Rapid Prototype Tooling

About rapid prototype tooling

Where to Find Rapid Prototype Tooling Suppliers?

China remains the central hub for rapid prototype tooling production, with key manufacturing clusters in Guangdong and Shandong provinces driving innovation and cost efficiency. Shenzhen and Dongguan in Guangdong province host over 70% of high-precision CNC machining and mold-making facilities specializing in rapid tooling, supported by mature ecosystems of material suppliers, metrology labs, and logistics networks. Qingdao in Shandong has emerged as a center for metal bending and stamping-based prototype tooling, leveraging proximity to steel production zones to reduce raw material costs by 15–25% compared to Western alternatives.

These industrial clusters enable vertically integrated operations—from design and simulation to machining, assembly, and testing—within compact geographic radii. This integration reduces lead times for functional prototypes to 7–14 days on average and supports low-volume production runs with minimal setup delays. Buyers benefit from scalable output, localized supply chains that cut transportation expenses, and access to advanced processing technologies including multi-axis CNC milling, wire EDM, and precision grinding. Typical advantages include 20–35% lower unit costs, MOQs starting at 1 piece, and flexibility for iterative design modifications during early-stage development.

How to Choose Rapid Prototype Tooling Suppliers?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capabilities Verification

Confirm expertise in core processes such as CNC machining (aluminum, stainless steel, tool steel), sheet metal forming, and fixture/gauge fabrication. Prioritize suppliers offering full digital workflows—from 3D CAD/CAM modeling to inspection reports using CMM or optical measurement systems. Materials commonly used include 4140/4340 tool steels, 6061/7075 aluminum, and SUS304 stainless steel, with surface treatments like anodizing, hardening, or precision grinding available upon request.

Production Infrastructure Assessment

Evaluate critical capacity indicators:

- In-house CNC machining centers (minimum 10 units recommended for scalability)

- Dedicated quality control stations equipped with micrometers, calipers, and coordinate measuring machines (CMM)

- Prototyping-to-production transition capability, including mold flow analysis and DFM feedback

Cross-reference equipment lists with on-time delivery performance (target ≥96%) and response time metrics (≤3 hours preferred) to assess operational responsiveness.

Quality & Compliance Validation

While formal ISO 9001 certification is not universally listed, consistent on-time delivery rates above 95% and documented inspection protocols indicate robust internal quality management. For regulated industries (automotive, aerospace), verify compliance with dimensional tolerance standards such as ISO 2768-mK or ASME Y14.5. Request first-article inspection (FAI) reports and process capability (Cp/Cpk) data when prototyping mission-critical components.

Procurement Risk Mitigation

Utilize incremental ordering strategies—start with single-piece samples to validate fit and function before scaling. Use secure payment methods tied to delivery milestones. Analyze reorder rates as a proxy for customer satisfaction; values exceeding 30% suggest reliable service and part consistency. Conduct virtual factory audits via video tours to confirm equipment conditions and workflow organization prior to large-scale engagement.

What Are the Best Rapid Prototype Tooling Suppliers?

| Company Name | Main Products (Listings) | On-Time Delivery | Response Time | Reorder Rate | Online Revenue | Min. Order Flexibility | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Shenzhen Wish Precision Technology Co., Ltd. | Machining Services (213), Sheet Metal (12), Moulds (7) | 96% | ≤3h | 35% | US $180,000+ | 1 piece | $0.03–0.50 / $3.66–6.66 |

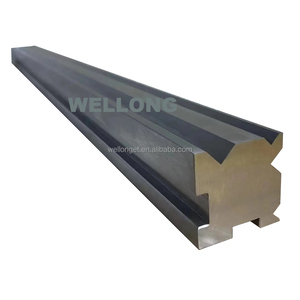

| Qingdao Wellong Metal&plastic Products Co., Ltd. | Moulds (549), Machining Services (20), Sheet Metal (4) | 100% | ≤3h | - | - | 1 set | $6–10 |

| Dongguan Best Precision Hardware Products Co., Ltd. | Machining Services (3943), Cylinder Blocks (2) | 100% | ≤2h | 31% | US $110,000+ | 10–100 pieces | $0.20–20 |

| Chongqing Ce'an Machinery Co., Ltd. | Machining Services (625), Moulds (48) | 100% | ≤1h | <15% | US $2,000+ | 1 piece | $10–100 |

| Baoji City Huatianyi New Material Techonology Co., Ltd. | Machining Services (771), Fasteners (555+) | 43% | ≤4h | 20% | US $30,000+ | 1–100 pieces | $7.40–35 |

Performance Analysis

Suppliers like Qingdao Wellong and Dongguan Best demonstrate strong reliability with 100% on-time delivery and extensive machining portfolios, making them suitable for standardized gauge and mold components. Shenzhen Wish offers competitive pricing and high reorder rates, indicating customer retention through consistent quality in low-cost precision parts. Chongqing Ce’an stands out for ultra-fast response times (≤1 hour) and one-piece flexibility, ideal for urgent prototype iterations despite limited revenue scale. Baoji Huatianyi specializes in titanium-based EDC tools but shows lower delivery reliability (43%), suggesting potential logistical or production bottlenecks. Buyers should prioritize partners with proven track records in functional prototype execution, especially those supporting automotive checking fixtures and ball positioning systems referenced across multiple listings.

FAQs

What materials are commonly used in rapid prototype tooling?

Common materials include 6061-T6 and 7075-T6 aluminum for lightweight fixtures, 4140 and 4340 tool steels for high-wear applications, and SUS304 stainless steel for corrosion resistance. Plastics like Delrin and nylon are also used for non-metallic gauges and alignment guides.

What is the typical lead time for prototype tooling?

Standard lead times range from 5 to 14 days depending on complexity. Simple locating pins or bushings can be delivered within 5–7 days, while custom checking fixtures or multi-component molds may require 10–14 days, including inspection and packaging.

Can suppliers support customization and design feedback?

Yes, most suppliers offer OEM/ODM services with engineering input on manufacturability (DFM). They typically provide drawing reviews, tolerance analysis, and material recommendations within 24–48 hours of inquiry submission.

What are common MOQs for prototype tooling?

MOQs vary: many suppliers accept orders as small as 1 piece for machined components, while batch-produced items like dowel pins or handles may require minimums of 100 pieces. Set-based tooling (e.g., bending dies) often has MOQs of 1–5 sets.

How are quality inspections conducted?

Reputable suppliers perform in-process and final inspections using calibrated instruments. Deliverables often include dimensional check sheets, visual inspection reports, and surface finish verification. For critical applications, CMM-generated reports in PDF or DMIS format can be requested.