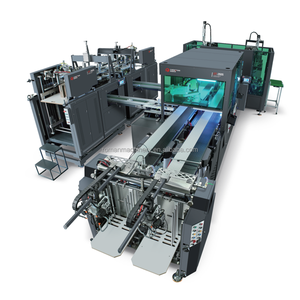

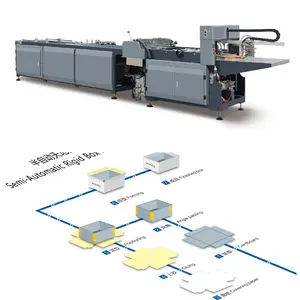

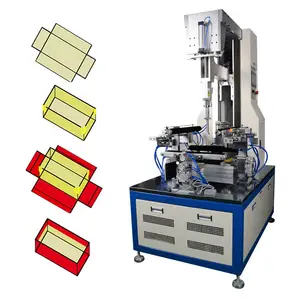

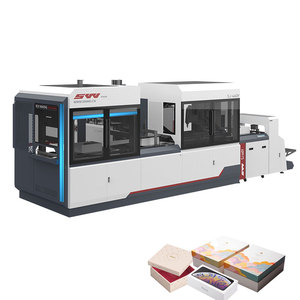

Automatic Paper Box Making Machine

1/6

1/6

1/13

1/13

1/12

1/12

1/7

1/7

1/17

1/17

1/16

1/16

1/16

1/16

1/13

1/13

1/11

1/11

About automatic paper box making machine

Where to Find Automatic Paper Box Making Machine Suppliers?

China remains the global epicenter for automatic paper box making machine manufacturing, with key industrial clusters concentrated in Zhejiang and Guangdong provinces. These regions host vertically integrated supply chains encompassing servo-driven automation systems, precision mold fabrication, and sustainable paper processing technologies. Wenzhou, a hub within Zhejiang, specializes in high-speed food packaging machinery, leveraging proximity to pulp and recycled paper suppliers to reduce material costs by 12–18%. Meanwhile, Shenzhen-based manufacturers focus on intelligent control systems and rigid gift box automation lines, benefiting from access to advanced electronics and IoT integration components.

The clustering effect enables streamlined production cycles, with most suppliers maintaining in-house R&D, CNC machining, and final assembly under one roof. This integration supports rapid prototyping and customization, with standard lead times averaging 20–35 days for non-customized units. Buyers benefit from scalable output capacities—ranging from compact semi-automatic models for startups to fully automated lines capable of 60–200 units per minute—paired with 20–30% cost advantages over European or North American equivalents.

How to Choose Automatic Paper Box Making Machine Suppliers?

Selecting a reliable supplier requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Certifications

Verify adherence to international safety and quality benchmarks. CE certification is essential for market access in Europe, while ISO 9001 indicates structured quality management. For food-grade applications (e.g., lunch boxes, hamburger containers), confirm compliance with FDA or EU 1935/2004 standards for material contact. Request documentation on motor efficiency, sealing system durability, and photoelectric sensor calibration.

Production Capability Assessment

Evaluate core infrastructure indicators:

- Minimum factory area exceeding 3,000m² for stable batch production

- In-house engineering teams supporting PLC programming, HMI interface design, and mechanical debugging

- On-site mold fabrication and testing facilities for custom box dimensions

Cross-reference delivery performance (target ≥94%) and response time (ideally ≤4 hours) as proxies for operational responsiveness.

Customization & Quality Control

Confirm capability to adjust parameters such as box size, folding pattern, gluing method, and sealing type (ultrasonic, thermal, or cold press). Leading suppliers offer pre-shipment testing with video validation of machine operation using customer-specified paper stock. Insist on third-party inspection services like SGS or TÜV for orders exceeding $20,000.

What Are the Best Automatic Paper Box Making Machine Suppliers?

| Company Name | Location | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Key Product Range | Price Range (USD) | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Wenzhou Roman Machinery Co., Ltd. | Zhejiang, CN | $1.3M+ | 100% | ≤2h | <15% | Rigid gift, shoe, phone cases | $899–$148,000 | Size, color, logo, packaging |

| Wenzhou Tianyue Machinery Co., Ltd. | Zhejiang, CN | $650K+ | 94% | ≤4h | 28% | Hamburger, lunch, takeaway boxes | $5,000–$7,000 | Mold, automation level, sealing system |

| Ruian Xuanhai Machine Co., Ltd. | Zhejiang, CN | $30K+ | 100% | ≤2h | <15% | Pizza, disposable food boxes | $5,000–$15,000 | Material, size, logo |

| Ruian Mosun Machinery Co., Ltd. | Zhejiang, CN | $200K+ | 100% | ≤2h | 20% | Rigid, carton, book-shape boxes | $8,500–$25,000 | Gluing, pressing, forming width |

| Shenzhen Gold Paddy Machinery Co., Ltd. | Guangdong, CN | $4K+ | 100% | ≤7h | <15% | V-type, cardboard, folding boxes | $639–$12,000 | Box style, automation line integration |

Performance Analysis

Wenzhou-based suppliers dominate in speed and specialization for food packaging, with Tianyue achieving a 28% reorder rate due to consistent mid-range pricing and extensive customization. Roman Machinery offers the widest price and product variance, catering to both entry-level and premium rigid box producers. Ruian Mosun stands out for balanced pricing and robust build quality in medium-volume carton production. Shenzhen Gold Paddy provides budget-accessible options but lacks demonstrated scale, reflected in its lower online revenue. Prioritize suppliers with verifiable after-sales support, particularly those offering remote diagnostics and spare parts logistics.

FAQs

How to verify automatic paper box machine supplier reliability?

Cross-check certifications (CE, ISO) with issuing bodies and request test reports for critical subsystems like servo drives and sealing mechanisms. Analyze transaction history through verified revenue data, on-time delivery rates, and response consistency. Conduct virtual audits to assess workshop organization and inventory management practices.

What is the typical MOQ and lead time?

Most suppliers list a minimum order quantity of 1 set, facilitating pilot procurement. Standard lead times range from 20 to 35 days post-deposit, depending on machine complexity. Custom configurations may extend delivery by 10–15 days.

Can these machines handle biodegradable or recycled paper?

Yes, leading models are compatible with kraft, FSC-certified board, and PLA-coated papers. Confirm tensile strength thresholds and moisture resistance with the supplier, especially for hot-sealing applications involving grease-resistant coatings.

Do suppliers provide installation and training?

Many offer remote setup guidance via video call. For full automation lines, on-site technician deployment may be available at additional cost. Ensure training covers PLC troubleshooting, mold changeovers, and preventive maintenance schedules.

How to negotiate better terms with suppliers?

Leverage competitive quotes from multiple vendors to benchmark pricing. Request bundled deals including spare dies, glue nozzles, or extended warranties. Payment terms such as 30% deposit with balance upon inspection improve risk mitigation, especially for first-time transactions.