prototype manufacturing, with key production clusters in Shenzhen, Zhongshan, and Suzhou enabling rapid prototyping and low-volume production. These regions host vertically integrated facilities specializing in flexible printed circuits (FPC), rigid-flex PCBs, and HDI modules, leveraging localized supply chains for polyimide films, adhesiveless laminates, and microvia drilling technologies. Shenzhen stands out for high-mix, low-volume capabilities, supporting turnaround times as fast as 3–5 days for single-layer prototypes.

The ecosystem benefits from mature infrastructure: component sourcing, precision etching, laser cutting, and automated optical inspection are available within compact industrial zones. This proximity reduces lead times by up to 40% compared to offshore alternatives and supports just-in-time prototyping workflows. Buyers gain access to suppliers offering one-stop services—from Gerber file review to assembly—with typical MOQs starting at 1 piece and scalable to mid-volume runs of 1,000 units. Cost advantages range from 20–50% over North American or European fabricators, particularly for multilayer and impedance-controlled designs.

How to Choose Flex Circuit Prototype Suppliers?

Effective supplier selection requires verification across technical, operational, and transactional dimensions:

Technical Capability Assessment

Confirm expertise in flex-specific processes: controlled-depth laser drilling, coverlay lamination, and dynamic bend testing. Suppliers should support minimum trace/space down to 3/3 mil and aperture sizes as small as 0.1 mm. For medical or aerospace applications, verify RoHS, UL, and IPC-6013 compliance. Review design-for-manufacturability (DFM) feedback quality during inquiry stages.

Production Infrastructure Evaluation

Assess core capabilities through verifiable metrics:

- In-house FPC and rigid-flex production lines (not outsourcing)

- Minimum monthly capacity exceeding 10,000 sqm for scalability

- On-site engineering support for stack-up optimization and impedance control

Cross-reference response time data (<3 hours ideal) and on-time delivery rates (>95%) as indicators of operational efficiency.

Procurement Risk Mitigation

Prioritize suppliers with documented quality management systems and online transaction histories indicating consistent performance. Use incremental ordering—start with 1–5 units—to validate material accuracy and dimensional tolerance before scaling. Insist on first-article inspection reports and solder mask adhesion testing for dynamic flex applications.

What Are the Best Flex Circuit Prototype Suppliers?

| Company Name | Location | Verification Status | Main Products | MOQ | Price Range (USD) | On-Time Delivery | Avg. Response | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Toptek Pcb Co., Limited | China | Multispecialty Supplier | Rigid-Flex PCB, Custom Prototype | 1 piece | $16–18 | 100% | ≤1h | 66% |

| Zhongshan Fcx Tech Co., Ltd. | Zhongshan, CN | Not Verified | FPC, Rigid-Flex, PCBA | 1 piece | $1–5 | 100% | ≤2h | 50% |

| Suzhou Engine Electronic Technology Co., Ltd. | Suzhou, CN | Multispecialty Supplier | OEM FPC, Multilayer Flex | 1 piece | $0.30–0.50 | 91% | ≤3h | <15% |

| Shenzhen Wanfeng Technology Co., Ltd. | Shenzhen, CN | Custom Manufacturer | Flex PCB, Rigid-Flex, PCBA | 1 piece | $0.66–4.60 | 100% | ≤1h | 44% |

| Shenzhen Yingsheng Technology Co., Ltd. | Shenzhen, CN | Not Verified | HDI, Rigid-Flex, Aluminum PCB | 5 pieces | $1–5 | 100% | ≤8h | <15% |

Performance Analysis

Toptek Pcb and Shenzhen Wanfeng demonstrate strong reliability with 100% on-time delivery and sub-1-hour response times, making them suitable for urgent prototyping cycles. Suzhou Engine offers the lowest per-unit pricing ($0.30) but has a lower reorder rate, suggesting potential gaps in post-sale support. Zhongshan Fcx balances cost and responsiveness with a 50% reorder rate and competitive $1–3 pricing. Shenzhen-based suppliers dominate customization depth, offering material, color, and Gerber-based modifications. For high-reliability applications, prioritize verified manufacturers with documented quality systems and direct production oversight.

FAQs

What is the typical lead time for flex circuit prototypes?

Standard single-layer prototypes ship in 3–7 days. Multilayer or rigid-flex boards require 7–12 days depending on via complexity and lamination cycles. Rush services (24–72 hours) are available from select suppliers for an additional fee.

Do suppliers accept small orders under 10 units?

Yes, all listed suppliers support MOQs of 1–5 pieces, enabling cost-effective design validation. Unit pricing decreases significantly at volumes above 100 units, especially for double-sided and multilayer configurations.

Can I customize materials and stack-up?

Most suppliers allow full customization of base materials (e.g., polyimide vs. PET), copper thickness (½ oz to 2 oz), and coverlay specifications. Stack-up design and impedance profiles are typically reviewed during DFM checks prior to fabrication.

Are RoHS and UL certifications standard?

Compliance varies by supplier. While most offer RoHS-compliant materials upon request, formal UL certification is less common. Buyers must explicitly specify regulatory requirements during quoting to ensure adherence.

How are quality issues resolved post-delivery?

Suppliers with high reorder rates (≥44%) typically provide replacement batches for confirmed defects. Proactive buyers should request sample inspections upon receipt and retain test records for dispute resolution. Some suppliers offer partial refunds or credits for minor non-conformances.