Open Source Portfolio Management Software

CN

CN

1/3

1/3

CN

CN

1/4

1/4

CN

CN

1/2

1/2

1/18

1/18

1/18

1/18

1/26

1/26

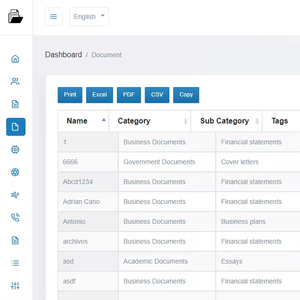

About open source portfolio management software

Where to Source Open Source Portfolio Management Software?

The global supplier base for open source portfolio management software is concentrated among specialized development firms in India and China, where cost-efficient engineering talent and mature IT outsourcing ecosystems enable scalable software delivery. Indian suppliers, particularly those based in metropolitan tech hubs, leverage strong English proficiency and agile development frameworks to serve Western financial and investment firms. Chinese providers, primarily located in Shanghai and Hangzhou, integrate tightly with domestic SaaS platforms and offer robust customization within enterprise-grade system architectures.

These regions support rapid deployment cycles through established DevOps pipelines and modular codebases. Suppliers typically operate lean but technically proficient teams focused on full-stack development, cloud integration, and API-driven extensibility. Buyers benefit from access to cross-platform solutions—web, desktop, and mobile—with average project completion times ranging from 4 to 12 weeks depending on complexity. Key advantages include lower development costs (up to 60% below North American rates), flexible engagement models, and support for both standalone deployments and embedded financial analytics modules.

How to Evaluate Open Source Portfolio Management Software Suppliers?

Adopt the following evaluation criteria to ensure technical reliability and transaction security:

Development Expertise Verification

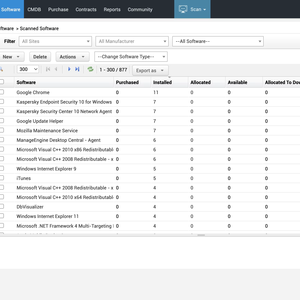

Confirm proven experience in financial data modeling, asset tracking, risk analysis, and compliance reporting functionalities. Prioritize suppliers with demonstrable portfolios in fintech applications, investment dashboards, or ERP-integrated portfolio systems. Assess technical stack compatibility—commonly Python/Django, Node.js, React, or Java Spring—with your existing infrastructure.

Production and Customization Capacity

Evaluate core capabilities through the following indicators:

- Minimum team size of 5–10 developers with documented project management methodology (Agile/Scrum)

- Evidence of version-controlled, open-source-compliant code delivery (e.g., GitHub repositories or CI/CD workflows)

- Support for RESTful APIs, third-party integrations (e.g., brokerage feeds, accounting software), and multi-tenant SaaS architecture

Cross-reference claimed delivery timelines with on-time performance metrics (where available) to assess operational discipline.

Transaction and Quality Assurance

Require milestone-based payment structures with escrow protection until final验收 (acceptance). Validate software quality through staged deliverables: requirement documentation, UI wireframes, beta builds, and post-deployment support terms. Favor suppliers offering source code ownership transfer and licensing clarity under recognized open-source frameworks (e.g., MIT, GPL). Conduct code audits pre-release to verify security standards and absence of proprietary lock-ins.

What Are the Leading Open Source Portfolio Management Software Suppliers?

| Company Name | Location | Main Products | Starting Price | Min. Order | On-Time Delivery | Avg. Response | Online Revenue | Verification Status |

|---|---|---|---|---|---|---|---|---|

| TAKSH IT SOLUTIONS PRIVATE LIMITED | India | AI Applications, Web & Desktop Apps, APIs | $4,500 | 1 unit | 75% | ≤1h | US $2,000+ | - |

| KAEM SOFTWARES PRIVATE LIMITED | India | Cloud Infrastructure, Project & Document Management | $95 | 1 unit | - | ≤2h | US $8,000+ | - |

| Shanghai Honghuan Network Technology Co., Ltd. | Shanghai, CN | Business Finance, Procurement, Project Systems | $500 | 1 set | 100% | ≤3h | - | Multispecialty Supplier |

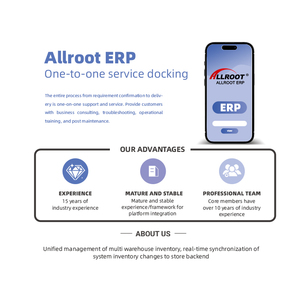

| HANGZHOU ALLROOT Software Co., Ltd. | Hangzhou, CN | ERP, Customization, API Integration | $100 | 1 piece | 100% | ≤4h | - | Multispecialty Supplier |

| PROTOLABZ ESERVICES | India | Inventory & Software Development | $2 | 2 pieces | - | ≤4h | - | - |

Performance Analysis

Suppliers like Shanghai Honghuan and HANGZHOU ALLROOT demonstrate high execution reliability with verified 100% on-time delivery, indicating disciplined project management despite limited public revenue data. TAKSH IT SOLUTIONS offers premium-tier pricing aligned with complex crypto-focused analytics development, while KAEM SOFTWARES provides mid-range solutions with higher platform visibility (US $8,000+ online revenue). PROTOLABZ stands out for ultra-low entry pricing ($2), suggesting template-based or semi-automated offerings suitable for basic inventory-linked portfolio use cases. Indian suppliers lead in responsiveness, with two achieving sub-2-hour average reply times—critical for iterative development coordination across time zones.

FAQs

How to verify open source portfolio management software supplier credibility?

Request case studies, client references, and sample repositories demonstrating actual implementation work. Verify business registration details and review historical order patterns if available. Assess communication clarity and technical depth during initial consultations as proxies for long-term collaboration effectiveness.

What is the typical development timeline?

Standard implementations range from 4 to 8 weeks. Fully customized systems with real-time market data integration, compliance modules, or multi-currency support may require 10–14 weeks. Prototypes or MVP versions are typically delivered within 3 weeks for validation.

Can suppliers provide open source licensing compliance?

Reputable developers will disclose all underlying open-source components and adhere to license requirements (attribution, source availability). Confirm that derivative works are properly licensed and that no restrictive third-party libraries are embedded without permission.

Do suppliers support post-deployment maintenance?

Most offer optional SLA-backed support packages covering bug fixes, updates, and minor enhancements. Inquire about documentation completeness, training provisions, and source code handover terms to ensure long-term maintainability independent of the original vendor.

How does customization affect pricing and MOQ?

Custom features such as AI-driven forecasting, automated rebalancing, or regulatory reporting increase base prices significantly. MOQ remains generally low (1 unit/set), reflecting service-based delivery rather than physical manufacturing constraints. Bulk licensing discounts apply only in enterprise-wide deployment scenarios.